- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

09:00 Germany IFO - Business Climate March 111.3 110.9 110.7

09:00 Germany IFO - Current Assessment March 114.4 114.6 115.2

09:00 Germany IFO - Expectations March 108.3 107.7 106.4

09:30 United Kingdom Retail Price Index, m/m February -0.3% +0.5% +0.6%

09:30 United Kingdom Retail prices, Y/Y February +2.8% +2.6% +2.7%

09:30 United Kingdom RPI-X, Y/Y February +2.8% +2.6% +2.7%

09:30 United Kingdom Producer Price Index - Input (MoM) February -0.9% +0.4% -0.4%

09:30 United Kingdom Producer Price Index - Input (YoY) February -3.1% -5.3% -5.7%

09:30 United Kingdom Producer Price Index - Output (MoM) February +0.3% +0.2% 0.0%

09:30 United Kingdom Producer Price Index - Output (YoY) February +1.2% +1.0% +0.5%

09:30 United Kingdom BBA Mortgage Approvals February 50.0 50.0 47.6

09:30 United Kingdom HICP, m/m February -0.6% +0.5% +0.5%

09:30 United Kingdom HICP, Y/Y February +1.9% +1.7% +1.7%

09:30 United Kingdom HICP ex EFAT, Y/Y February +1.6% +1.6% +1.7%

11:00 United Kingdom CBI industrial order books balance March 37 30 13

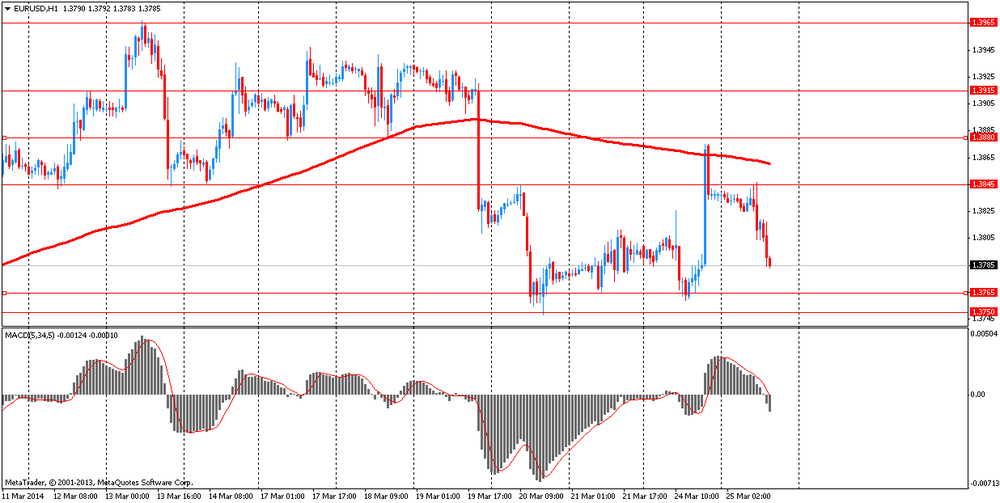

Euro fell against the dollar on weak data on Germany from the IFO. Level of business confidence in Germany fell more than expected in March , according to the monthly report from the institute IFO. Business climate index , which reflects business sentiment fell to 110.7 from 111.3 in February, when according to the expectations index was down to 110.9 . Meanwhile, the assessment of current conditions improved to 115.2 from 114.4 in the previous month . Economists expected the index to rise slightly to 114.6 . The expectations index fell to 106.4 in March from 108.3 a month ago. Experts' forecasts were at 107.7 .

Furthermore, the pressure on the euro was head of the Bundesbank comments . Governor of the Bank of Germany Jens Weidmann said in an interview today MNI, that negative interest rates until represent a kind of " terra incognita ", and there is no certainty that they will help to lower rates on loans. Head of the Bundesbank , who is also a member of the ECB Governing Council , admitted that negative rates can be an adequate tool to curb growth in the euro , but this issue requires more careful consideration.

"We should discuss their efficiency, their costs and side effects , - said Weidmann . He also added that this is not intended to completely exclude an application QE. In addition, Weidmann said that in case of risks to price stability, followed by tightening monetary policy.

