- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

07:00 Germany Gfk Consumer Confidence Survey March 8.3 Revised From 8.2 8.3 8.5

07:00 Switzerland UBS Consumption Indicator January 1.81 1.44

09:25 United Kingdom MPC Member Dr Ben Broadbent Speaks

09:30 United Kingdom Business Investment, q/q Quarter IV +2.0% +2.6% +2.4%

09:30 United Kingdom GDP, q/q (Revised) Quarter IV +0.7% +0.7% +0.7%

09:30 United Kingdom GDP, y/y (Revised) Quarter IV +2.8% +2.8% +2.7%

Euro fell against the dollar retreated from highs reached on data potrebdoveriyu in Germany. According to a survey by GfK consumer confidence index in Germany reflected the improvement in March. Consumer confidence index rose to 8.5 points from 8.3 points in February. The index is projected to grow only had 8.3 points from February's initial value of 8.2.

After five successive increases in economic expectations recorded a moderate decline of 3.4 points to 31.9 in February. In contrast to economic expectations , income expectations continued to rise in February to 48.6 from 46.2 . They once again improved slightly from a 13-year high reached in the previous month .

Willingness to buy remained at a high level, and only slightly decreased to 48.9 from 50.0 in January. Propensity to save has not registered any significant changes . Research group GfK predicted real growth of total private consumption by 1.5 percent in 2014.

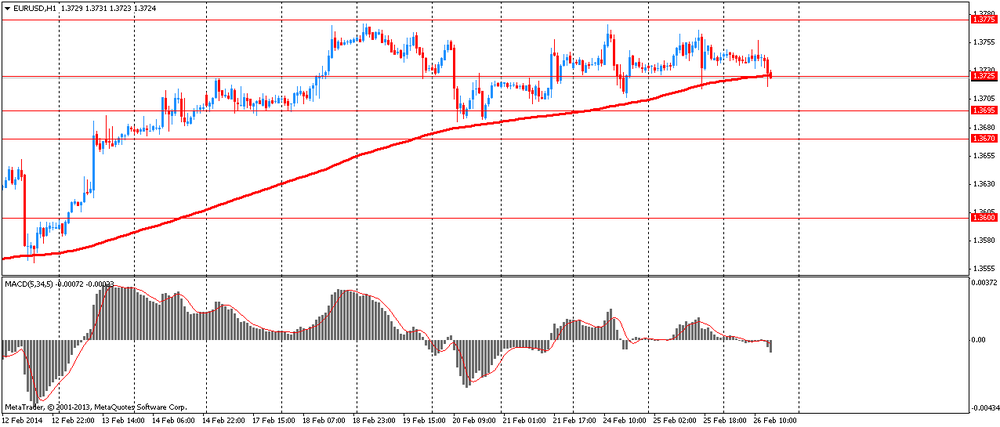

Later, the pair EUR / USD down at the end of the European session , a fresh daily low. However , the pair remains within the range this week , unable to determine the direction of movement. "The lack of economic data , interest and momentum - that's the motto under which were the last days in the currency markets - analysts TD Securities. - EUR / USD stuck at around 1.37 , and intraday ranges are getting smaller and smaller. EUR looks quite " happy ", in our opinion, and despite the fact that the price is not too eager to test the peaks of the recent range , at the moment there is no obvious catalysts its downward movement . "

