- Analytics

- News and Tools

- Market News

- Oil rose

Oil rose

Brent

crude rose from the lowest level in almost five months amid concern that talks

between the Libyan government and rebels won’t restore oil exports. West Texas

Intermediate’s discount to Brent widened.

The

European benchmark gained as much as 0.6 percent. The rebels’ Executive Office

for Barqa, representing the region of Cyrenaica, denied a report that the group

will cede one of the four ports that have been under its control since July to

the government in a few days. WTI traded below $100 as U.S. jobless claims rose

more than forecast last week.

“Libya

is right on Europe’s doorstep and it has more impact on Brent,” said Michael

Lynch, president of Strategic Energy & Economic Research in Winchester,

Massachusetts. “There are concerns about Libya’s ports and oil exports.”

Brent

for May settlement gained 23 cents to $105.02 a barrel at 10:46 a.m. New York

time on the London-based ICE Futures Europe exchange. Volume was 35 percent

above the 100-day average. Prices fell to $104.79 yesterday, the lowest

settlement since Nov. 7. The North Sea grade is used to price more than half

the world’s oil, including exports from Libya.

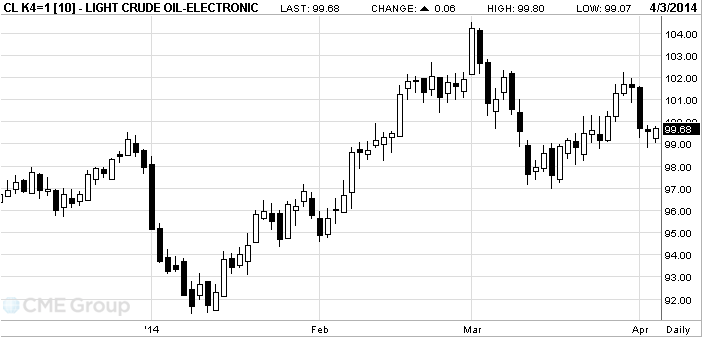

WTI for

May delivery declined 23 cents to $99.39 a barrel on the New York Mercantile

Exchange. The volume of all futures traded was 24 percent below the 100-day

average.

WTI was

at a discount of $5.63 to the European benchmark crude. The spread shrank to

$5.17 yesterday, the narrowest level since October.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.