- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

07:00 United Kingdom Nationwide house price index February +0.7% +0.6% +0.6%

07:00 United Kingdom Nationwide house price index, y/y February +8.8% +9.0% +9.4%

07:00 Germany Retail sales, real adjusted January -2.5% +1.2% +2.5%

07:00 Germany Retail sales, real unadjusted, y/y January -2.4% +0.1% +0.9%

07:45 France Consumer spending January -0.1% -0.8% -2.1%

07:45 France Consumer spending, y/y January +1.4% +1.4% -0.5%

08:00 Switzerland KOF Leading Indicator February 2.01 Revised From 1.98 2.03 2.03

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) February +0.7% +0.7% +0.8%

10:00 Eurozone Unemployment Rate January 12.0% 12.0% 12.0%

The euro rose against the dollar after U.S. data on inflation and unemployment in the eurozone. Eurozone inflation was 0.8 percent for the third month in a row in February , showed preliminary estimate of Eurostat , published on Friday . Inflation is projected to slow down to was 0.7 percent. Inflation has remained below the target of the European Central Bank " below but close to 2 percent," the thirteenth consecutive month and is in the four-year low .

The unemployment rate in the euro area remained at 12 per cent from October , showed on Friday Eurostat data . Result is consistent with economists' expectations . In January, 19.17 million people were unemployed in the euro area . The number of people unemployed increased by 17,000 in December , while it fell by 67,000 in January 2013.

Another report showed that German retail sales rose more than expected in January compared with the previous month , on Friday showed the data published by the Federal Statistical Office. Retail sales rose a seasonally adjusted and calendar corrections by 2.5 percent on a monthly measurement , offsetting a decline of 2 percent in December . Economists had expected an increase of 1 percent. In annual terms, sales rose 0.9 percent in January , after falling 1.5 percent in the previous month . Economists had forecast a decline of 1.7 percent.

The British pound rose against the dollar on housing data and potrebdoveriyu . UK consumer confidence remained unchanged in February at the highest level in more than six years , as personal financial expectations improved by expanding the background of economic recovery. The consumer confidence index remained unchanged at -7 in February , the highest level since September 2007 , data showed on Friday, the latest survey GfK NOP. Result noted significant improvement since last February , when the index reached -26 . The survey showed that two of the five indicators used to calculate the index , fell this month , the two sub-indices increased , and one remained unchanged.

Housing prices in the UK rose significantly more rapidly in February , with more than economists forecast , data showed a survey released on Friday Nationwide. The housing price index rose by 9.4 per cent per annum, after increasing 8.8 percent in January. Economists had expected growth in February at 9 percent. Prices rose twelfth consecutive month. The rise in prices reflects an increase in demand for new homes , supported by record low interest rates , improving access to credit and rising consumer confidence .

House prices in the UK averaged 177,846 pounds in February , which is higher than 176,491 pounds a month earlier . House prices rose a seasonally adjusted 0.6 percent compared to January , when the index recorded an increase of 0.8 percent , which was revised from 0.7 per cent . In February, a result in line with expectations of economists.

