- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

08:00 Switzerland KOF Leading Indicator January 1.95 2.02 1.98

08:55 Germany Unemployment Change January -15 -5 -28

08:55 Germany Unemployment Rate s.a. January 6.9% 6.9% 6.8%

09:30 United Kingdom Net Lending to Individuals, bln December 1.5 1.9 1.7

09:30 United Kingdom Mortgage Approvals December 70.8 72.5 71.6

10:00 Eurozone Business climate indicator January 0.2 Revised From 0.27 0.34 0.19

10:00 Eurozone Economic sentiment index January 100.4 Revised From 100.0 101.0 100.9

10:00 Eurozone Industrial confidence January -3.4 -3.0 -3.9

13:00 Germany CPI, m/m (Preliminary) January +0.4% -0.4% -0.6%

13:00 Germany CPI, y/y (Preliminary) January +1.4% +1.5% +1.3%

Euro fell against the U.S. dollar despite the strong data on the labor market in Germany sentiment in the eurozone economy . German unemployment fell in January, more than forecast , as companies were more confident in the strength of Europe's largest economy . Number of people out of work fell by a seasonally adjusted 28,000 to 2.93 million , after falling by 19,000 in December , reported the Federal Labour Agency . Economists had forecast a drop of 5000 . Adjusted unemployment rate was 6.8 percent, almost unchanged from December , and remained near the minimum of twenty years . Unemployment fell by 16,000 in West Germany and 12,000 in the eastern part .

In turn, in the euro area level of economic confidence rose ninth consecutive month in January , data showed on Thursday a survey from the European Commission .

Economic sentiment index rose to 100.9 in January from 100.4 in the previous month . But at the same time the reading was slightly lower than expected level of 101.

Confidence in industry fell unexpectedly by 0.5 to -3.9 in January , as a consequence of the management worsened assessment of stocks of finished products. The result was predicted to improve to -3.0 . Confidence in the services sector grew by 1.9 points to 2.3 , resulting in improved estimates of expected demand and past business situation , while the assessment of the past demand has not changed much .

In addition , consumer confidence has improved markedly to 11.7 , being in accordance with a preliminary estimate , compared with 13.5 in December. The increase was primarily due to improved expectations about future unemployment and the general economic situation . The result was above its long-term average for the first time since July 2011 . Confidence in the retail sector increased to -3.4 -5 , due to improvements in all of its three components, namely the present and expected business situation and the assessment of stocks.

Meanwhile , confidence in the construction sector fell strongly to -30.1 from -26.4 as a result of a marked deterioration in ratings portfolio managers orders and deteriorating employment expectations . In January, the business climate indicator for the euro area almost unchanged at 0.19 compared to 0.20 in December. Economists had expected the result 0.34. Production expectations leaders , their assessment of past production, and general and export order book remained broadly unchanged . At the same time , the level of stocks of finished products was evaluated more negatively .

The British pound fell against the dollar after the number of approved applications for mortgage loans in the UK in December rose less than forecast , but this figure was the highest in the last six years. These are the data published by the Bank of England on Thursday .

The number of permits for house purchase rose to 71,638 in December from a revised 70,820 in November. Economists had expected the figure to rise to 72,500 by November initial 70,758 .

The latter figure is the highest since January 2008 , when the number of mortgage approvals was 71,999 .

Loans secured by housing increased by 1.7 billion pounds , while economists expected an increase of 1.2 billion pounds .

Consumer loans increased by 0.6 billion pounds , while economists had expected growth to 0.7 billion pounds.

