- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

07:00 Germany Gfk Consumer Confidence Survey April 8.5 8.5 8.5

07:00 Switzerland UBS Consumption Indicator February 1.44 1.57

12:30 U.S. Durable Goods Orders February -1.0% +1.1% +2.2%

12:30 U.S. Durable Goods Orders ex Transportation February +1.1% +0.3% +0.2%

12:30 U.S. Durable goods orders ex defense February -1.8% +2.0% +1.8%

Euro fell against the dollar despite strong data on consumer confidence in Germany. German consumer confidence index , as expected , remained 7 - year high in April , but the events in the Crimea may affect consumer sentiment in the coming weeks , showed on Wednesday the results of a survey research group GfK. Expected consumer confidence index remained unchanged at 8.5, in line with expectations . Result is consistent with the March value , which was the highest since January 2007. The survey , based on the opinions of consumers in 2000 , was held on the eve of the crisis escalates to the referendum and the subsequent annexation of Russian autonomous region of Crimea in Ukraine . If Crimean crisis will spread to other parts of Ukraine , will be very likely negative effect on German consumer sentiment , said the GfK. " It can not be excluded that this event will unsettle consumers in the coming weeks ," the statement said.

Economic expectations of consumers in March were on the road to recovery. The indicator rose by 1.3 points to 33.2 points. According to GfK, a favorable global growth prospects with improved export prospects , as well as lower interest rates will stimulate the propensity to invest .

Meanwhile , a measure of expected income fell by three points to 45.6 points in March . Nevertheless , expectations remain at very high levels , while stable job market strengthens hopes for a greater increase in collective income. After a slight decline in the previous month, the third component of consumer confidence , willingness to purchase , registered a clear gain of 6.6 points , reaching 55.5 points in March . The indicator shows that the upward trend that started in early 2013 , was continued. Stable labor market, good dynamics of income and moderate inflation will continue to maintain a willingness to buy . GfK has confirmed that private consumption will again be a reliable pillar of the economy this year.

U.S. Department of Commerce published a report on orders for durable goods contributed to the growth of the U.S. dollar against the yen. Orders for durable goods - products such as refrigerators and cars , period of use for more than three years - rose a seasonally adjusted 2.2% in February compared to a month earlier , said the Ministry of Commerce on Wednesday . This is the strongest value in November. Result January was revised downward to fall by 1.3%. Economists forecast that overall orders for durable goods rise by 1.1%.

New orders for civilian and defense aircraft and parts led growth. Fluctuations in these categories can cause significant changes in the overall index . The Boeing Company reported an increase almost twice the number of orders for its aircraft in February compared to a month earlier.

Excluding the volatile transportation segment , orders for durable goods rose by only 0.2 %. New orders for primary metals and electronic products led the growth. But the demand for electrical machinery and equipment declined last month.

The Australian dollar rose for a fourth day after the head of the Reserve Bank of Australia Governor Glenn Stevens in his speech said that the period of record-low interest rates will continue for some time . However, he warned that the region's economic prospects remain uncertain due to the attenuation of the boom in the mining industry .

