- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

09:00 Eurozone Current account, adjusted, bln September 17.9 Revised From 17.4 18.3 13.7

10:00 Eurozone Trade Balance s.a. September 12.3 14.3 14.3

The euro rose against the dollar on payments data and the trade balance of the euro area. In the euro area 's current account surplus fell to a seasonally adjusted 13.7 billion in September from 17.9 billion euros in August , said Monday the European Central Bank . The data showed that the trade surplus fell to 13.7 billion euros from 14.7 billion euros in August. In addition, the services account surplus fell to 7.6 billion euros in September from 8.2 billion euros in August.

Trade area in goods with the rest of the world has led to a positive balance of € 13.1 billion in September , compared with EUR 6.9 billion surplus in August. A year earlier , the surplus amounted to 8.6 billion euros. In September, exports increased by 1 percent compared to the previous month, adjusted for seasonal variations. Imports fell by 0.3 percent. On an unadjusted basis exports rose 3 percent in September compared with a year earlier. While imports remained unchanged on an annual basis.

The U.S. dollar remains under slight pressure , continuing to remain under the influence of comments Janet Yellen , voiced last week. Yellen dovish statement and its responses to the Committee's questions regarding the role of the Federal Reserve have convinced markets that the Bank will continue to conduct ultra accommodative policy. The future head of the Federal Reserve noted that in her opinion , the Fed should continue to support economic recovery. A cautious approach to any issue related with folding Fed program of 85 billion dollars , supports risk by stimulating the stock markets and putting pressure on the dollar.

Today is expected to address the Fed Plosser ( Philadelphia Fed ) and Dudley ( Federal Reserve Bank of Chicago ) .

EUR / USD: during the European session, the pair rose to $ 1.3517

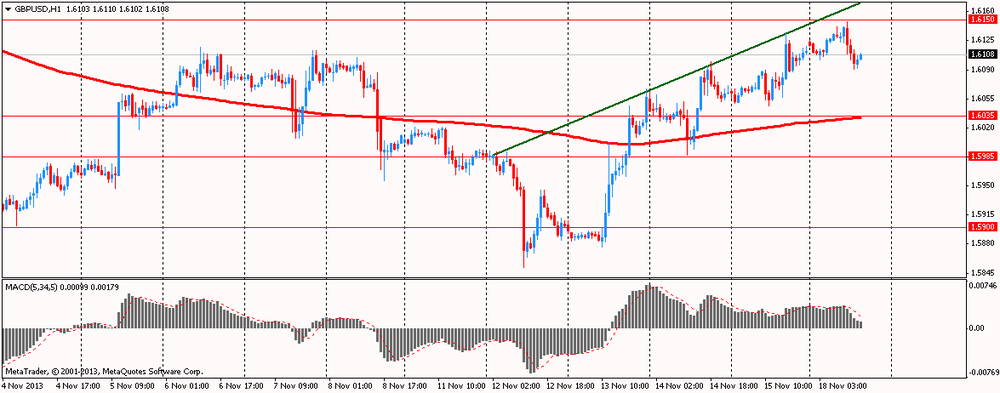

GBP / USD: during the European session, the pair has set high at $ 1.6150 and then retreated to lows on $ 1.6091

USD / JPY: during the European session, the pair fell to Y99.77 and stepped

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.