- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

06:45 France Industrial Production, m/m February -0.2% +0.1%

06:45 France Industrial Production, y/y February -0.1% -0.8%

06:45 France CPI, m/m March +0.6% +0.5%

06:45 France CPI, y/y April +0.9% +0.6%

08:00 Eurozone ECB Monthly Report April

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom MPC Rate Statement

The euro rose against the dollar on French data on industrial production and inflation. Inflation in France, agreed by EU methodology , slowed in March, mainly due to falling oil prices , data showed on Thursday statistical office Insee. Harmonised inflation (HICP) fell more than expected to 0.7 percent in March from 1.1 percent in February. It was expected that inflation will be 0.8 percent.

Annual consumer price inflation fell to 0.6 percent from 0.9 percent the previous month and remained below the expected 0.7 percent.

Food prices fell 0.2 percent, while the prices of petroleum products decreased by 6 percent. Meanwhile, the cost of clothing and footwear increased by 0.6 percent.

On a monthly measurement of consumer prices rose by 0.4 percent after rising 0.6 percent the previous month. At the same time, the HICP rose by 0.5 percent.

Basic consumer prices rose by 0.1 percent compared with the previous month, amounting to an annual increase of 0.4 percent in March.

French industrial production expanded slightly in February , data showed on Thursday Insee. Industrial production in the second -largest eurozone economy grew by 0.1 % in February from January . Analysts had forecast an average increase of 0.2%.

Reduced energy production and release in the oil refining industry restrained overall industrial production, while manufacturing output grew by 0.3%. On an annual basis , industrial production fell by 0.8 % after falling 0.1% the month before.

Support for the single currency had news that Greece has successfully returned to the debt markets . Today, Greece held the first since 2010 auction on sovereign debt , in which were placed 5 - year bonds worth 3 billion euros against 2.5 billion target average yield was 4.95 % against the expected 5-5.25 %. Vice Prime Minister of Greece , said after the auction that the " bond issue said that Greece's debt is acceptable ."

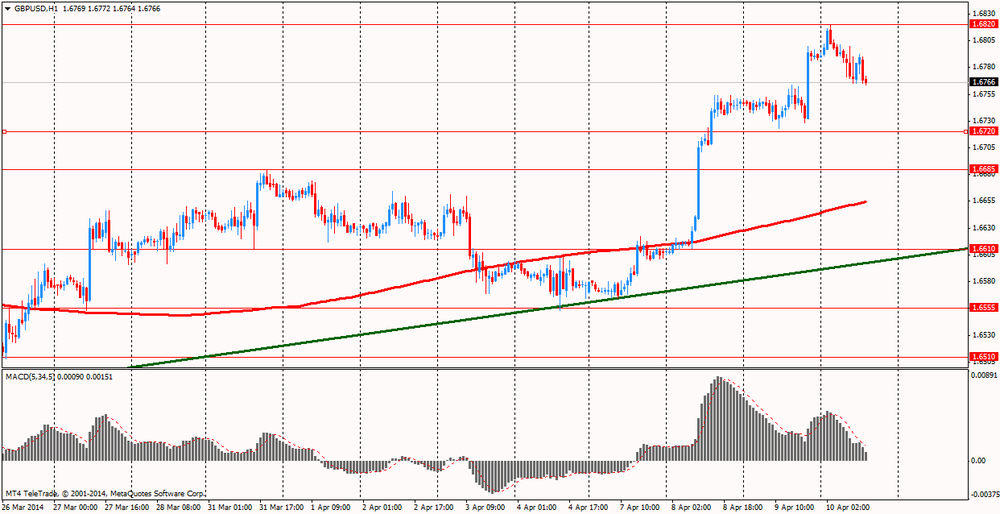

The British pound is trading slightly lower against the dollar after the Bank of England left policy unchanged . The Bank of England did not bring any surprises , decided to leave its key rate at a record low of 0.5% , which she held for 5 years ( since March 2009 ), and a program of bond purchases in the amount of £ 375 billion

CB stated that it intends to keep rates low for at least as long as the b / p drops below 7%, and it is not expected before 2016. However, his representatives have repeatedly said that the mere drop rates b / d less than 7% will not be a direct incentive to improve .

