- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

07:58 France Manufacturing PMI (Preliminary) March 49.7 49.8 51.9

07:58 France Services PMI (Preliminary) March 47.2 47.9 51.4

08:28 Germany Manufacturing PMI (Preliminary) March 54.8 54.7 53.8

08:28 Germany Services PMI (Preliminary) March 55.9 55.9 54.0

08:58 Eurozone Manufacturing PMI (Preliminary) March 53.2 53.2 53.0

08:58 Eurozone Services PMI (Preliminary) March 52.6 52.6 52.4

11:00 Germany Bundesbank Monthly Report March

The euro rose against the dollar on strong data on private sector activity in France and then fell sharply to nedotyanuvshih forecasts to data on business activity in the euro zone and Germany.

French private sector returned to growth in March for the first time since last October , revealed on Monday showed preliminary surveys conducted Markit Economics. Composite activity index rose to 51.6 from 47.9 in February. Score above 50 indicates expansion , and the last reading indicates the fastest growth in 31 months . Expansion was broad-based and in the service sector and in manufacturing. The index of activity in services rose to 51.4 , a 26- month high , from 47.2 in February. Index , as expected , had to grow to 47.9 . In addition, the PMI index for the manufacturing sector has improved more than expected to 51.9 , a 33- month high , from 49.7 in the previous month . The index is projected to grow to was 49.8 .

Private sector growth slowed in Germany in March from 33 -month high , but growth remained markedly high on Monday showed preliminary data from surveys conducted in the Markit Economics. Composite activity index fell to 55.0 from February's 33 -month high of 56.4 . Weakening growth in business activity was broad-based , while both indices - for producers and service providers showed weaker growth than seen in February. Preliminary index of service sector activity fell more than expected to 54.0 from 55.9 in February. Predicted that the index would remain at 55.9 . Furthermore , preliminary manufacturing PMI 53.8 compared to 54.8 in February and below the expected reading of 54.7 .

Eurozone economy expanded ninth consecutive month in March , but the growth rate slowed slightly , data showed on Monday, Markit Economics . Consolidated activity index was 53.2 in March. Result was slightly lower than achieved in February of this year a 32- month high of 53.3 and above the expected level of 53.1 . The index remains above the neutral mark of 50, which indicates an increase in private sector activity . Eurozone economy in March continues to be in the strongest period of growth since the first half of 2011, said Markit. Preliminary PMI in service sector fell to 52.4 from 52.6 in February , while he , according to expectations , had to remain at the level of 52.6 . In addition, the manufacturing PMI fell to 53.0 from 53.2 in February. It was expected that the index will also remain unchanged at the February level .

The Australian dollar rose against the U.S. dollar after ratings agency Fitch announced its decision to leave Australia at the same rating at AAA with a stable outlook , as the country has managed to maintain stability to external shocks due to " the presence of a strong economic and institutional foundations, including the highly advanced and flexible economy, and reliable policies and effective political and social institutions . "

However, the agency noted factors , mainly related to the slowdown in China's economy that could potentially determine the downgrade in the future : deterioration in the trade balance, large-scale problems in the banking sector or unsuccessful rebalancing the economy.

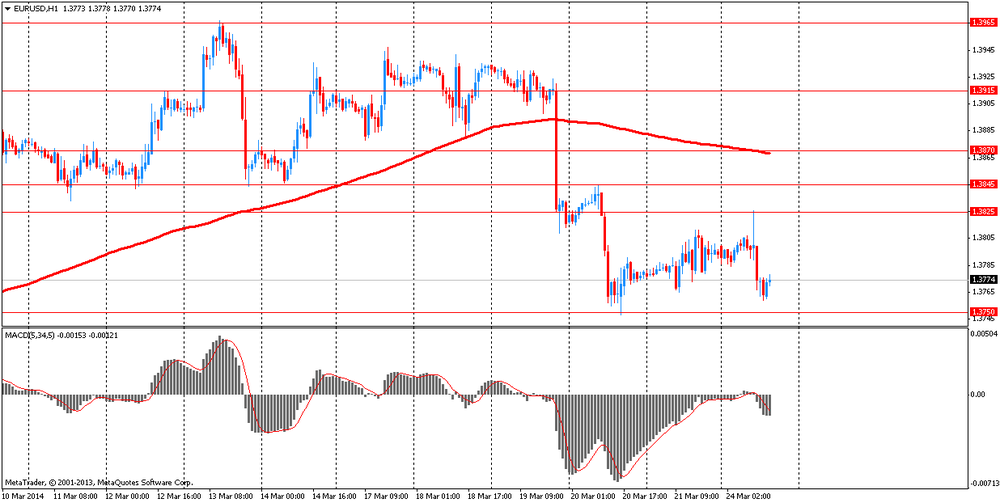

EUR / USD: during the European session, the pair rose to $ 1.3826 , but then fell to $ 1.3759

GBP / USD: during the European session, the pair rose to $ 1.6510 , but then fell to $ 1.6464

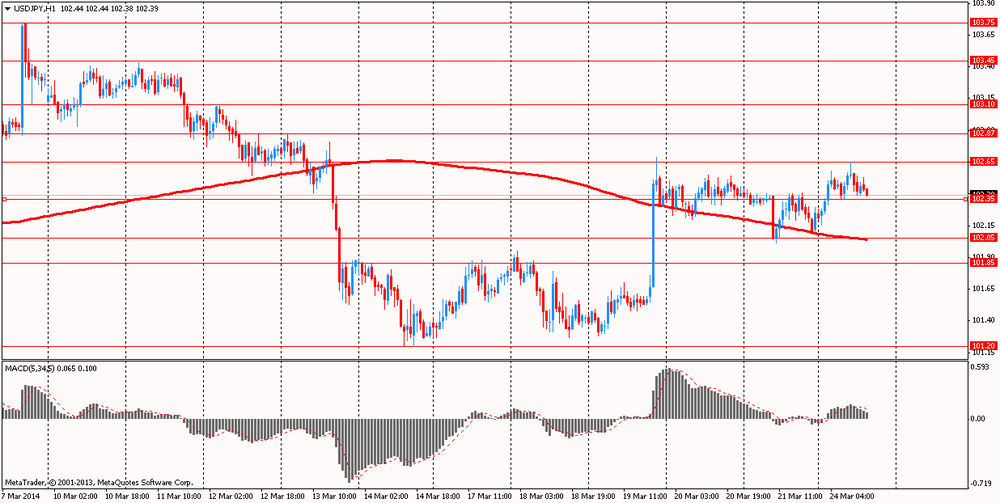

USD / JPY: during the European session, the pair rose to Y102.65 and stepped

At 13:45 GMT the United States will index of business activity in the manufacturing sector in March.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.