- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

07:00 United Kingdom Nationwide house price index December +0.7% Revised From +0.6% +0.8% +1.4%

07:00 United Kingdom Nationwide house price index, y/y December +6.5% +7.1% +8.4%

08:00 Switzerland KOF Leading Indicator December 1.85 1.92 1.95

08:30 Switzerland Manufacturing PMI December 56.5 56.4 53.9

09:00 Eurozone M3 money supply, adjusted y/y November +1.4% +1.5% +1.5%

09:30 United Kingdom PMI Construction December 62.6 62.3 62.1

09:30 United Kingdom BOE Credit Conditions Survey Quarter IV

09:30 United Kingdom Net Lending to Individuals, bln November 1.7 2.0 0.91

09:30 United Kingdom Mortgage Approvals November 67.7 69.7 70.8

Тhe euro is trading slightly lower against the U.S. dollar , amid reducing lending to the private sector in the euro area . Overall eurozone money supply grew slightly faster pace in November , data showed the European Central Bank . Annual M3 growth at 1.5 per cent in November compared with 1.4 percent in October. Annual growth rate of M1 amounted to 6.5 per cent in November.

Loans to the private sector decreased by 2.3 percent year on year in November , after falling 2.2 percent in October. Meanwhile, loans to households increased by 0.1 per cent per annum after 0.2 percent growth in the previous month . Annual growth rate of lending for house purchase , the most important component of household loans amounted to 0.9 percent in November , unchanged compared with the previous month . Loans to non-monetary financial intermediaries except insurance corporations and pension funds , fell 9.1 percent from a year earlier in November. This followed a decline of 8 percent in the previous month .

In the absence of key U.S. reports the focus of investors will be performances by the Fed at a conference in Philadelphia , including Plosser , Stein and Ben Bernanke. Jeffrey Lacker will speak separately in Baltimore.

Of particular interest is Bernanke , who will leave his post on January 31 , giving him Janet Yellen . Before the publication of the last meeting next week the markets will wait hints at the future of folding . Recall that at the December meeting of the Central Bank minimized program to $ 10 billion to $ 75 billion , as reasons for calling the economic growth forecast. It is expected that further Fed QE again reduce by 10 billion U.S. dollars , completing it by December 2014 .

Previously pound rose against the U.S. dollar after the release of data on business activity in the construction sector. Activity in the UK construction sector has increased the eighth consecutive month in December , the pace close to a six-year highs due to the emergence of new companies and the growth of confidence in late 2013 .

The continuing increase in construction work in all three sectors : residential , commercial and civil engineering , followed by growth in the manufacturing sector , suggesting that the British economy ended the year on the rise.

PMI was 62.1 in December from 62.6 in November. A reading above 50 indicates growth in activity , while below shows the reduction of activity in the sector . Balance is calculated by subtracting the number of respondents who reported falling activity, the number of those who celebrate the increase .

Commercial construction is growing at the fastest pace since August 2007 . " The latest survey stresses that developers come in 2014 with the wind in their sails , - said Chris Williamson , chief economist at Markit. - More than half of all respondents anticipate an increase in the level of production in 2014 , instead of 1/3 at the same time a year ago. "

Increased activity also increased job creation the seventh consecutive month , emphasizing strengthening confidence in the sector.

