- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the Australian dollar increased against the U.S. dollar after the Reserve Bank of Australia’s interest rate decision and the strong manufacturing data from China

Foreign exchange market. Asian session: the Australian dollar increased against the U.S. dollar after the Reserve Bank of Australia’s interest rate decision and the strong manufacturing data from China

Economic calendar (GMT0):

01:00 China Manufacturing PMI June 50.8 51.0 51.0

01:30 Japan Labor Cash Earnings, YoY May +0.7% +0.8% +0.8%

01:35 Japan Manufacturing PMI June 51.1 51.5

01:45 China HSBC Manufacturing PMI (Finally) June 50.8 50.8 50.7

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

06:30 Australia RBA Commodity prices, y/y June -12.8% -9.6%

07:30 Switzerland Manufacturing PMI June 52.5 52.6 54.0

07:48 France Manufacturing PMI (Finally) June 49.6 47.8 48.2

07:53 Germany Manufacturing PMI (Finally) June 52.3 52.4 52.0

07:55 Germany Unemployment Change June 24 -9 9

07:55 Germany Unemployment Rate s.a. June 6.7% 6.7% 6.7%

07:58 Eurozone Manufacturing PMI (Finally) June 52.2 51.9 51.8

08:30 United Kingdom Purchasing Manager Index Manufacturing June 57.0 56.7 57.5

09:00 Eurozone Unemployment Rate May 11.6% 11.7% 11.6%

The U.S. dollar traded mixed against the most major currencies. The U.S. currency remained under pressure after yesterday's release of weaker-than-expected Chicago purchasing managers' index. Chicago purchasing managers' index dropped to 62.6 in June from 65.5 in May, missing expectations for a decline to 63.2.

The New Zealand dollar traded slightly higher against the U.S dollar due to the strong manufacturing data from China. The Chinese manufacturing purchase managers' index increased to 51.0 in June from 50.8 in May, in line with expectations.

China's final HSBC manufacturing purchase managers' index declined to 50.7 in June from 50.8 in May. Analysts had forecasted the index to remain unchanged at 50.8.

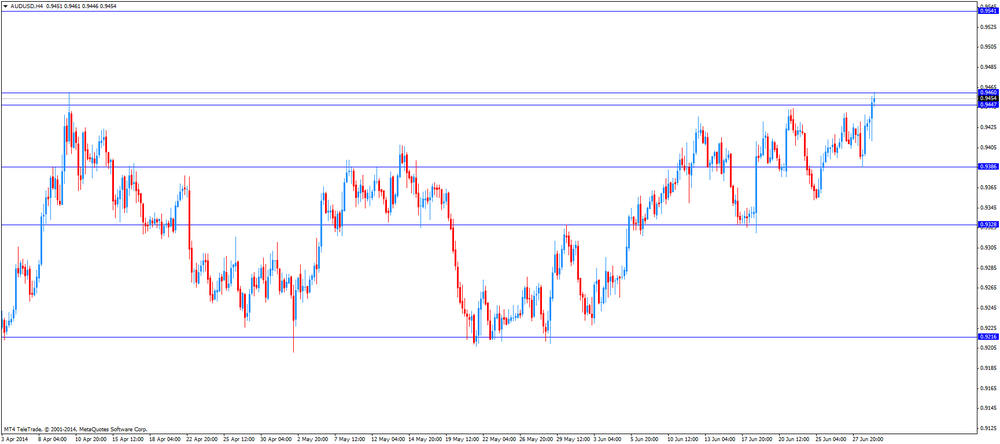

The Australian dollar increased against the U.S. dollar after the Reserve Bank of Australia's interest rate decision and the strong manufacturing data from China. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at a record low 2.5%. The RBA Governor Glenn Stevens said that the Australian dollar "offering less assistance than it might" in lifting economic growth.

RBA commodity prices decreased 9.6% in June, after a 12.8 drop in May.

AIG manufacturing index for Australia declined to 48.9 in June from 49.2 in May.

