- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

07:58 France Manufacturing PMI (Preliminary) December 48.4 49.1 47.1

07:58 France Services PMI (Preliminary) December 48.0 48.9 47.4

08:28 Germany Manufacturing PMI (Preliminary) December 52.7 53.1 54.2

08:28 Germany Services PMI (Preliminary) December 55.7 55.2 54

08:58 Eurozone Manufacturing PMI (Preliminary) December 51.6 51.9 52.7

08:58 Eurozone Services PMI (Preliminary) December 51.2 51.5 51.0

10:00 Eurozone Trade Balance s.a. October 14.3 15.2 14.5

The euro rose against the dollar after strong data on business activity in the euro zone and Germany. Eurozone private sector activity grew at a faster pace in December , and to a greater extent than expected by economists , showed a survey conducted by Markit Economics. On a seasonally adjusted composite index of production, which measures the performance of the manufacturing sector and the services sector rose to 52.1 December from 51.7 in November. Economists had expected a modest increase to 51.9 .

Led recovery of the total activity of the private sector is worth purchasing managers index for the manufacturing sector , which rose to 52.7 in December from 51.6 in November , reaching its highest level in thirty one month. Economists had forecast an increase to 51.9 . Meanwhile, the activity indicator for the services sector fell to a four-month low of 51 in December from 51.2 in November , marking the third consecutive slowdown . Expectations were at 51.5 .

Activity index for the manufacturing of Germany rose in December to its highest level in thirty months , indicating a much more rapid increase in activity. The seasonally adjusted purchasing managers' index (PMI) for the manufacturing rose to 54.2 in December from 52.7 in November. Value in December was the highest in thirty months. Economists had expected the index to rise to 53.1 .

Production in the manufacturing sector rose the steepest pace since May 2011 , and growth accelerated for the third month in a row. This reflects the continued growth of new business, which was the fastest since April 2011 . Input price inflation faced by German producers, accelerated in December , while the selling prices for the products increased only slightly due to strong competition for new orders.

Meanwhile, the activity indicator for the services sector fell to 54 in December from 55.7 in November. Economists' expectations were at a decline to 55.2 . The composite index , reflecting activity in the manufacturing sector and in the services sector fell to two-month low of 55.2 in December from 55.4 in November.

Pound rose against the dollar , recovering from the lows . Economic Calendar for Britain today presented only data on the housing market . According to real estate Rightmove, the average asking price for homes for sale on the website Rightmove, was 1.9 % lower in December compared to November , but remained 5.4% higher than at the end of 2012 . In November , house prices fell by 2.4% m / m and rose 4.0 % y / y

Monthly decline , typical for this time of year , was the smallest since the beginning of December to the global credit crisis and suggests that the demand for real estate remains high, which is expected to support prices afloat in 2014 - according to Rightmove.

" The smallest drop in December 2006 shows that the housing market is on track to grow further momentum in 2013 ," - said Miles Shipsayd , director of Rightmove. Due to the constant lack of proposals , house price inflation has gathered momentum in 2013, exerting upward pressure on prices . Only increase in the number of homes for sale until spring will be sufficient to limit the rate of appreciation of property prices to the extent observed in 2013 - said Shipsayd .

EUR / USD: during the European session, the pair rose to $ 1.3789

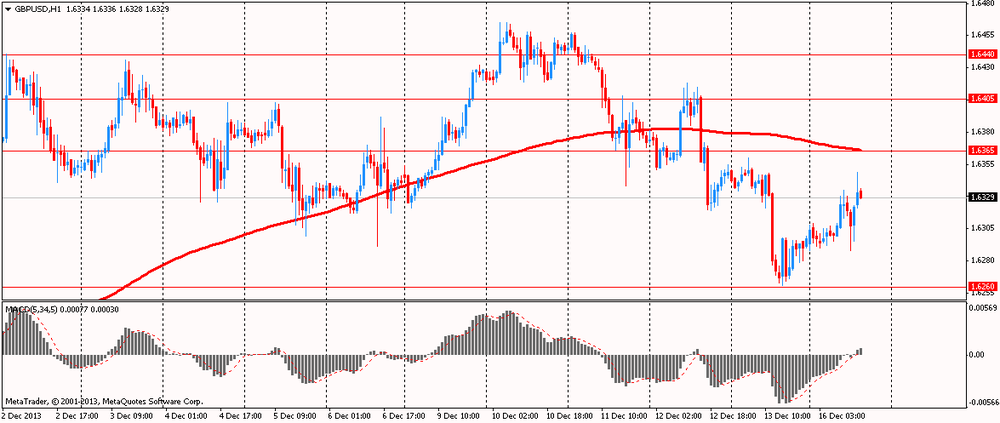

GBP / USD: during the European session, the pair fell to $ 1.6288 , and then rose to $ 1.6349

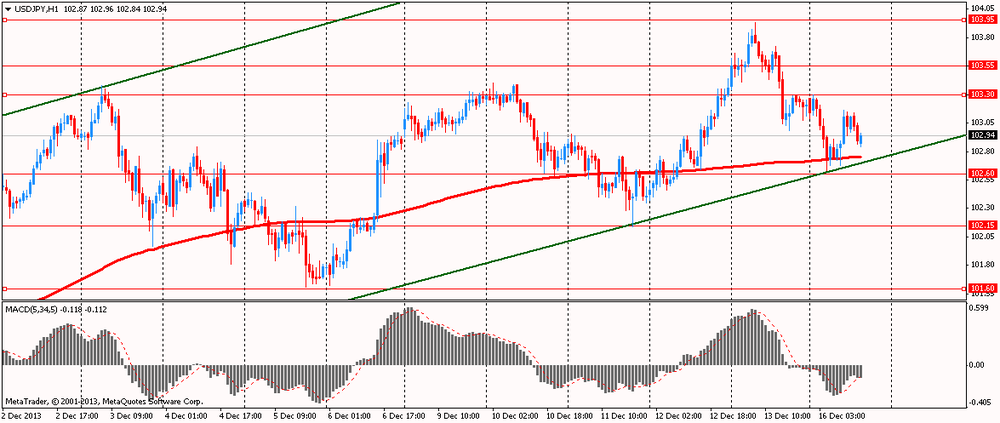

USD / JPY: during the European session, the pair rose to Y103.16 and stepped

At 13:30 GMT , Canada will report on the volume of transactions with foreign securities in October. At 13:30 GMT the U.S. manufacturing index will be released in December Empire Manufacturing and changes in the level of labor productivity in the non-manufacturing sector for the 3rd quarter . At 14:00 GMT to make a speech , ECB President Mario Draghi . In the U.S. at 14:00 GMT will net purchases of long-term U.S. securities by foreign investors in October , the index of business activity in the manufacturing sector in December , total net purchases of U.S. securities by foreign investors in October , in the 14:15 GMT - the load factor of production capacity, the change in volume of industrial production in November. At 17:00 GMT a speech SNB board member Fritz Zurbrugg . At 23:00 GMT Australia is to publish an index of leading economic indicators from the Conference Board in October.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.