- Analytics

- News and Tools

- Market News

- European session: the euro stabilized

European session: the euro stabilized

The euro is trading sideways against the U.S. dollar on the background of how the final data on inflation in the euro area in line with the preliminary estimates.

Annual inflation in the 17 countries of the eurozone declined in December , bringing inflation was still below the European Central Bank's target level. Eurostat on Thursday confirmed its preliminary assessment of the dynamics of prices in December , published last week. According to the report , the consumer price index (CPI) in December rose by 0.3 % compared to November and 0.8% compared to December 2012 .

The data indicate a weakening of annual inflation compared with November , when it stood at 0.9 % , and this figure was still below the target level , the ECB near 2.0%.

Eurostat also confirmed that the increase in core consumer price index (Core CPI), which excludes volatile food prices and energy prices, slowed to 0.7 %, showing the lowest growth since the beginning of such statistics in 2001.

Today was a monthly report published by the ECB. In its January newsletter Governing Council of the ECB have to maintain rates at current or lower level for a long period of time. Authorities said that accommodative monetary policy rate will be maintained long as need be.

Risks to the economic outlook of the eurozone are still bearish . Global uncertainty coupled with rising commodity prices , weak domestic demand, export growth and insufficient efforts of EU Member States , undertaken in the course of reform , may adversely affect the economic recovery of the region.

In addition, the Governing Council pointed to improvements in European financial institutions and stressed the need to consolidate the banking system evrobloka with a view to strengthening .

The dollar index close to four-month high , as investors believe that the U.S. economy is strong enough to survive without loss possible reduction incentives Fed . Economic activity in all regions of the U.S. grew in December, " moderate " pace due to an increase in consumer spending in the festive season , the improvement in the labor market and recovery of industrial production , released Wednesday shows a regional overview of the Fed.

Also today will be presented employment figures in the United States . According to the median forecast of economists , the number of new applications for unemployment benefits last week reduced to 327 thousand little later will be published Philadelphia Fed manufacturing index , which this month could grow to 8.8 from a revised 6.4 in December.

The Australian dollar fell to its lowest level since August 2010 against the U.S. dollar and to the eight year low against the New Zealand dollar after the publication of a negative report on employment in Australia. According to the National Bureau of Statistics , the number of jobs in the country in December fell by 22.6 thousand , while economists had expected growth of 10 thousand for the year Australia's economy lost 67.5 thousand jobs , which was the worst figure since 1992 .

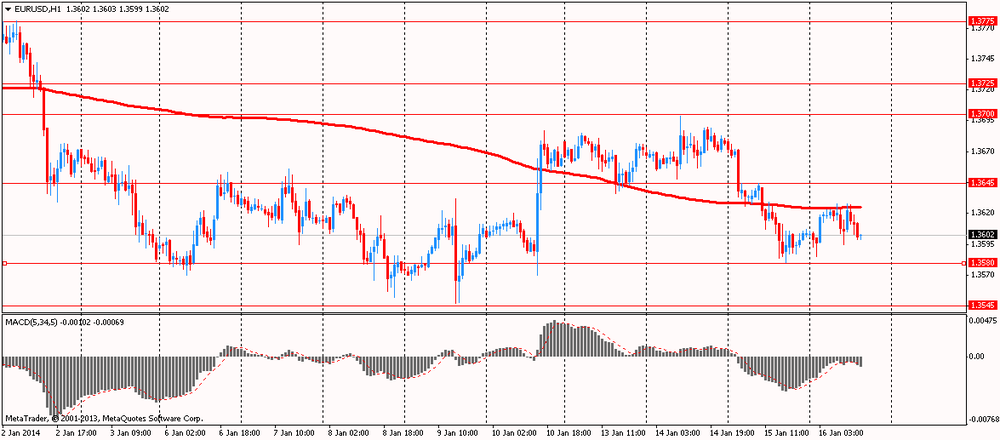

EUR / USD: during the European session, the pair traded in the range of $ 1.3595 - $ 1.3628

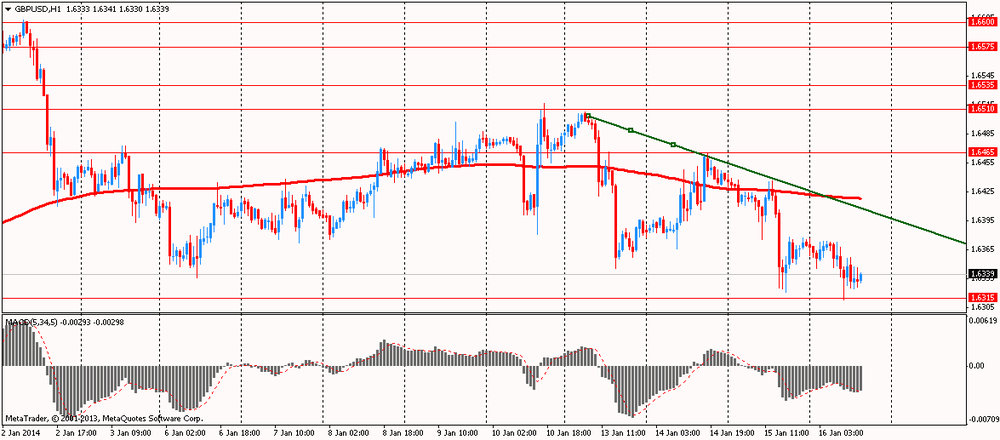

GBP / USD: during the European session, the pair fell to $ 1.6313

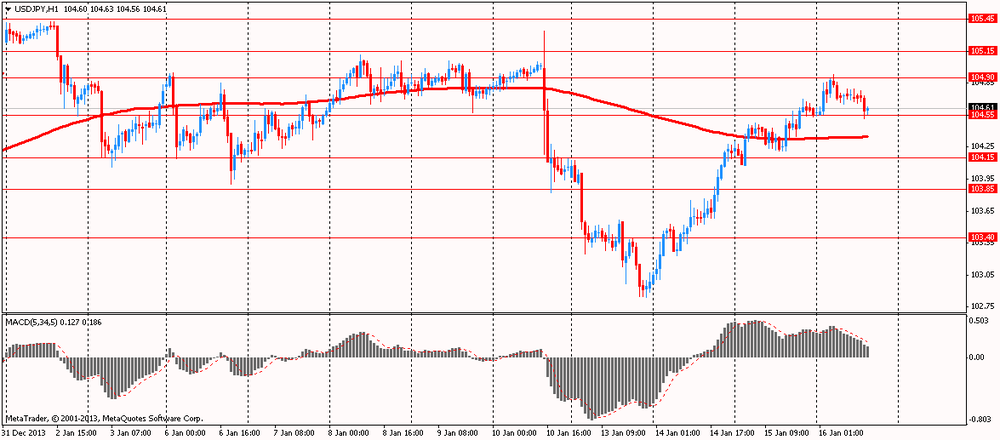

USD / JPY: during the European session, the pair fell to Y104.52

At 13:30 GMT , Canada will release the volume of transactions with foreign securities in November. At 13:30 GMT the United States will come in the consumer price index , consumer price index excluding prices for food and energy , consumer price index ( not seasonally adjusted ) , the main consumer price index for December. At 14:00 GMT , Canada will release the change in sales in the secondary housing market in December. In the U.S. at 14:00 GMT will net purchases of long-term U.S. securities by foreign investors , total net purchases of U.S. securities by foreign investors in November in 15:00 GMT - Fed manufacturing index Philadelphia housing market index for January of NAHB .

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.