- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

07:00 Switzerland Trade Balance October 2.49 2.45 2.42

07:30 Japan BOJ Press Conference

07:58 France Manufacturing PMI (Preliminary) November 49.1 49.6 47.8

07:58 France Services PMI (Preliminary) November 50.9 51.3 48.8

08:28 Germany Manufacturing PMI (Preliminary) November 51.7 52.3 52.5

08:28 Germany Services PMI (Preliminary) November 52.9 53.1 54.5

08:58 Eurozone Manufacturing PMI (Preliminary) November 51.3 51.6 51.5

08:58 Eurozone Services PMI (Preliminary) November 51.6 51.9 50.9

09:05 Australia RBA's Governor Glenn Stevens Speech

09:30 United Kingdom PSNB, bln October 9.4 10.1 6.4

10:00 Eurozone ECB President Mario Draghi Speaks

11:00 United Kingdom CBI industrial order books balance November -4 0 11

The euro rose against the dollar after the publication of mixed euro zone PMI figures . In Germany, business results exceeded forecasts , and in France and the eurozone disappointed investors . The rate of growth of business activity in the euro area in November continued to slow. They cast doubt on the fact that the eurozone economy will pick up speed in the 4th quarter after the 3rd quarter of its nascent recovery has stalled .

The deterioration of the survey data was due to a clear decrease in the activity of companies in France , the second largest economy in the eurozone. This decline in activity , suggesting that France could fall back into recession. Increased activity perked up in Germany, the largest economy of the block.

According to preliminary estimates Markit, a composite Purchasing Managers Index (PMI) euro zone in November fell to 51.5 from 51.9 in October. Although the indicator is above the threshold level of 50 indicates an increase in activity compared with the previous month , the rate of growth of activity were the weakest in three months.

The volume of new orders is gradually increasing , promising support for the activity in the coming months. However , employment fell 23rd consecutive month. This suggests that the record high for the euro zone unemployment rate - one of the main challenges for governments trying to generate economic growth and an end to the protracted debt crisis - in the near future will not fall quickly .

In Germany, the composite index of production, which measures business activity in the manufacturing sector and the service sector , rose to a ten- high 54.3 in November from 53.2 in October. Manufacturing Purchasing Managers Index , a measure of productivity in the industrial sector of the country rose to 29 -month high of 52.5 in November from 51.7 in October. Economists had forecast a rise to 52.3 . The index of manufacturing activity in manufacturing industry amounted to 54 in November from 53.6 in October. The index of activity in the service sector rose to a nine-month high of 54.5 from the 52.9 reading in October . It is predicted that the index would rise to 53.1 .

The state of the French economy has worsened in November on weaker activity in the private sector , which declined the most significant pace in five months. According to Markit, preliminary composite purchasing managers' index (PMI) fell to 48.5 in France in November.

Also supporting the euro have comments of the ECB . Draghi calmed markets after appearing on Wednesday reported that the central bank began to seriously think about the possibility of negative interest rates on deposits. The ECB President said that the regulator discussed this possibility at the last meeting , but no more. Recall that on Wednesday couple ervo / dollar fell from about 1.3540 to 1.3470 on news that the ECB is considering negative interest rates on deposits.

The British pound rose against the dollar after the publication of the Confederation of British Industry that the growth of British industrial orders and production in the last three months has reached its highest level since 1995.

According to the survey of industrial trends , 36 percent of companies said that their total order book was above normal, and 25 percent said it was lower , which makes the balance of 11 per cent. It was the highest level since March 1995 .

Similarly , the balance of industrial production was 24 per cent in the three months to November and grew at the fastest pace since January 1995 . Companies expect that production growth will continue at the same pace over the next three months. About 44 percent expect an increase in output and 20 percent forecast a decline , resulting in a balance amounted to 24 percent.

Stephen Gifford , director of economics CBI, said: " This new evidence shows encouraging signs of widening and deepening of recovery in the manufacturing sector. " " Manufacturers finally felt the benefit from the growth of confidence and spending in the UK and around the world ," added Gifford .

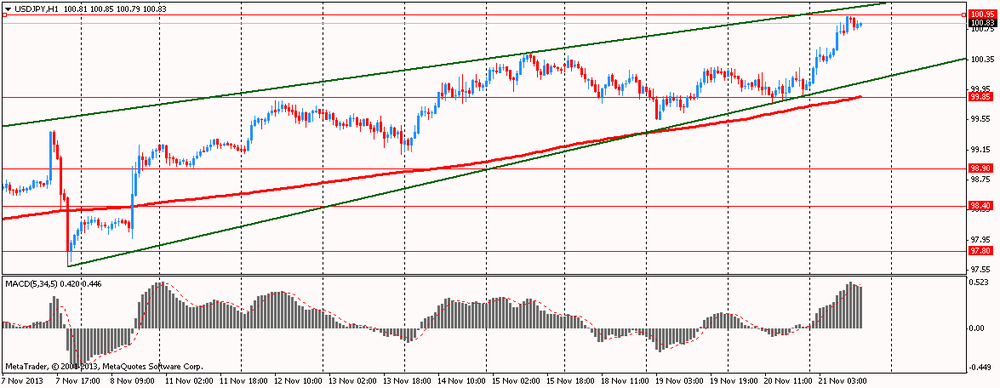

The yen fell to a two-month low against the dollar after the announcement of the results of the two-day meeting of the Bank of Japan. Central Bank has kept its refinancing rate and the asset purchase program unchanged , as expected . The decision was unanimous. The regulator also has not changed the outlook on the economy, which, according to the Central Bank, and gradually recovering moderately , while exports gaining momentum. The Bank of Japan has confirmed the promise to achieve the expansion of the monetary base by 60-70 trillion . yen ( 600-700 billion dollars) a year .

EUR / USD: during the European session, the pair rose to $ 1.3377

GBP / USD: during the European session, the pair rose to $ 1.6137

USD / JPY: during the European session, the pair rose to Y100.93

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.