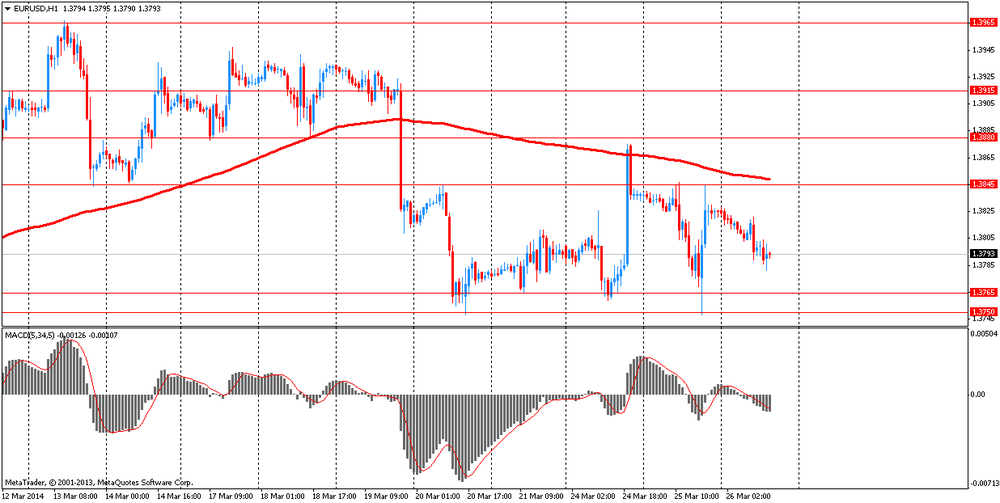

EUR / USD: during the European session, the pair fell to $ 1.3781

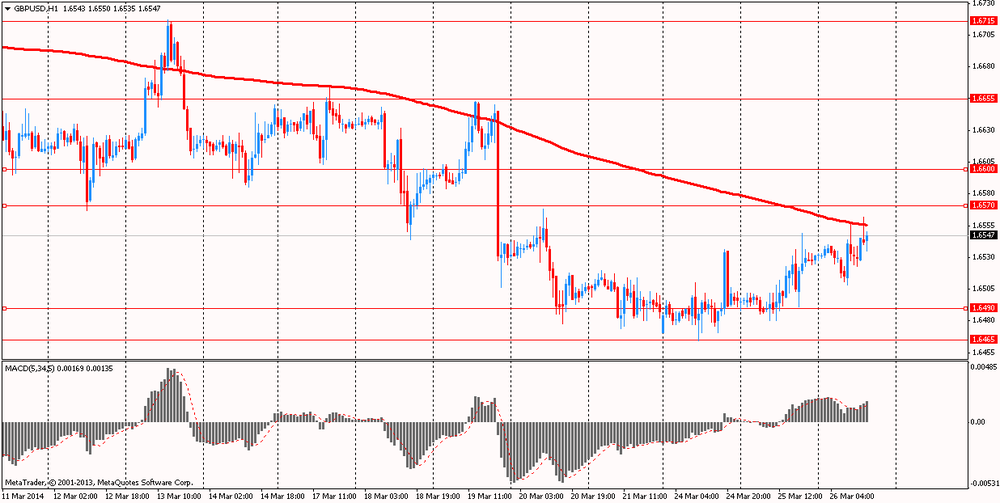

GBP / USD: during the European session, the pair rose to $ 1.6562

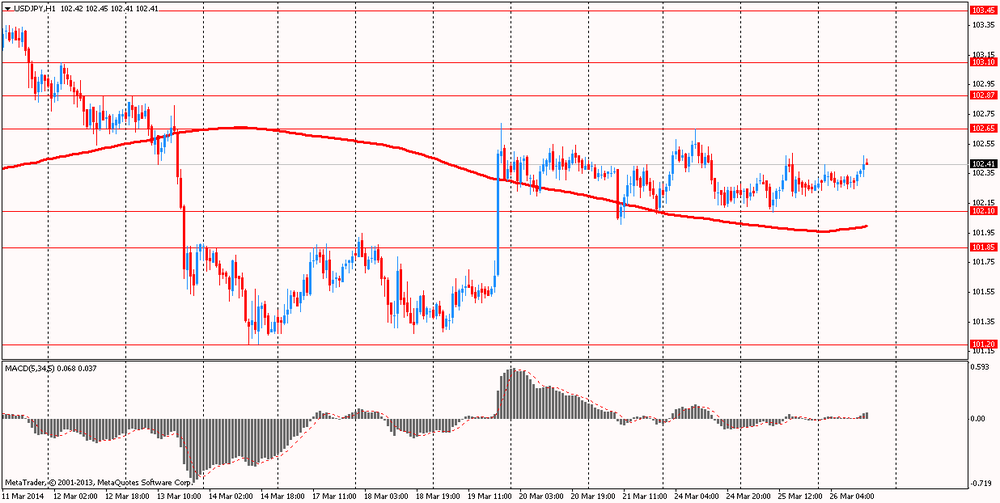

USD / JPY: during the European session, the pair rose to Y102.47

At 21:45 GMT New Zealand will release the trade balance (for 12 months , from the beginning of the year ) , trade balance for February.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.