- Analytics

- News and Tools

- Market News

- Oil is rising amid predictions IEA

Oil is rising amid predictions IEA

Oil prices rose after the announcement of an improved outlook for the growth rate of world consumption , which was granted by the International Energy Agency .

The International Energy Agency has changed the forecast growth in global oil consumption this year in a big way , increasing the rate of consumption by 50,000 to 1.3 million barrels per day. According to experts of the IEA , this change will figure by accelerating economic growth.

Also contributed to the increase in the price of oil news from China . According to reliable information , the Chinese Central Bank has provided financial system more than 42 billion dollars. Such actions were designed to stop the growth of lending rates , as well as to reassure market participants, who were worried because of the recurrence of the cash shortage .

In addition , on Monday the United States together with the European Union announced an easing of international economic sanctions against Iran. Recall that recently the parties concluded an agreement that in exchange for the lifting of sanctions Tehran start reducing its nuclear program, and retain the previous volume of exported oil . Analysts say that at the moment , the world market goes to 60% less Iranian oil than it was two years ago, and that in the near future supplies will remain at this level.

At the same time, market participants continue to worry about oil supplies from Libya and South Sudan . Earlier, President of South Sudan made a statement that government troops liberated from the rebels regional center Malakal , but soon the rebels gave a rebuttal to this statement. From the reports from Libya , it became known that the local authorities are planning in the coming days to clear all the invaders that are important for the export of oil , the eastern ports . Recall that the three major ports, which previously were shipping every day more than 600,000 barrels of oil for export, at the moment are on the control of armed protesters who are fighting for their political rights .

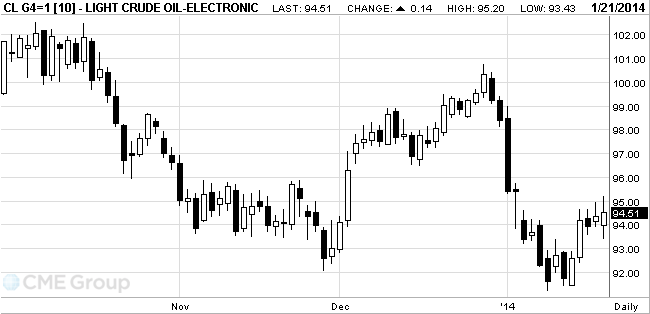

February futures price of U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 95.20 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture rose $ 1.48 , or 1.4 percent, to $ 107.83 a barrel on the London exchange ICE Futures Europe.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.