- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

07:00 Germany GDP (QoQ) (Finally) Quarter IV +0.4% +0.4% +0.4%

07:00 Germany GDP (YoY) (Finally) Quarter IV +1.3% +1.3% +1.4%

09:30 United Kingdom BBA Mortgage Approvals January 46.5 47.9 49.9

11:00 United Kingdom CBI retail sales volume balance February 14 15 37

12:45 Eurozone European Commission Economic Growth Forecasts February

The euro rose against the dollar on GDP data in Germany. The German economy grew moderately in late 2013 as originally anticipated at the beginning of this month , final data showed Destatis. Gross domestic product increased by 0.4 percent compared with the previous quarter , which is slightly faster than the expansion of 0.3 percent , which is seen in the third quarter . This was in accordance with the calculation results , published on February 14.

The expenditure breakdown of GDP showed that exports of goods and services grew by 2.6 percent compared with the third quarter . At the same time , imports increased by no more than 0.6 percent. As a result , the balance of exports and imports contributed to the growth by 1.1 percentage points of GDP and is a key economic engine in the fourth quarter . Investments grew by 1.4 percent in quarterly terms. Nevertheless , stocks declined significantly , leading to slower economic growth by 0.8 percentage points. While government spending remained unchanged from the previous quarter, household spending on final consumption decreased slightly by 0.1 percent .

In annual terms with the calendar adjusted GDP grew more than doubled to 1.4 percent from 0.6 percent in the third quarter. In addition, the price-adjusted GDP grew by 1.3 percent compared with 1.1 percent in the previous period . Results in the fourth quarter correspond to preliminary estimates .

The British pound rose against the U.S. dollar , supported by data and comments of the Bank of England McCafferty . McCafferty said in an interview with Reuters on Tuesday that the first term of the Bank of England rate hike will depend greatly on the state of inflation. In the case of acceleration of its growth may increase more than previously . Yet he stressed that the projections assume the first increase in Q2 . 2015 , and it is quite reasonable. Moreover, McCafferty said that the current growth of the pound does not harm British exports, but if it continues , the Bank of England will be forced to react.

With regard to the published statistics, the number of mortgage approvals in the UK rose by more than expected , and reached its highest level since September 2007 , data showed the British Bankers Association (BBA). Number of loans for house purchase rose to 49,972 in January , the highest level since September 2007 , from 47,086 in December. The expected level was 47,150 . Including re- mortgages , general statements made 82,151 compared to 78,584 a month ago.

Another report showed that UK retail sales rose at the fastest pace since June 2012 . These are the findings of research trends distributive trade from the Confederation of British Industry (CBI). About 45 percent of respondents reported that sales rose compared with the previous year , while 8 percent said they were down . This gave the balance 37 per cent. Retailers expect sales to grow at a steady pace in the next month - 43 percent expect growth, 15 percent expect a recession. The balance was 28 percent. Investment intentions for the year ahead given the balance of 17 percent, which is the strongest level since November 2010 . Retailers also expect that their overall business situation will improve over the next three months.