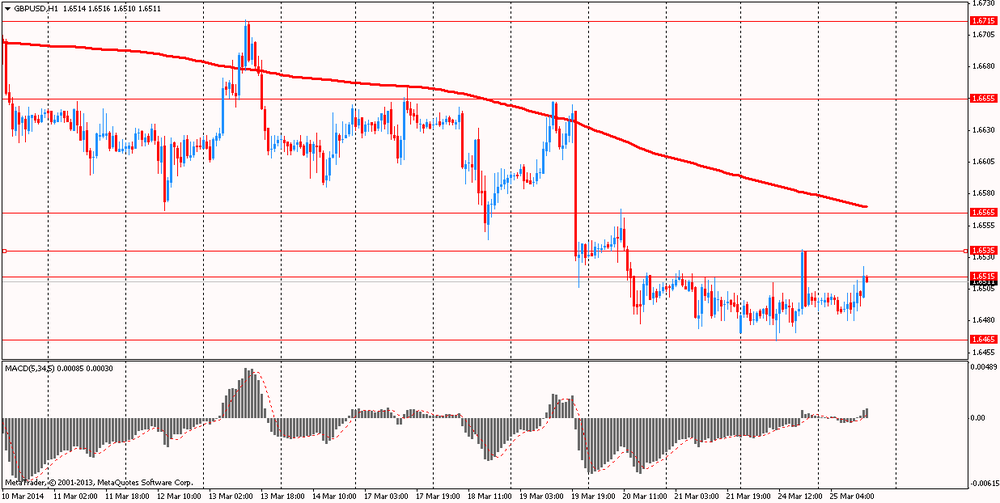

The British pound rose moderately against the U.S. dollar after a report on inflation. In the UK inflation slowed in February , as expected , to a four-year low due to lower transport prices showed Tuesday, official data Office for National Statistics . Consumer prices rose 1.7 percent year -on-year after increasing 1.9 percent in January. Growth rates in line with economists' expectations .

On a monthly measurement of consumer prices rose by 0.5 percent , according to the forecast , offsetting a drop of 0.6 percent in January . At the same time , core inflation , which excludes prices of energy, food , alcoholic beverages and tobacco , rose to 1.7 percent in February from 1.6 percent in January.

Another report showed that the number of mortgage certificates to purchase a home in the UK unexpectedly fell in February to its highest level in almost six and a half years , to reflect the latest data from the British Bankers Association (BBA).

Agreed amount of mortgage loans decreased from a seasonally adjusted 47,550 to 49,341 in January , which was revised to 49,972 . Economists had forecast an increase on the 50,000 figure . The level of January is the highest since September 2007 , when it was 54,148 . In February 2013 the number of certificates was 31,073 .

The total number of approvals , which includes re- mortgage and other secured borrowings , was 78,424 in February, compared with 81,047 in the previous month .

Gross mortgage borrowing increased by 47 percent annually to 11.5 billion pounds in February to the highest level since August 2008 . Credit card spending rose by 7 per cent compared with the previous year to 8.2 billion pounds . Deposits of individuals increased by 3.7 percent .

EUR / USD: during the European session, the pair fell to $ 1.3784

GBP / USD: during the European session, the pair rose to $ 1.6504

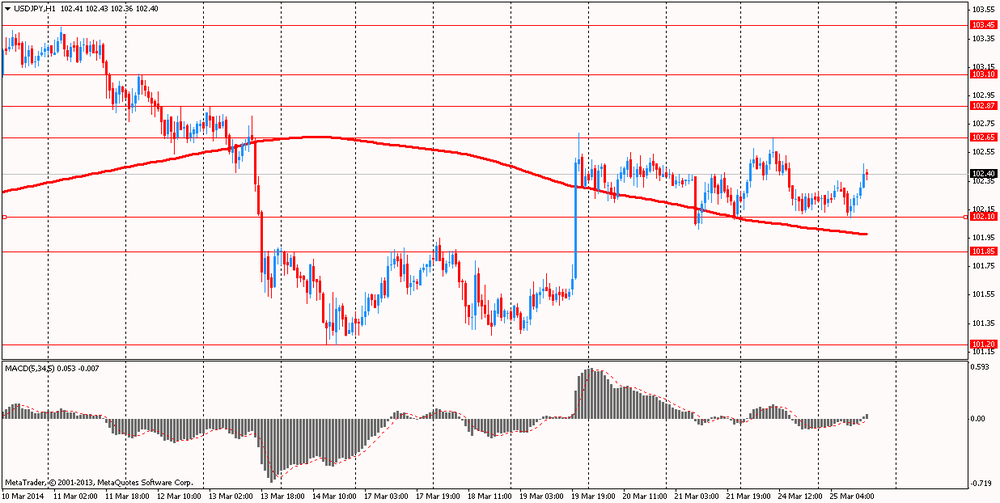

USD / JPY: during the European session, the pair rose to Y102.47

U.S. at 13:00 GMT release index of home prices in 20 major cities of S & P / Case-Shiller, national composite house price index S & P / CaseShiller January to 14:00 GMT - indicator of consumer confidence for March, sales in the primary market in February.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.