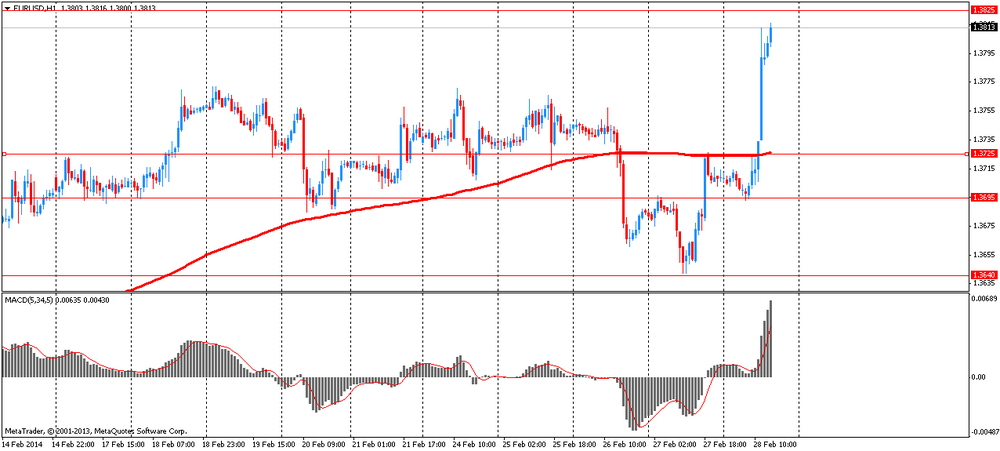

EUR / USD: during the European session, the pair rose to $ 1.3813

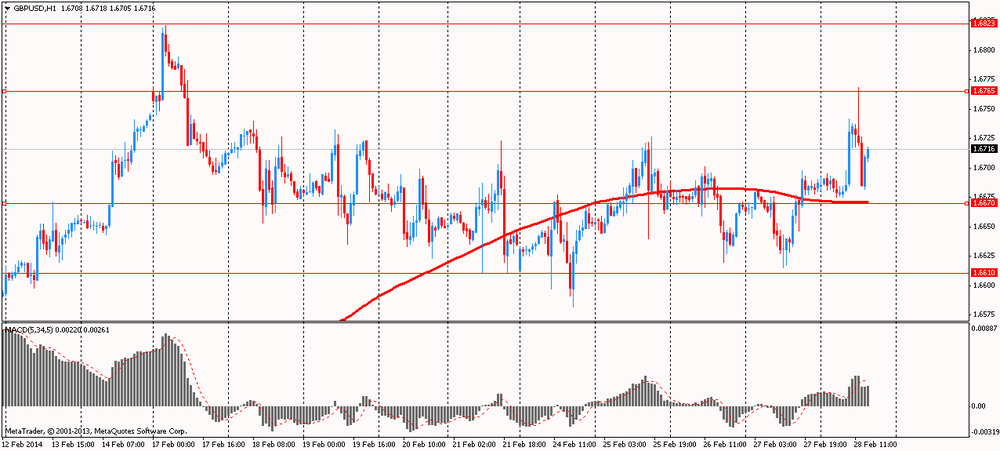

GBP / USD: during the European session, the pair rose to $ 1.6768 and retreated

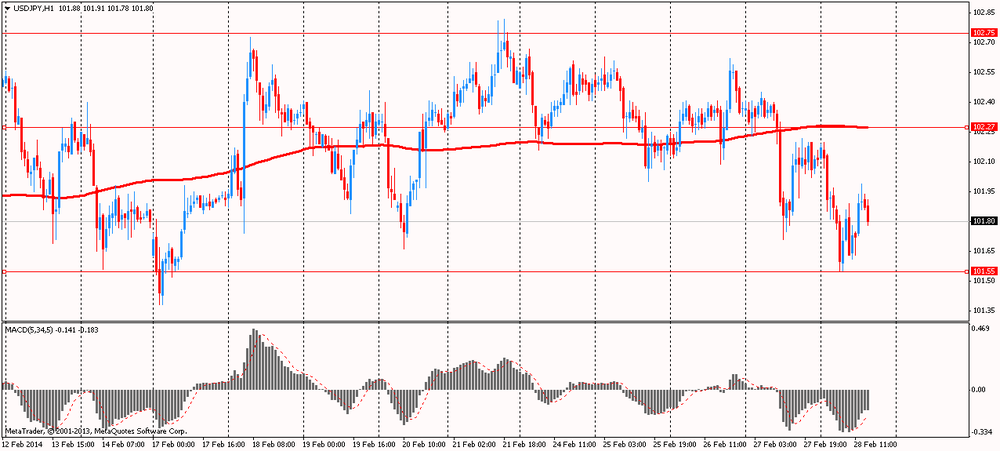

USD / JPY: during the European session, the pair dropped to Y101.55

At 13:30 GMT , Canada will release the GDP change in December. In the U.S. at 13:30 GMT will be released updated information on changes in the volume of GDP, the GDP price index , the index of personal consumption expenditures , the main index of personal consumption expenditures for the 4th quarter , in 14:45 GMT - Index Chicago PMI, at 14:55 GMT - indicator consumer confidence from the University of Michigan in February, at 15:00 GMT - the change in volume of pending home sales for January.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.