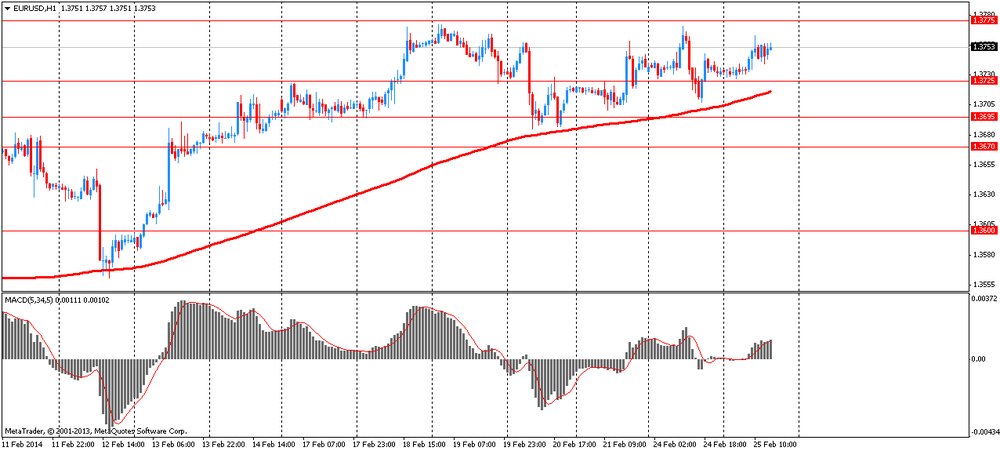

EUR / USD: during the European session, the pair rose to $ 1.3763

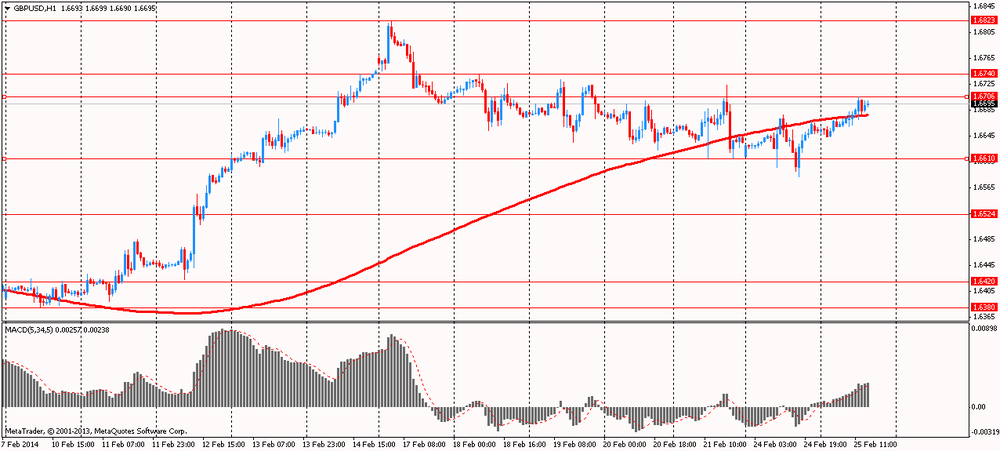

GBP / USD: during the European session, the pair rose to $ 1.6706

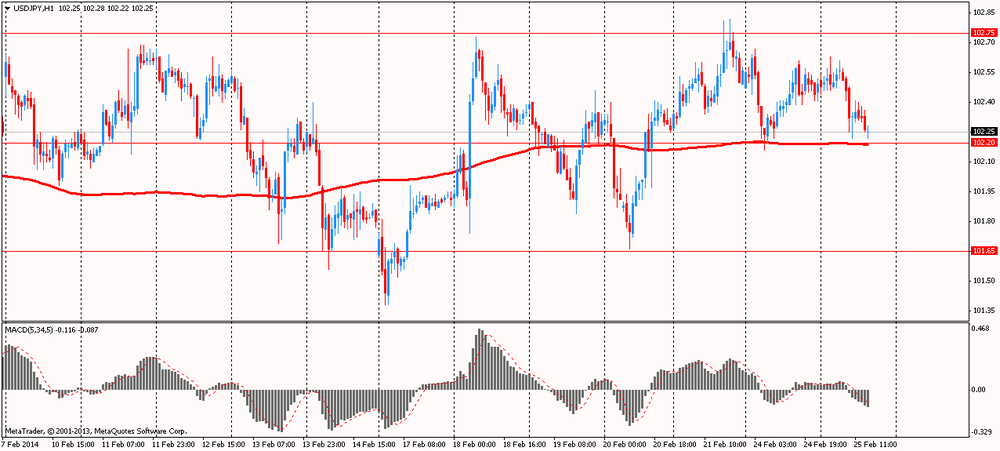

USD / JPY: during the European session, the pair fell to Y102.22

In the U.S. at 14:00 GMT will index of home prices in 20 major cities of S & P / Case-Shiller, national composite house price index S & P / CaseShiller December to 15:00 GMT - indicator of consumer confidence for February at 21:30 GMT - the change in volume of crude oil , according to the API. Chairman of the Board of Governors Federal Reserve Janet Yellen suggests .

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.