Minutes of the meeting will be published on Wednesday, April 23.

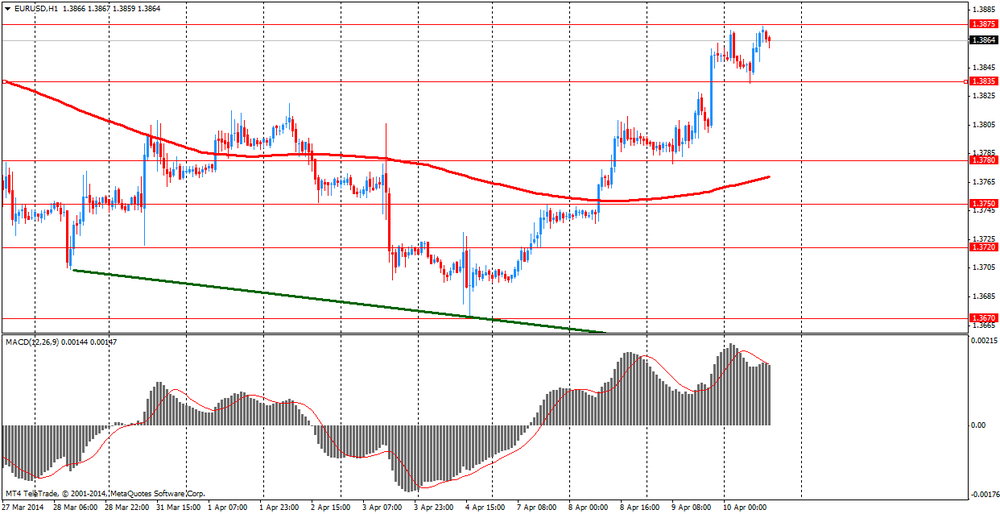

EUR / USD: during the European session, the pair rose to $ 1.3874

GBP / USD: during the European session, the pair fell to $ 1.6765

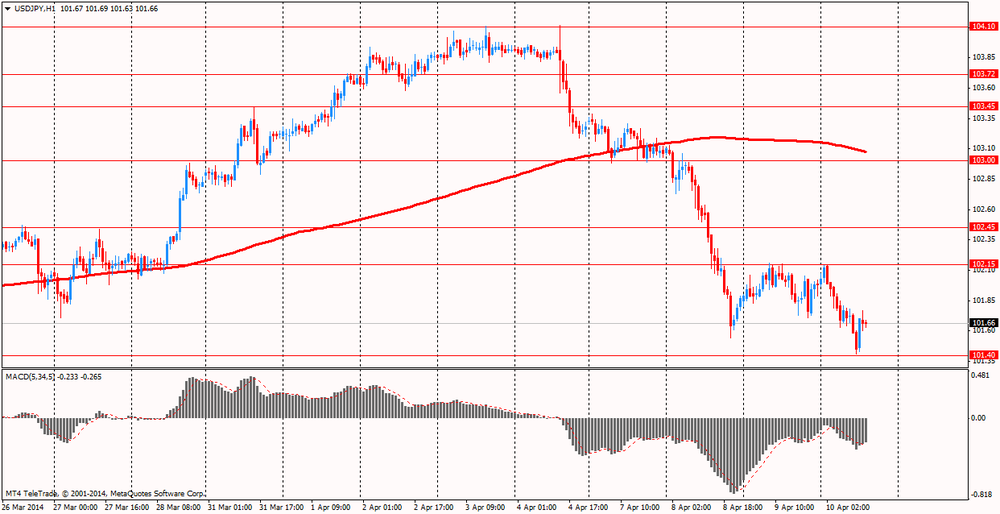

USD / JPY: during the European session, the pair fell to Y101.41 and stepped

At 12:30 GMT , Canada will release the housing price index on the primary market in February. In the U.S. at 12:30 GMT will import price index for March, at 18:00 GMT - monthly budget execution report for March. At 23:50 GMT the meeting minutes will be published on the Bank of Japan's monetary policy in March .

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.