- Analytics

- News and Tools

- Market News

- Foreign exchange market. Asian session: the U.S. dollar dropped against the most major currencies after the Fed’s interest decision on Wednesday

Foreign exchange market. Asian session: the U.S. dollar dropped against the most major currencies after the Fed’s interest decision on Wednesday

Economic

calendar (GMT0):

01:30 Australia RBA Bulletin Quarter II

04:30 Japan All Industry Activity Index, m/m April +1.5% -3.7% -4,3%

04:30 Switzerland SNB Financial Stability Report 2014

07:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

07:30 Switzerland SNB Monetary Policy Assessment

07:30 Switzerland SNB Press Conference

08:30 United Kingdom Retail Sales (MoM) May +1.3% -0.5% -0.5%

08:30 United Kingdom Retail Sales (YoY) May +6.9% +4.2% +3.9%

09:00 Eurozone Eurogroup Meetings

The U.S.

dollar dropped against the most major currencies after the Fed’s interest

decision on Wednesday. The Fed cut its monthly asset purchases by another $10

billion to $35 billion and kept the Federal Funds Target Rate between zero and

0.25 percent. Market participants had expected this decision. The Fed pointed

out that interest rates will remain unchanged for a considerable time after the

Fed’s asset purchase program ends.

Investors

had awaited Fed Chair Janet Yellen gave some hints when the Fed will start to

rise its interest rate, but it didn’t happen. Investors were disappointed. The

U.S. currency suffered due to this disappointment by investors.

The Fed lowered

its forecast for economic growth this year to a range of 2.1% to 2.3% from 2.8

to 3.0% previously.

The Fed expect

its interest rate to reach 1.2% by the end of 2015 and 2.5% by the end of 2016.

The New

Zealand dollar traded lower against the U.S dollar due to the slower than

expected economic growth in New Zealand. New Zealand’s gross domestic product

increased 1.0% in the first quarter, missing expectations for a 1.2% gain,

after a 1.0% rise in the fourth quarter of 2013. The fourth quarter of 2013

figure was revised up from a 0.9% increase.

On a yearly

basis, gross domestic product in New Zealand rose 3.8% in the first quarter,

exceeding expectations for a 3.7% increase, after a 3.1% gain in the fourth

quarter of 2013.

The

Australian dollar climbed against the U.S. dollar after the Fed’s interest

decision. Japanese life insurance firms and retail funds also supported the

demand for the Australian dollar due to higher yields.

The Reserve

Bank of Australia (RBA) released its June bulletin. The RBA said foreign property

demand may have pushed up houses and the supply of dwellings in Australia. The

RBA also said the growth in infrastructure investment in China could remain

strong for some time, which will have a positive impact on Australian commodity

exporters.

The RBA

pointed out that the lower retail sales from May to mid June was driven by “the

“significant downturn in consumer confidence”.

The

Japanese yen climbed against the U.S. dollar after the Fed’s interest decision.

Japan’s all industry activity index declined 4.3% in April, after a 1.5% increase

in March. Analysts had expected the index to fall 3.7%.

