- Analytics

- News and Tools

- Market News

- Asian session: The dollar headed

Asian session: The dollar headed

00:05 United Kingdom Gfk Consumer Confidence January -13 -10 -7

00:30 Australia Producer price index, q / q Quarter IV +1.3% +0.7% +0.2%

00:30 Australia Producer price index, y/y Quarter IV +1.9% +2.7% +1.9%

00:30 Australia Private Sector Credit, m/m December +0.3% +0.4% +0.5%

00:30 Australia Private Sector Credit, y/y December +3.8% +3.9%

The dollar headed for its best January since 2010 versus a basket of its peers ahead of data forecast to show Americans increased spending for an eighth month, adding to evidence the U.S. economy is growing. U.S. consumer spending probably rose 0.2 percent in December, following a 0.5 advance in November that was the biggest in five months, according to the median estimate of economists surveyed by Bloomberg before the Commerce Department report today.

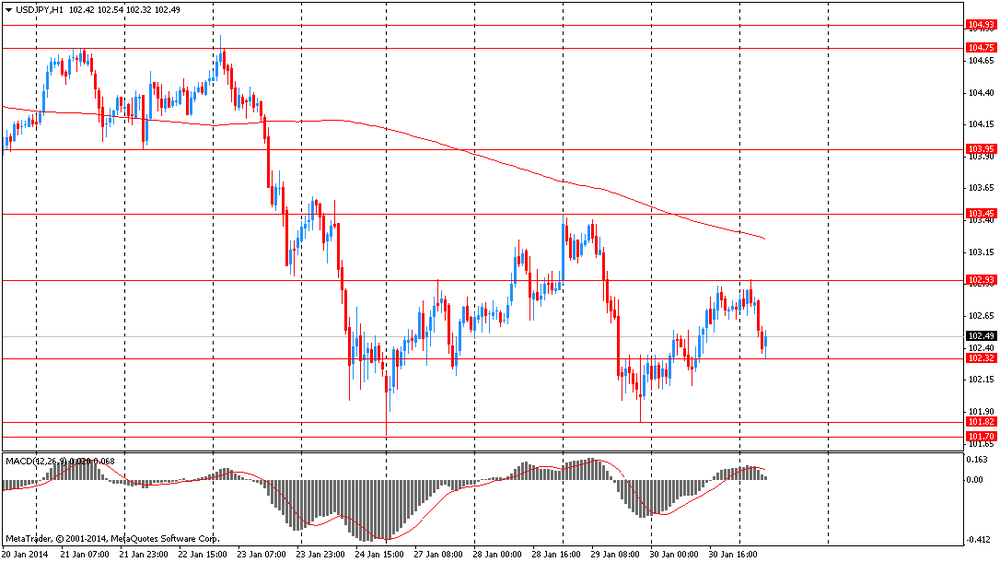

The yen extended monthly gains versus its 16 major peers as equities fell in Japan and data showing accelerating inflation reduced the case for monetary easing. A report today showed Japan’s December core consumer prices rose 1.3 percent from a year earlier, compared with the median estimate for a 1.2 percent gain in a Bloomberg News survey.

The euro was poised for its biggest monthly decline since March and the first loss since August against the greenback before a European Central Bank policy meeting Feb. 6.

The New Zealand dollar extended its worst start to a year since 2010 after Reserve Bank Governor Graeme Wheeler said today the exchange rate has “been stronger and initial indications are that house price inflation may be starting to moderate. The exchange rate remains a considerable headwind for the economy, and the bank does not believe its current level is sustainable in the long run,” he said.

