- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

08:15 Switzerland Retail Sales Y/Y November +1.6% Revised From +1.2% +2.3% +4.2%

10:00 Eurozone Trade Balance s.a. November 14.3 Revised From 14.5 16.7 16.0

Euro fell against the U.S. dollar under pressure data on the GDP of Germany . German economic growth slowed in 2013 due to uncertainty stemming from the eurozone crisis , the Federal Statistical Office Destatis Wednesday.

Germany 's gross domestic product adjusted for inflation increased by 0.4 % in 2013 after rising 0.7 % in the previous year, said Destatis.

"It seems that the crisis in the euro zone slowed the German economy ," - said President Roderick Destatis Egger at a press conference , adding that domestic demand could not fully compensate for the slowdown .

Household consumption in the euro zone 's largest economy in 2013 increased by 0.9 % , while government consumption rose by 1.1%. Export growth was 0.6 % in 2013 , compared with 3.2 % in the previous year .

Also published data on the trade balance of the eurozone. Eurozone exports fell for the first time in four months in November , showed on Wednesday data published Eurostat. Exports fell by a seasonally adjusted 0.2 percent in the month dimension, followed by zero growth in October. At the same time , lowering the import deepened to 1.3 percent of 1 percent.

While imports fell more than exports , the trade surplus rose to a seasonally adjusted up to 16 billion euros from 14.3 billion euros in October. On the basis of unadjusted trade surplus amounted to 17.1 billion euros, compared with a surplus of 16.8 billion euros in October. Expected surplus in November totaled 16.5 billion euros.

The U.S. dollar strengthened against the major currencies against the fact that the World Bank raised its forecast for global economic growth in 2014-2015 . According to forecasts , this year, the world economy will grow by 3.2% compared to the June forecast growth of 3%. The Bank expects that in 2015 global growth to reach 3.4 % compared with 3.3% projected in June. Prediction for the richest countries was revised to 2.2% from 2% . In the U.S., growth will accelerate to 2.8 % this year , while Japan's GDP will be 1.4 %. This year, the eurozone economy is expected to increase to 1.1% compared with 0.9 % reported by the World Bank in June.

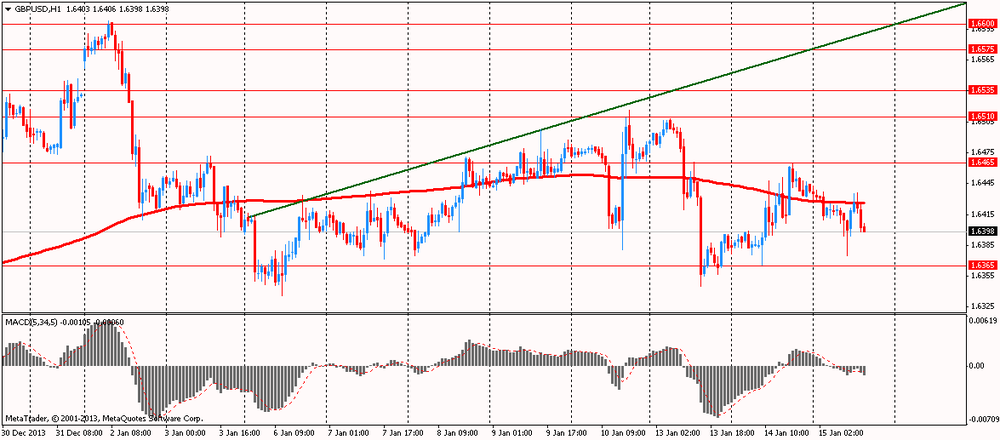

The British pound rose against the U.S. dollar despite the data from the Conference Board. A leading indicator of the UK economy grew fifth consecutive month in November , suggesting that the economy will continue to expand in the coming months .

The index of leading indicators rose 0.5 percent on a monthly measurement to 108.3 in November after rising 0.4 percent in October and 1.6 percent in September. Index currently registered positive growth for the fifth month in a row.

At the same time , the coincident index , which measures the current situation in the economy, increased by 0.2 percent sequentially to 105.7 in November. This followed growth of 0.1 percent in October and 0.5 percent increase in September.

During the six months ended in November , the index of leading indicators recorded a growth of 4.5 percent , while the coincident index remained unchanged.

"Widespread increased production and job growth , along with steady support from monetary policy will contribute to the restoration ," said Conference Board Chief Economist Bart van Ark .

EUR / USD: during the European session, the pair fell to $ 1.3603

GBP / USD: during the European session, the pair fell to $ 1.6375

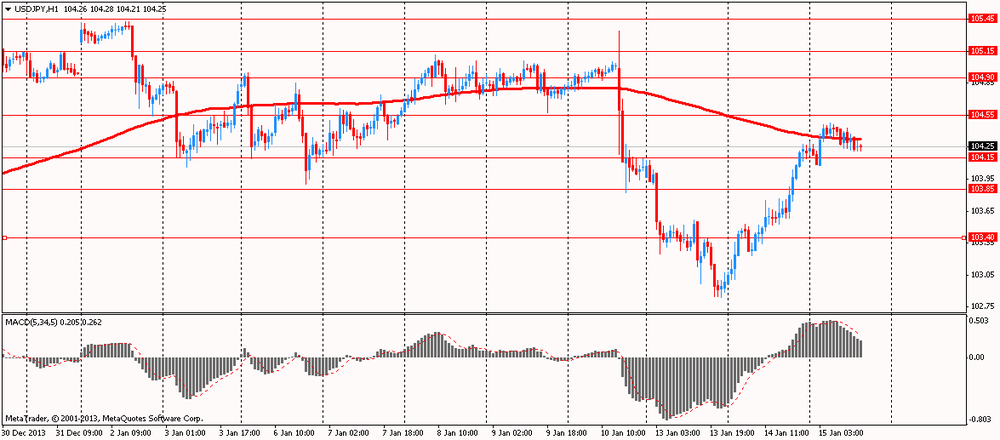

USD / JPY: during the European session, the pair fell to Y104.21

At 13:30 GMT the United States will producer price index, producer price index excluding prices for food and energy in December , Empire Manufacturing manufacturing index for January. At 19:00 GMT the United States will take the Fed's economic survey article by region " Beige Book ." At 23:50 GMT , Japan will release the change in orders for machinery and equipment, the index of activity in the service sector in November.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.