- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

06:00 Germany CPI, m/m (Finally) March +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) March +1.0% +1.0% +1.0%

Euro fell against the dollar on German inflation data . EU harmonized methodology inflation in Germany slowed to its lowest level in nearly four years , the final data showed Destatis, published on Friday .

Harmonized index of consumer prices ( HICP ) rose 0.9 percent year on year in March, according to preliminary estimates . It was the weakest level since June 2010 . In February, prices rose 1 percent . On a monthly measurement of the HICP increased by 0.3 percent , as originally anticipated by March 28.

The consumer price index rose by 1 percent per year in March after the 1.2 percent rise in the previous month . Statistical Office confirmed the preliminary assessment . Last inflation is the lowest since August 2010 . On a monthly basis, consumer prices rose by 0.3 percent, according to a preliminary projection.

More info Destatis showed that wholesale prices fell by 1.7 percent in March compared with the corresponding month of the previous year , after declining by 1.8 percent in February and 1.7 percent in January. From February to March , wholesale prices remained unchanged.

Dollar ends week the biggest drop in eight months against most major currencies after the published minutes of the last meeting of the Federal Reserve reduced the likelihood of an early rise in interest rates in the United States . It is learned that after the meeting of Federal Reserve officials moved away from quantitative benchmarks , ie abandoned former promises to increase its benchmark interest rate at a certain level of unemployment. Instead, they said they would consider " a wide range of information," including labor market conditions , inflationary pressures and financial conditions. Recall that during the last meeting of the Central Bank decided to reduce the amount of monthly bond purchases at $ 10 billion to $ 55 billion earlier Fed Chairman Janet Yellen said the bank 's readiness to begin to raise interest rates six months after the after the final collapse of the program asset purchases .

Additional pressure on the U.S. currency may have today's publication of the inflation data in the U.S.. According to the median forecast of economists producer price index is likely to rise in March by 1.0 % compared with the previous period a year earlier. Recall that in February it amounted to 0.9% ( the lowest since November 2010 ) .

EUR / USD: during the European session, the pair fell to $ 1.3871

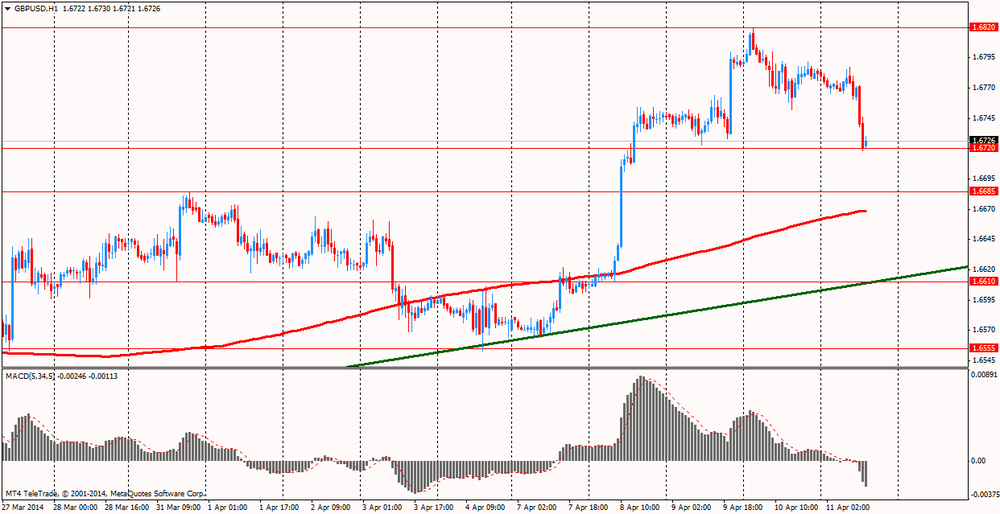

GBP / USD: during the European session, the pair fell to $ 1.6718

USD / JPY: during the European session, the pair rose to Y101.87 and stepped

In the U.S. at 12:30 GMT will producer price index, producer price index excluding prices for food and energy in March in 13:55 GMT - consumer sentiment index from the University of Michigan in April.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.