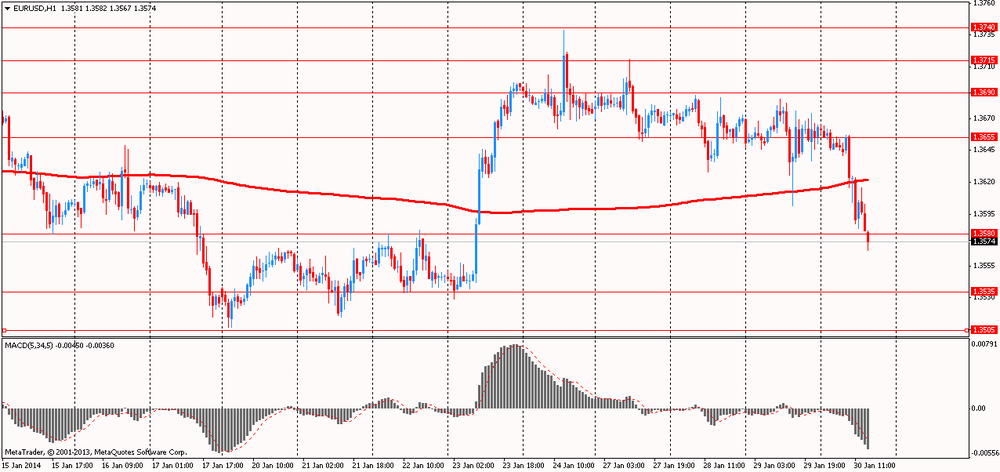

EUR / USD: during the European session, the pair fell to $ 1.3582

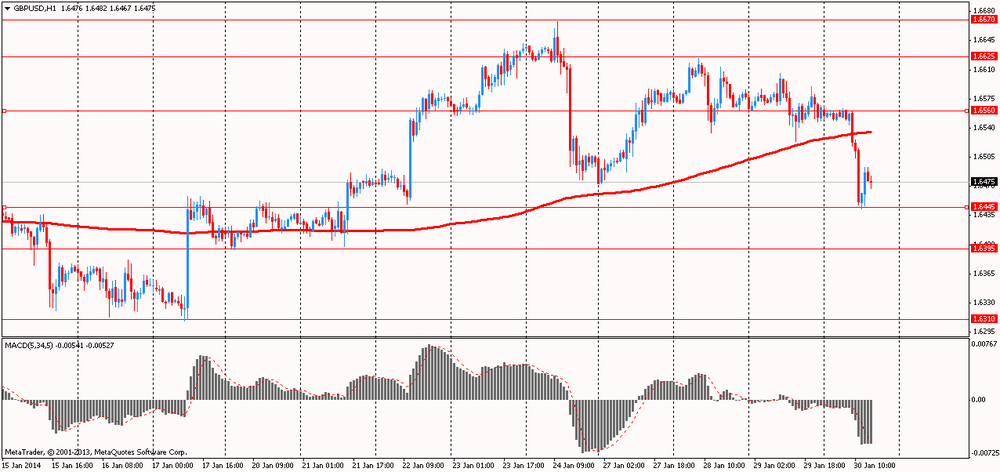

GBP / USD: during the European session, the pair fell to $ 1.6443

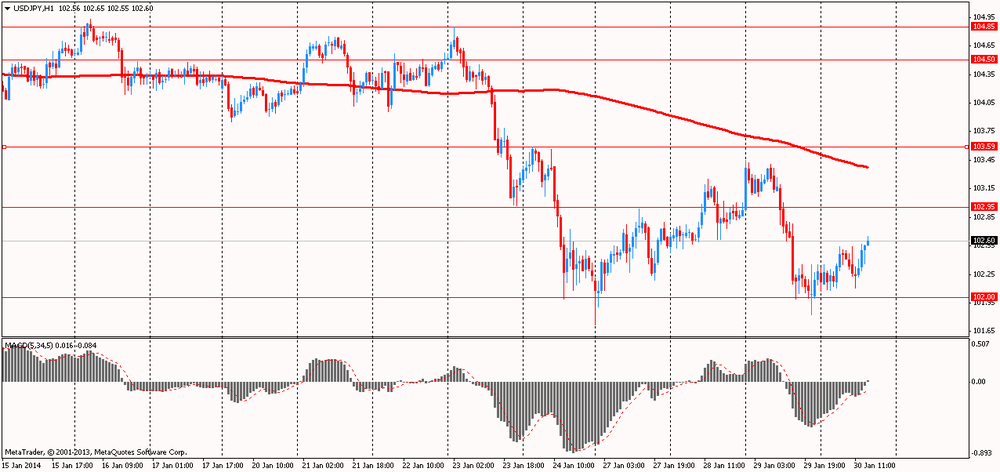

USD / JPY: during the European session, the pair rose to Y102.65

In the U.S. at 13:30 GMT will be released preliminary data on changes in GDP , the GDP price index , the index of personal consumption expenditures , the main index of personal consumption expenditures for the 4th quarter , in 15:00 GMT - the change in volume of pending home sales for December. At 21:45 New Zealand will present the trade balance (for 12 months , from the beginning of the year ) , the balance of foreign trade in December. At 23:00 GMT a speech control RBNZ Graham Wheeler . At 23:30 GMT , Japan will release the change in the volume of expenditure of households , CPI , consumer price index excluding prices for fresh food , the consumer price index excluding prices for food and energy in December , Tokyo CPI , CPI Tokyo prices excluding fresh food , Tokyo CPI excluding prices for food and energy in January . At 23:50 GMT , Japan is to publish preliminary data on industrial production in December.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.