- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

07:00 Germany Retail sales, real adjusted December +1.5% +0.2% -2.5%

07:00 Germany Retail sales, real unadjusted, y/y December +1.6% +1.9% -2.4%

07:45 France Consumer spending December +1.4% -0.2% -0.1%

07:45 France Consumer spending, y/y December +1.5% -0.8% +0.2%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January +0.8% +0.9% +0.7%

10:00 Eurozone Unemployment Rate December 12.1% 12.1% 12.0%

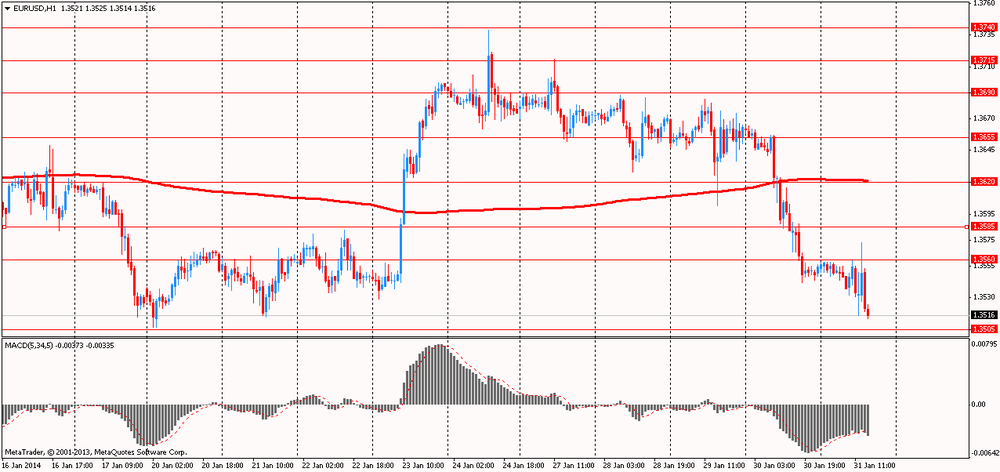

The euro exchange rate shows mixed against the U.S. dollar with a predominance of negative component . Today we have published data on inflation and unemployment in the eurozone. Eurozone inflation slowed for the second month in a row in January , showed preliminary estimate by Eurostat. Another report showed that the unemployment rate in the currency bloc fell slightly in December.

Inflation unexpectedly fell to 0.7 percent in January from 0.8 percent in December . Economists had forecast that inflation will rise to 0.9 percent. Meanwhile, core inflation, which excludes prices of energy , food, alcohol and tobacco, rose to 0.8 percent from 0.7 percent in December . Result is consistent with economists' expectations . Inflation has remained below the target level of the European Central Bank " below but close to 2 percent," the twelfth consecutive month.

In a separate report , Eurostat said that the unemployment rate fell slightly to 12 percent in December compared with 12.1 percent in November. According to expectations , the unemployment rate was to remain unchanged. The number of unemployed fell by 129,000 from November to 19.01 million . In the 28 countries of the EU unemployment rate was 10.7 percent in December , compared with 10.8 percent in November .

In light of these results , Martin Van Vlient analyst ING, commented: "Given the uncertain recovery and high unemployment rate (12.0 %) , wage and price pressures in the euro area is likely to remain low for a longer time than currently expects the ECB ... However, at the moment, new signs of recovery suggest that during the meeting next week the central bank chooses to " keep their powder dry ."

At the same time , pressure on the single currency was weak retail sales data in Germany. German retail trade turnover decreased unexpectedly during the Christmas season , showed the preliminary results of the Federal Statistical Office .

Retail turnover fell by 2.5 percent in real terms compared with a month ago , offset by growth in November to 0.9 percent. Sales are expected to increase were 0.2 percent . Retail sales , on an annual basis , fell 2.4 percent in December , in contrast to 1.1 percent growth , placed in November and 1.9 percent growth expected by economists. Retail trade turnover during the year 2013 was 0.1 percent more than in the previous year , showing the same pace as in 2012 .

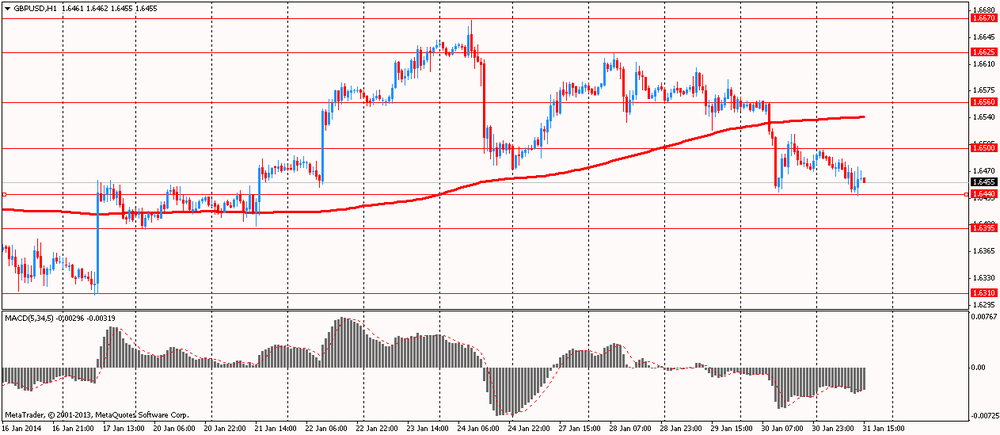

The British pound fell against the U.S. dollar despite the strong consumer confidence . UK consumer optimism in January reached its highest level in more than six years , helped by an improvement in both their personal finances because of the economic situation . This is evidenced by the results of the survey, presented Friday by research company GfK. Monthly consumer confidence index calculated by GfK, in January rose to -7 to -13 in December. This is the highest level since September 2007. The result was better than -10 expected by most economists .

"After three consecutive drops at one point in January, the index showed a dramatic return to the sharp increase , which was observed last summer ," - said Nick Moon , managing director of the Social Science Research in GfK. " All five of the individual elements that make up the index , showed a significant increase in this month ."

EUR / USD: during the European session, the pair rose to $ 1.3573 , and then fell to $ 1.3514

GBP / USD: during the European session, the pair fell to $ 1.6438

USD / JPY: during the European session, the pair fell to Y102.10

At 13:30 GMT , Canada will report on changes in the volume of GDP in November. In the U.S. at 13:30 GMT will main index for personal consumption expenditures , changes in spending, deflator for personal consumption expenditures in December , the index of the cost of labor for the 4th quarter , in 14:45 GMT - Chicago PMI index for January, in 14:55 GMT - an indicator of consumer confidence from the University of Michigan in January

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.