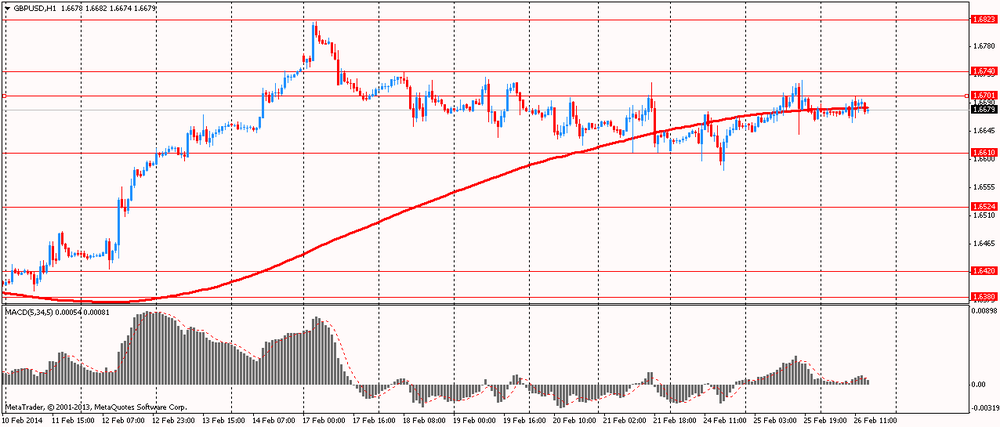

The British pound rose moderately against the U.S. dollar after the release of the revised GDP data . The UK economy grew in line with preliminary estimates for the fourth quarter and for the full growth in 2013 was weaker preliminary calculations. Such data are the Office for National Statistics (ONS ) .

Gross domestic product expanded 0.7 percent in the quarterly measurement , according to a preliminary estimate published on 28 January. Growth rate slowed down slightly from the 0.8 percent increase in the third quarter . In annual terms, the economy grew by 2.7 percent - growth has been revised downwards to 2.8 percent. In general, the 2013 GDP growth was revised down slightly to 1.8 percent from 1.9 percent.

With regard to production , mining , including oil and gas production fell by 1.9 percent in the fourth quarter . Total production gained 0.5 percent, compared with a preliminary estimate of 0.7 percent. Construction volumes rose 0.2 percent instead of 0.3 percent fall estimated initially.

Increase in the dominant services sector confirmed at 0.8 percent. Meanwhile , production in agriculture , forestry and fishing fell by a revised 0.1 percent.

Another report from the ONS showed that production in the services sector grew by 3.2 percent in December compared with the previous year . Compared with November services index rose 0.2 percent .

According to preliminary results of the ONS , only gross fixed capital formation increased by £ 1.3 billion or 2.4 percent in the fourth quarter compared with the previous quarter .

At the same time , business investment grew by an estimated 0.8 billion pounds or 2.4 percent compared to the previous quarter and were 8.5 percent higher compared to the fourth quarter of 2012 .

EUR / USD: during the European session, the pair rose to $ 1.3745 , and then fell to $ 1.3716

GBP / USD: during the European session, the pair rose to $ 1.6701

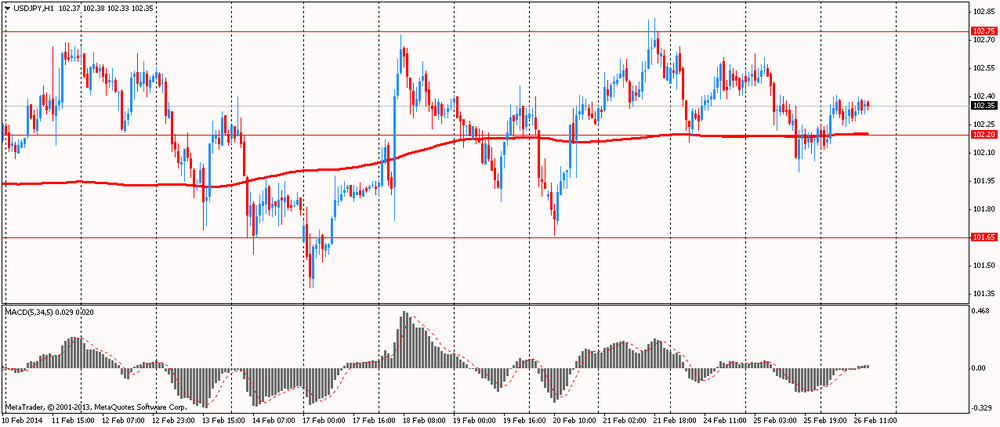

USD / JPY: during the European session, the pair rose to Y102.40

At 15:00 GMT the United States will sales in the primary market in January . At 21:45 GMT New Zealand will release the trade balance (for 12 months , from the beginning of the year ) and the trade balance for January.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.