- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

07:00 Germany Producer Price Index (MoM) October +0.3% +0.1% -0.2%

07:00 Germany Producer Price Index (YoY) October -0.5% -0.6% -0.7%

09:30 United Kingdom Bank of England Minutes November

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) November 24.9 30.0 31.6

Euro fell against the dollar on the comments of the representative of the ECB Weidmann , who said that the ECB is not yet technically ready to wrap up emergency measures . However, Weidmann bit offset this statement , saying that despite the fact that the moderate inflation outlook justifies expansionist policy , it is unwise to soften it further after November's decline.

Furthermore, the pressure on the single currency price data bit manufacturers in Germany. The index of producer prices in industry in Germany fell by 0.7 percent year on year in October, following a 0.5 percent drop in September. Prices fell for the third month in succession. Economists had forecast a slower decline of 0.6 percent in October.

On the overall index was influenced by the 1.9- percent drop in the prices of intermediate goods, and exactly the same reduction in energy costs. Meanwhile , the price of capital goods rose by 0.7 percent compared to October 2012 , and consumer prices rose by 1.8 percent.

The producer price index fell by 0.2 percent compared to September , when it showed 0.3 percent growth. The index according to the expectations of economists was to grow by 0.1 percent in the month dimension.

The British pound rose against the dollar and the euro after the publication of the minutes of the last meeting of the Bank of England. MPC Minutes from November 6-7, showed that the committee voted unanimously for having to leave the rate by 0.5 % and the asset purchase program at £ 375 billion As the protocol MPC noted the steady recovery in economic activity in Britain and has predicted that the economy continue to grow above the long-term average in Q2 . GDP forecast , however, may be subject to upside risks (increase confidence and improve conditions in the lending sector ), and the downside risks (the process of restoring the balance and slow income growth ) .

MPC noted the still unstable growth of the European economy , which could damage the British economy , and suggested that " as the external situation is unlikely to stimulate growth in the UK and in view of fiscal consolidation in the country, we will keep growth forecast for the current level. Important role for economy in the medium -term recovery play household spending amid rising business costs. " Despite the recent rise in inflation expectations, the MPC believes that they are restrained in the medium term , because at the moment they do not play a big role in the demands on wages .

The U.S. dollar fell against the yen after Federal Reserve Chairman Ben Bernanke said that the basic interest rate of the central bank is likely to remain near zero for another " long time " after the purchase of assets, and after the unemployment rate will fall less than 6.5 %. Bernanke made it clear that his views are similar to the opinion of the deputy chairman of the Federal Reserve Janet Yellen , which she expressed at the hearing of the Senate Banking Committee on November 14. "I agree with the sentiments expressed by my colleague Janet Yellen last week that the surest path to a normal approach to monetary policy , that is, we need to promote more rapid recovery ," - he said.

Also, the dynamics of the dollar today will affect the published data from the U.S. Department of Commerce . According to the median forecast of economists , the volume of retail sales in the world's largest economy is likely to grow in October by 0.1 % , after a 0.1 % decline in the previous month .

The yen has suspended its decline after the release of data on the trade balance of the country. In October, the trade deficit Japan rose more than analysts had expected. Imports grew at the fastest pace since 2010 , and was outweighed exports . The deficit amounted to 1.09 trillion . yen ( 10.9 billion dollars). Imports increased by 26.1 % compared with a year earlier, while exports gained 18.6%.

EUR / USD: during the European session, the pair fell to $ 1.3516

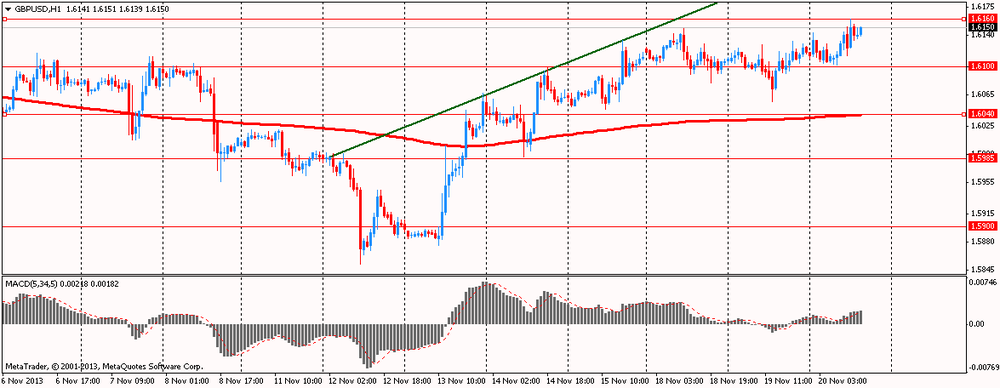

GBP / USD: during the European session, the pair rose to $ 1.6160

USD / JPY: during the European session, the pair fell to Y99.78

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.