- Analytics

- News and Tools

- Market News

- Foreign exchange market. European session: the euro dropped against the U.S. dollar due to the weaker-than-expected data from France

Foreign exchange market. European session: the euro dropped against the U.S. dollar due to the weaker-than-expected data from France

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

22:30 New Zealand Business NZ PMI June 52.7 53.3

23:01 United Kingdom RICS House Price Balance June 57% 55% 53%

23:50 Japan Core Machinery Orders May -9.1% +0.9% -19.5%

23:50 Japan Core Machinery Orders, y/y May +17.6% +9.5% -14.3%

23:50 Japan Tertiary Industry Index May -5.4% +1.9% +0.9%

01:00 Australia Consumer Inflation Expectation July +4.0% +3.8%

01:30 Australia Changing the number of employed June -4.8 +12.3 +15.9

01:30 Australia Unemployment rate June 5.8% 5.9% 6.0%

02:00 China Trade Balance, bln June 35.9 37.3 31.6

05:00 Japan Consumer Confidence June 39.3 40.7 41.1

06:45 France CPI, m/m June 0.0% +0.2% 0.0%

06:45 France CPI, y/y June +0.7% +0.6%

06:45 France Industrial Production, m/m May +0.3% +0.5% -1.7%

06:45 France Industrial Production, y/y May -2.0% -3.7%

08:00 Eurozone ECB Monthly Report July

08:30 United Kingdom Trade in goods May -8.9 -9.0 -9.2

13:00 United Kingdom Asset Purchase Facility 375 375 375

13:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

13:00 United Kingdom MPC Rate Statement

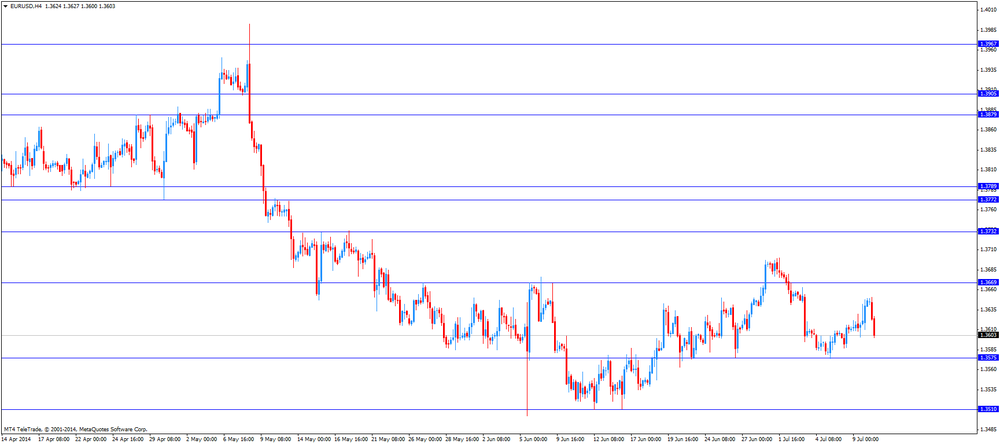

The U.S. dollar traded higher against the most major currencies due to yesterday's Fed's monetary policy meeting minutes. Markets participants were disappointed because there was no information on when the Fed could start to raise its interest rate. The Fed could keep interest rate at low level for a longer period.

Fed policymakers agreed to end the Fed's bond-buying programme in October.

The Fed said that the economy is continuing to improve. But there are different views over the outlook for inflation.

The central bank added that U.S. consumer prices should increase and the labour market tighten before it will start to raise its interest rate.

The euro dropped against the U.S. dollar due to the weaker-than-expected data from France. French industrial production declined 1.7% in May, missing expectations for a 0.5% rise, after a 0.3% gain in April.

On a yearly basis, French industrial production fell 3.7% in May, after a 2.0% drop in April.

French consumer price index remained flat in June, missing expectations for a 0.2% rise. On a yearly basis, French consumer price index increased 0.6% in June, after a 0.7% gain in May.