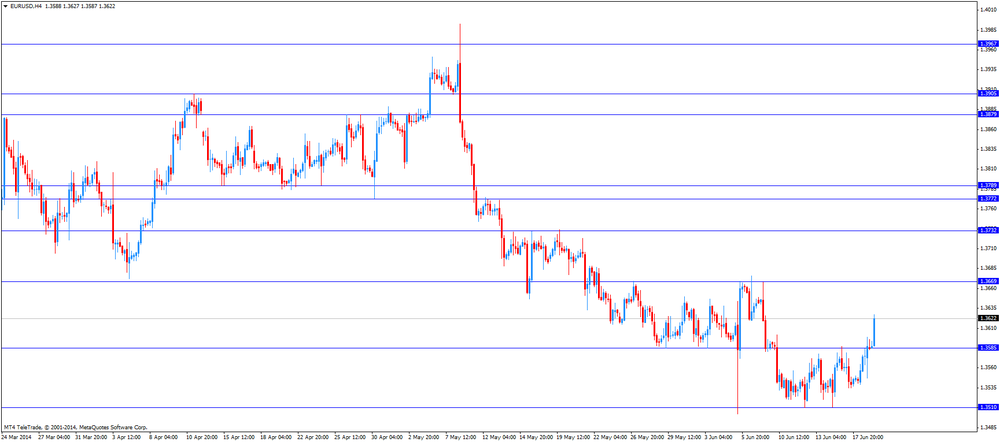

EUR/USD:

the currency pair traded mixed

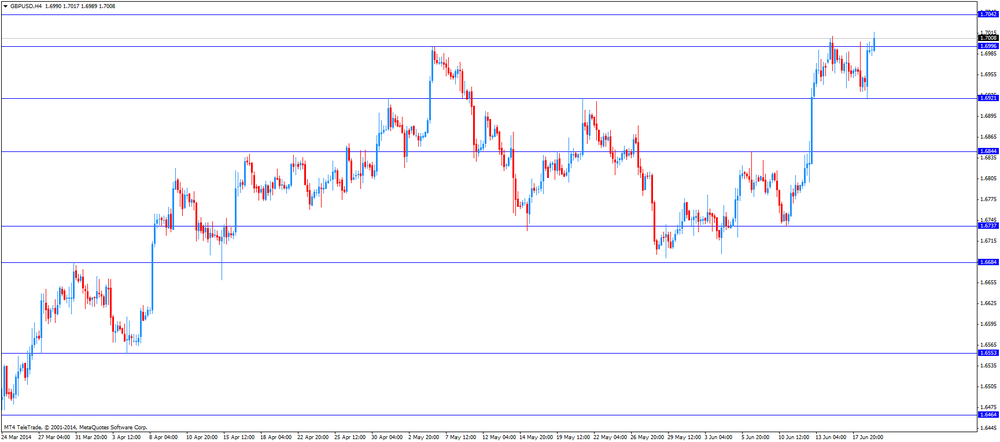

GBP/USD:

the currency pair traded mixed

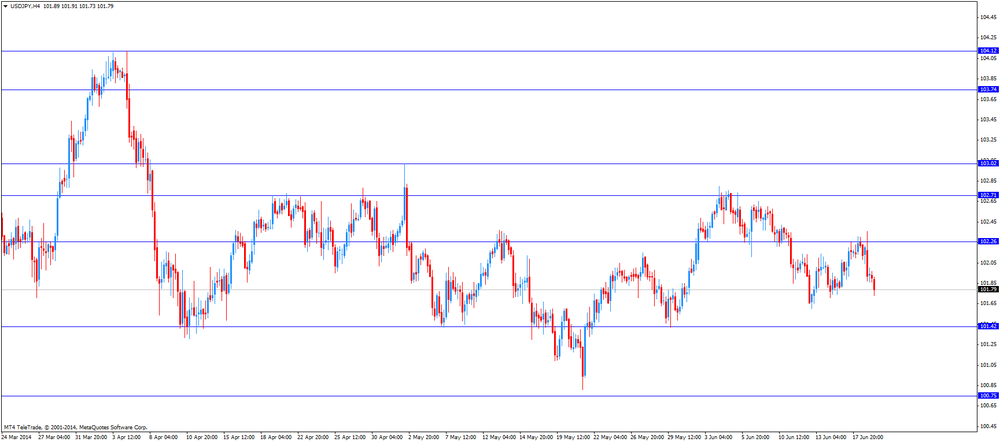

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

10:00 United Kingdom CBI industrial order books balance June 0 3

12:30 U.S. Initial Jobless Claims June 317 316

14:00 U.S. Leading Indicators May +0.4% +0.6%

14:00 U.S. Philadelphia Fed Manufacturing Survey June 15.4 14.3

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.