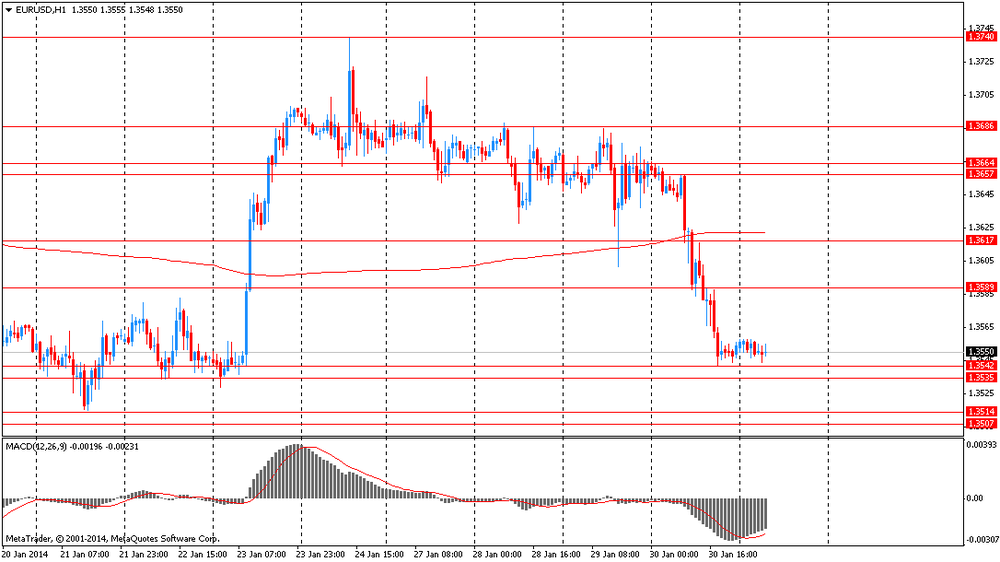

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3545-55

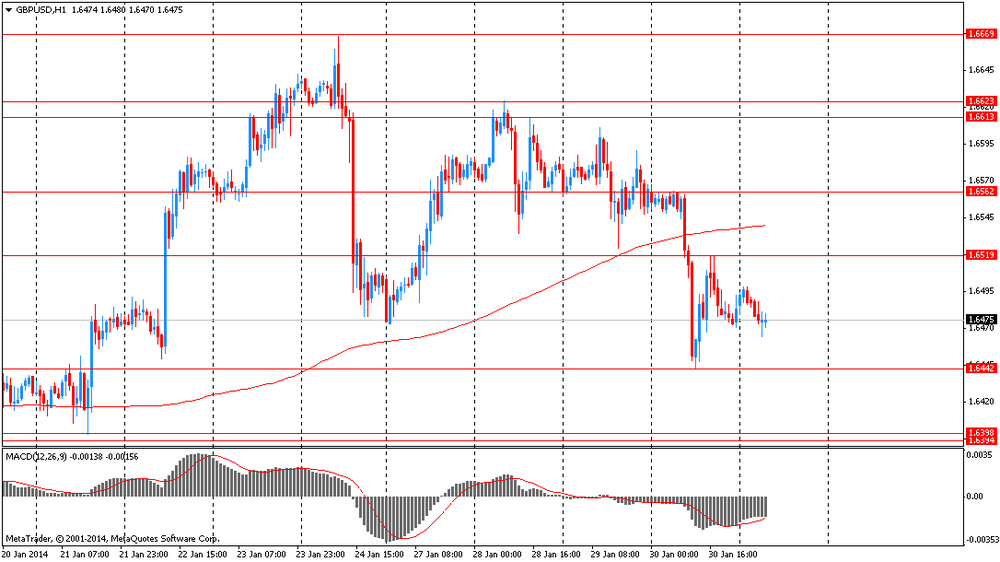

GBP / USD: during the Asian session the pair fell to $ 1.6465

USD / JPY: on Asian session the pair fell to Y102.30

Although the week's main events are behind us, there is still a full calendar ahead Friday. The European calendar gets underway at 0700GMT, with the release of the German December retail sales data. Sales are seen rising 0.2% on month, up 1.9% on year. At the same time, the German Finance Ministry releases its monthly report. French data set for release at 0745GMT includes the December construction spending data and the December PPI numbers. ECB Governing Council members Nowotny, Noyer and Rimsevics are to speak in Budapest, Hungary from 0800GMT. The EMU data set for release at 1000GMT is the December employment data and, perhaps more importantly, the January flash HICP data. HICP is seen by analysts at +0.9% on year, although there is a risk of a downside surprise.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.