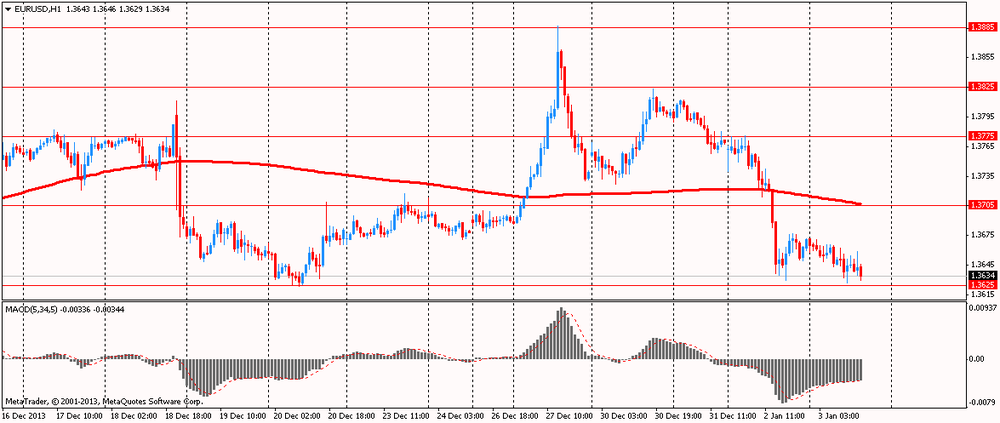

EUR / USD: during the European session, the pair fell to $ 1.3627

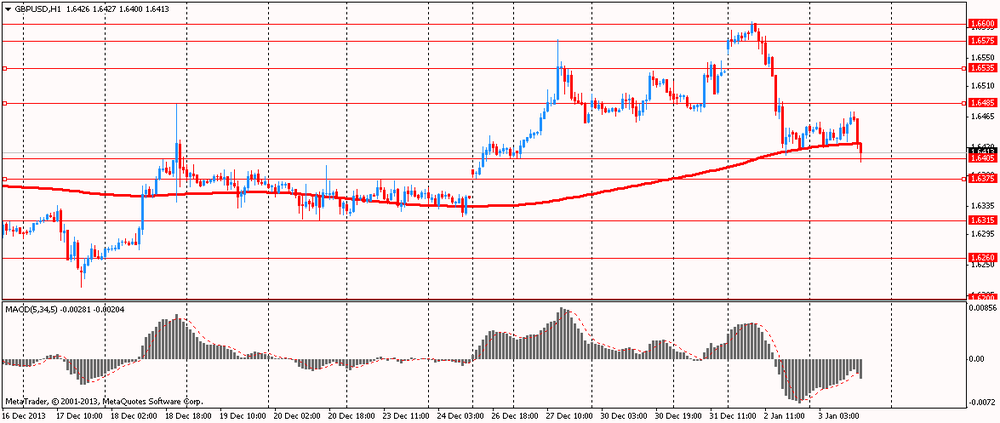

GBP / USD: during the European session, the pair rose to $ 1.6472 , and then fell to $ 1.6400

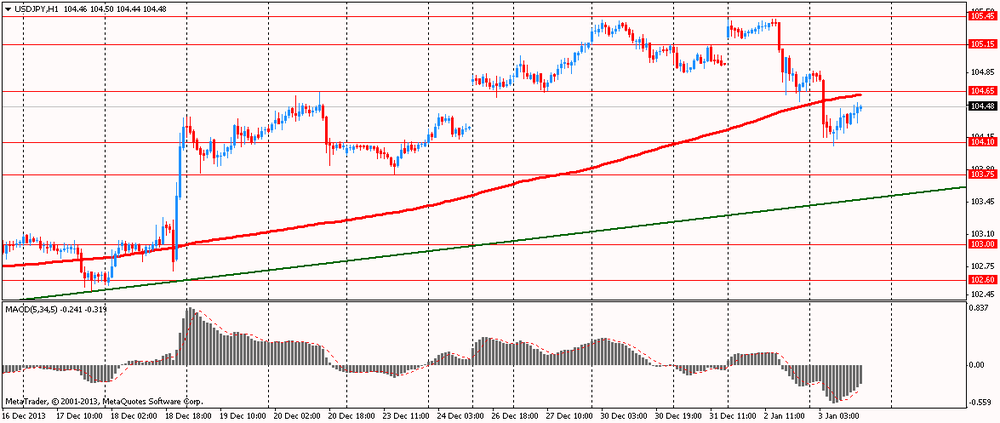

USD / JPY: during the European session, the pair rose to Y104.53

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.