- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

10:00 Eurozone Industrial production, (MoM) January -0.4% Revised From -0.7% +0.6% -0.2%

10:00 Eurozone Industrial Production (YoY) January +1.2% Revised From +0.5% +1.9% +2.1%

The euro has risen sharply against the U.S. dollar despite weak data on industrial production in the euro area . Official data showed Eurostat, in the euro zone industrial production fell unexpectedly in January , largely due to reduced production of energy.

Industrial output fell 0.2 percent on a monthly basis in January , showing the second consecutive fall. Economists had expected production to grow by 0.6 percent after falling by a revised 0.4 percent in December .

Production of energy decreased by 2.5 percent, and the production of durable consumer goods fell by 0.6 percent . Intermediate goods decreased by 0.1 percent. Partially offset this decline is that the release of capital goods rose by 0.9 percent, while production of consumer non-durable goods increased by 0.4 percent.

On an annual basis, industrial production growth accelerated to 2.1 percent from 1.2 percent in December . Economists forecast that output will grow by 1.9 per cent .

In light of this release analysts ING Bnak NV commented : " The main reason for poor outcome again was to reduce energy production by 2.5% , but intermediate goods and consumer durables also pointed to the decline in production ... While the benchmark is not met expectations , weak energy component probably overshadowed a slight improvement in the overall indicator. However, to strengthen the eurozone recovery process still requires export growth . "

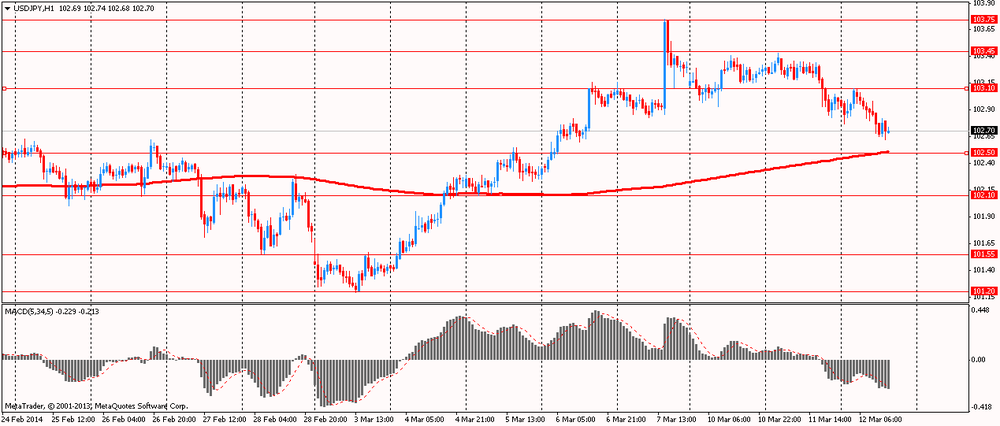

The yen rose against most currencies on concerns about the state of China's economy. This increases the demand for safe-haven assets , which is the yen . In February, China's exports fell by the largest value since the beginning of the financial crisis . Index decreased yoy by 18.1 % , while the experts had expected growth of 7.5%. However, the real picture is quite difficult to evaluate because of the rather long New Year celebrations on the lunar calendar . Holidays in China traditionally distort statistics . Meanwhile, imports grew by 10.1% , resulting in a trade deficit reached highs for 2 years at $ 23 billion

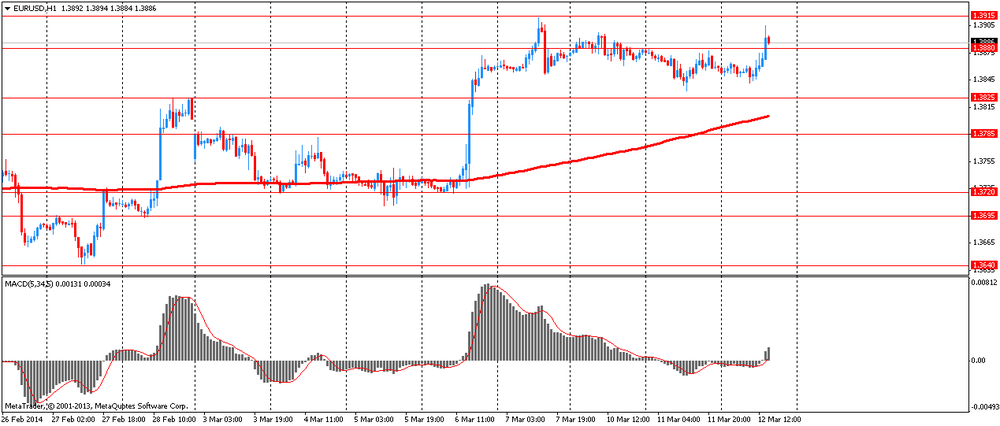

EUR / USD: during the European session, the pair rose to $ 1.3905

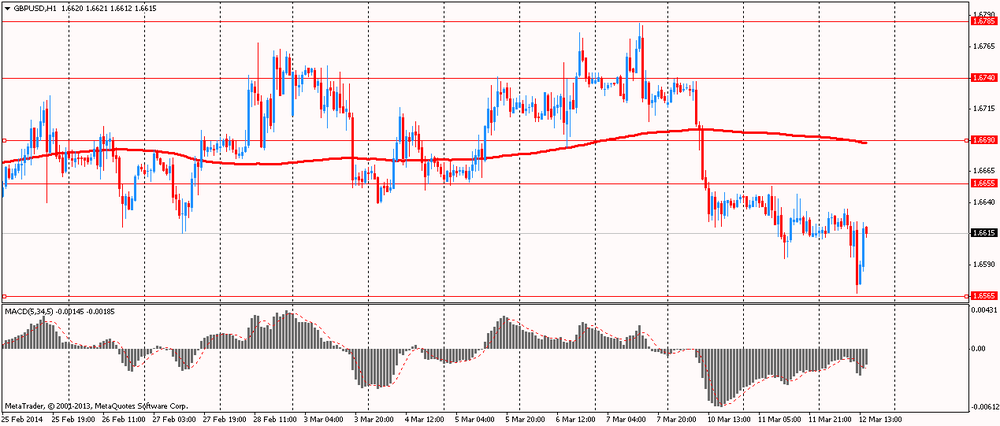

GBP / USD: during the European session, the pair fell to $ 1.6567 and retreated

USD / JPY: during the European session, the pair fell to Y102.62

At 17:01 GMT the United States places the 10 - year bonds . At 18:00 GMT the United States will be released monthly budget execution report . At 20:00 GMT we will know the RBNZ decision on the basic interest rate will be a press conference by the RBNZ will be done RBNZ accompanying statement , the protocol will monetary policy RBNZ . At 23:50 GMT , Japan will publish the change in orders for machinery and equipment in January .

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.