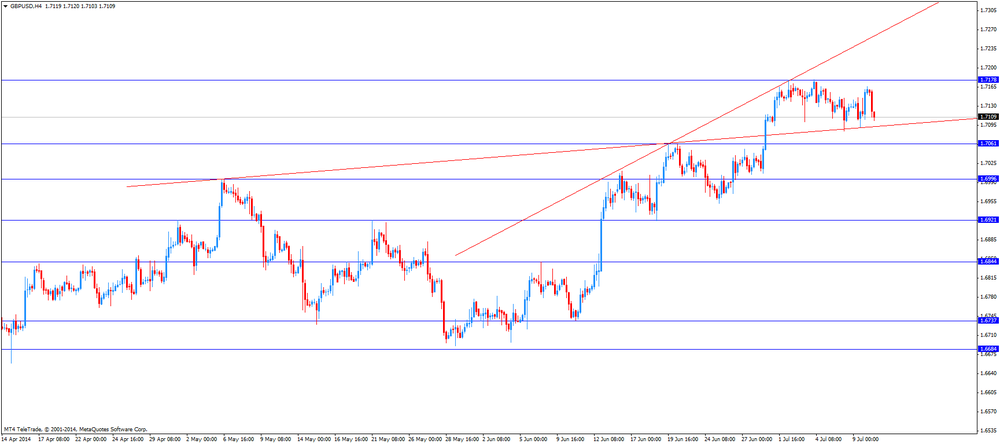

The British pound declined against the U.S. dollar after the Bank of England's interest decision and the weaker-than-expected trade data from the U.K. The Bank of England kept unchanged its interest rate at 0.5%. The volume of the BoE's asset purchase program remained unchanged at £375 billion. This decision was expected by the analysts.

The U.K. trade deficit climbed to £9.2 billion in May from a deficit of £8.81 billion in April. April's figure was revised up from a deficit of £8.92 billion. Analysts had expected a deficit of £9.00 billion.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian new housing price index. The index should increase 0.3% in May, after a 0.2% gain in April.

EUR/USD: the currency pair declined to $1.3600

GBP/USD: the currency pair decreased to $1.7103

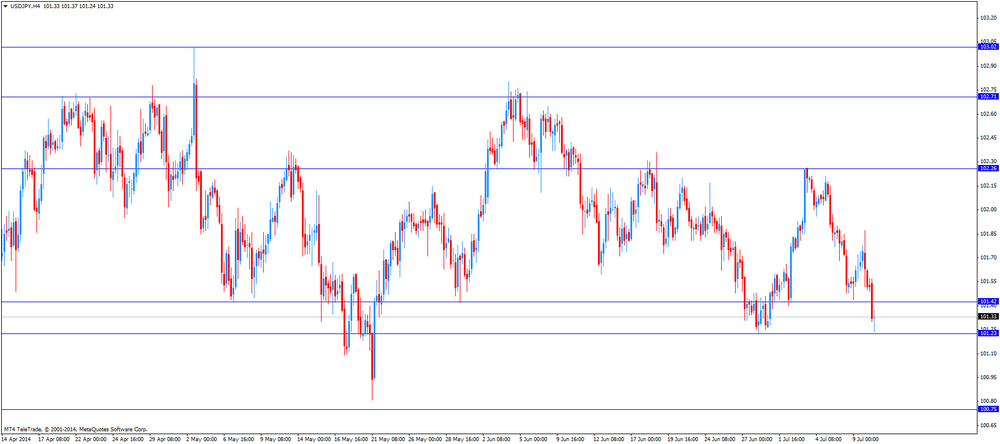

USD/JPY: the currency pair fell to Y101.24

The most important news that are expected (GMT0):

14:30 Canada New Housing Price Index May +0.2% +0.3%

14:30 U.S. Initial Jobless Claims July 315 316

16:00 U.S. Wholesale Inventories May +1.1% +0.6%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.