- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after Eurozone’s consumer inflation

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after Eurozone’s consumer inflation

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index May -0.1% +0.2%

01:30 Australia NAB Quarterly Business Confidence Quarter II 6 6

01:55 Australia RBA Assist Gov Edey Speaks

09:00 Eurozone Construction Output, m/m May +0.8% +0.8%

09:00 Eurozone Construction Output, y/y May +8.0% +3.5%

09:00 Eurozone Harmonized CPI June -0.1% +0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) June +0.5% +0.5% +0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y June +0.8% +0.8% +0.8%

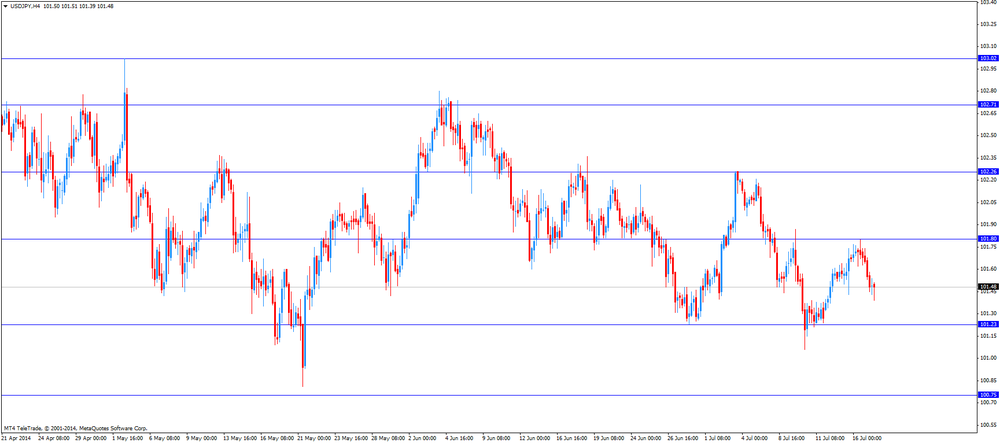

The U.S. dollar traded mixed to higher against the most major currencies. The U.S. currency remained supported by Tuesday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The U.S. currency was also supported by new sanctions against Russia.

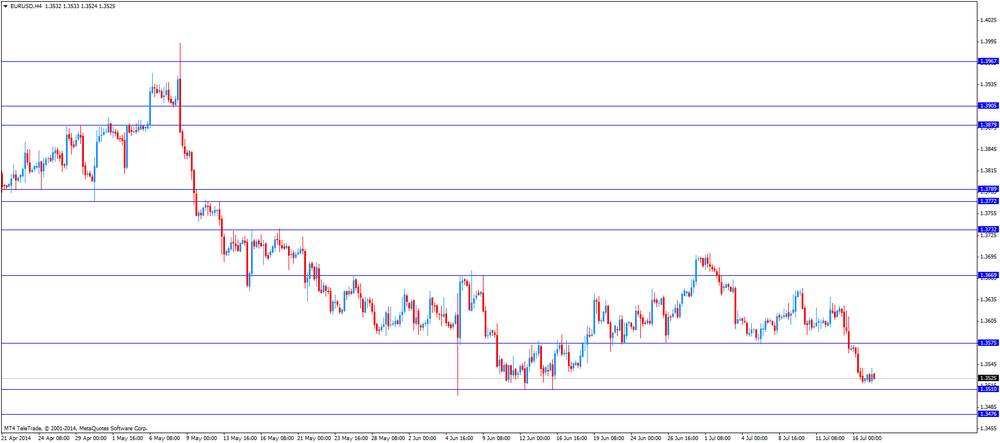

The euro traded mixed against the U.S. dollar after Eurozone's consumer inflation. Eurozone's consumer inflation rose 0.5% in June, in line with expectations, after a 0.5% gain in May. The consumer inflation remained below the European Central Bank's 2% target. Inflation in the Eurozone has been below 1% since October 2013.

On a monthly basis, consumer price index climbed 0.1% in June, after a 0.1% decline in May.

Consumer price index excluding food, energy, alcohol, and tobacco costs climbed 0.8% in June, in line with expectations, after a 0.8% rise in May.

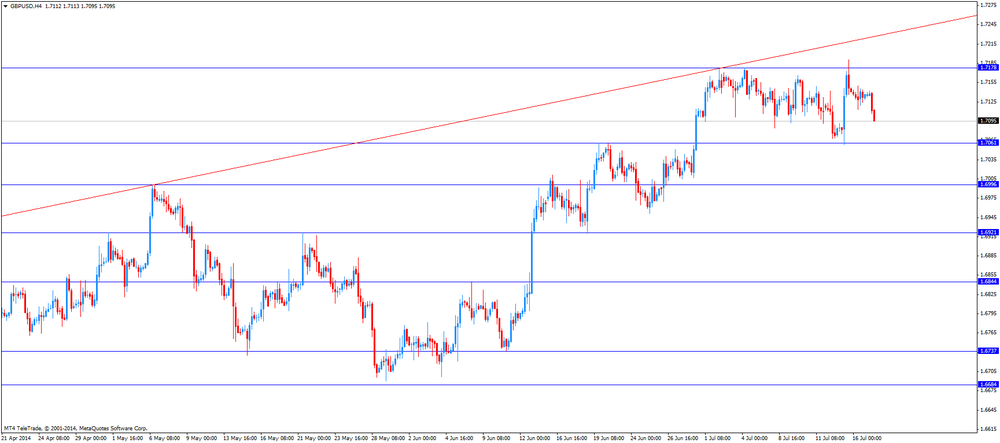

The British pound declined against the U.S. dollar in the absence of any major market reports in the UK.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.7095

USD/JPY: the currency pair declined to Y101.39

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases May 10.13 14.23

12:30 U.S. Initial Jobless Claims July 304 310

12:30 U.S. Building Permits, mln June 0.99 1.04

12:30 U.S. Housing Starts, mln June 1.00 1.02

14:00 U.S. Philadelphia Fed Manufacturing Survey July 17.8 15.6

23:50 Japan Monetary Policy Meeting Minutes

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.