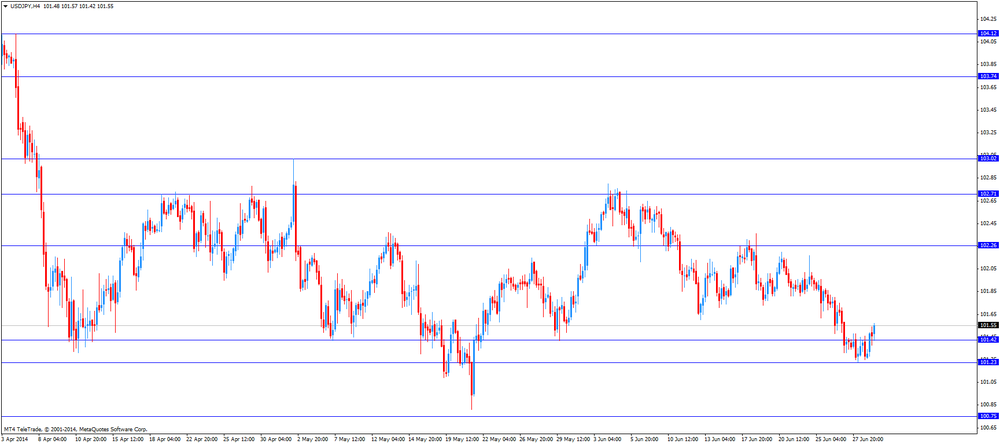

The Japanese yen traded mixed against the U.S. dollar after the weaker-than-expected data from Japan and the strong manufacturing data from China. Japan's Tankan manufacturing index was plus 12 in the second quarter, missing expectations for plus 16, after plus 17 the previous quarter. This was the first decline in six quarters.

Japan's Tankan non-manufacturing index was plus 19 in the second quarter, in line with expectations, after plus 24 the previous quarter.

Japan's average cash earnings climbed 0.8% in May, in line with expectations, after a 0.7% gain in April.

Japanese manufacturing purchase managers' index climbed to 51.5 in June from 51.1 in May.

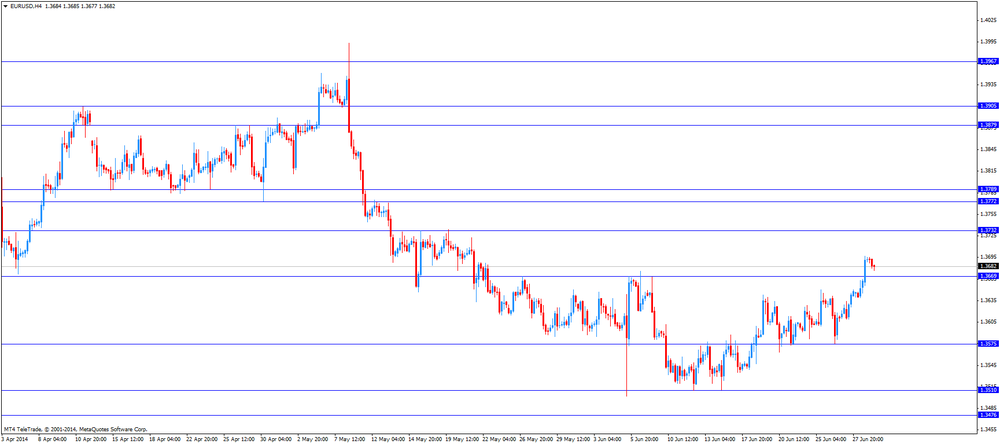

EUR/USD: the currency pair declined to $1.3685

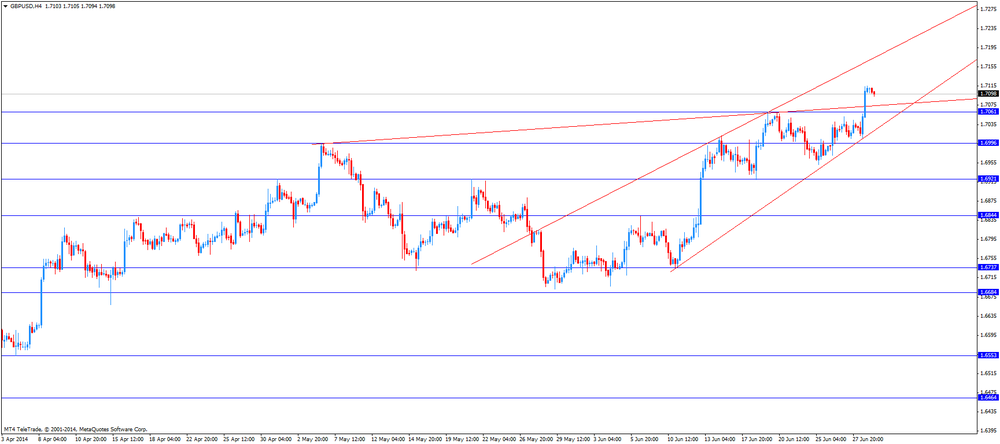

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

AUD/USD: the currency pair increased to $0.9456

The most important news that are expected (GMT0):

12:00 Canada Bank holiday

12:00 U.S. Treasury Sec Lew Speaks

13:45 U.S. Manufacturing PMI (Finally) June 57.5 57.5

14:00 U.S. Construction Spending, m/m May +0.2% +0.5%

14:00 U.S. ISM Manufacturing June 55.4 55.6

23:50 Japan Monetary Base, y/y June +45.6% +48.3%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.