- Analytics

- News and Tools

- Market News

- Asian session: The dollar held gains against most major peers

Asian session: The dollar held gains against most major peers

00:30 Australia RBA Monetary Policy Statement Quarter IV

02:00 China Trade Balance, bln October 15.2 23.5 31.1

The dollar held gains against most major peers before a U.S. jobs report today and after data yesterday showed the economy expanded more than forecast, fueling bets for an earlier taper in Federal Reserve stimulus. U.S. nonfarm payrolls rose by 120,000 last month after a 148,000 gain in September, a Bloomberg News survey of economists indicated before today’s Labor Department data. Gross domestic product in the U.S. grew at a 2.8 percent annualized rate in the third quarter, up from 2.5 percent in the previous three months, according to a Commerce Department report yesterday. Economists forecast a 2 percent expansion.

The euro was set for a second weekly loss versus the yen after the European Central Bank unexpectedly cut interest rates to a record. ECB President Mario Draghi pushed for the cut over opposition from Bundesbank President Jens Weidmann and at least two other Governing Council members who wanted to wait until next month to decide, according to euro-area central bank officials who asked not to be identified.

The Australian and New Zealand dollars strengthened after import gains outpaced economists’ estimates in China, the biggest trading partner of both South Pacific nations. In China, data today showed imports advanced 7.6 percent in October from a year earlier, a fourth-straight gain and exceeding the median analyst estimate.

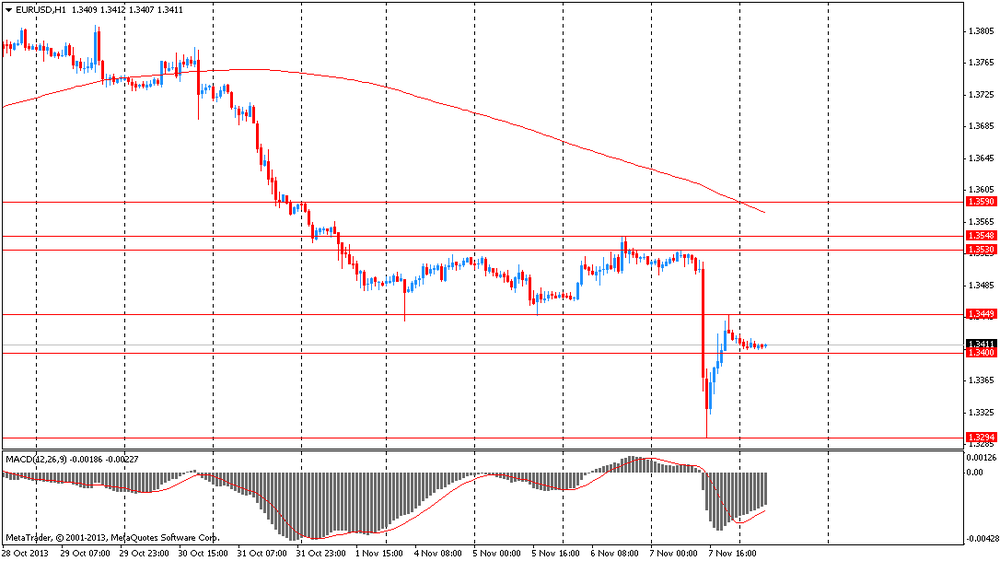

EUR / USD: during the Asian session the pair traded in the range of $ 1.3400-20

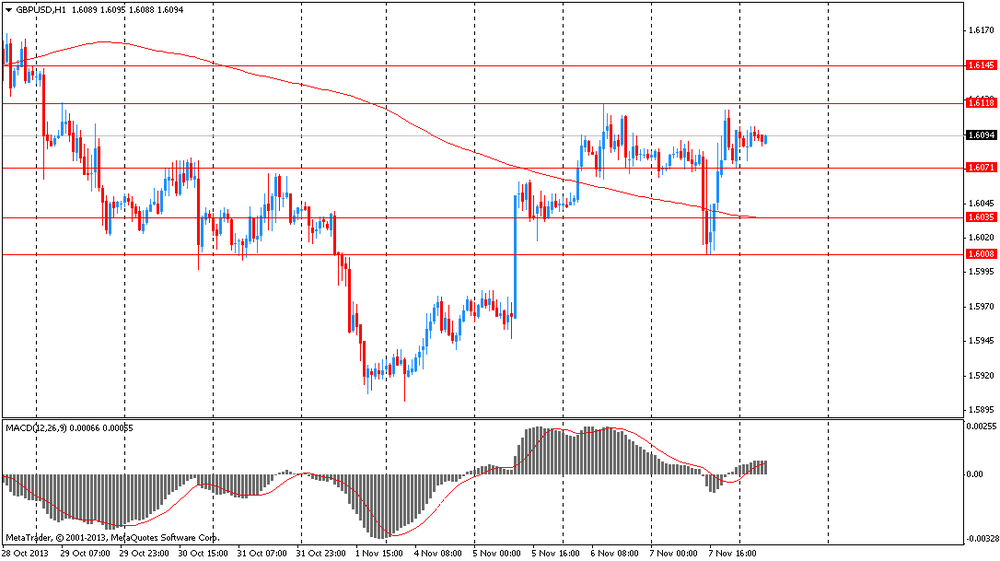

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6075-00

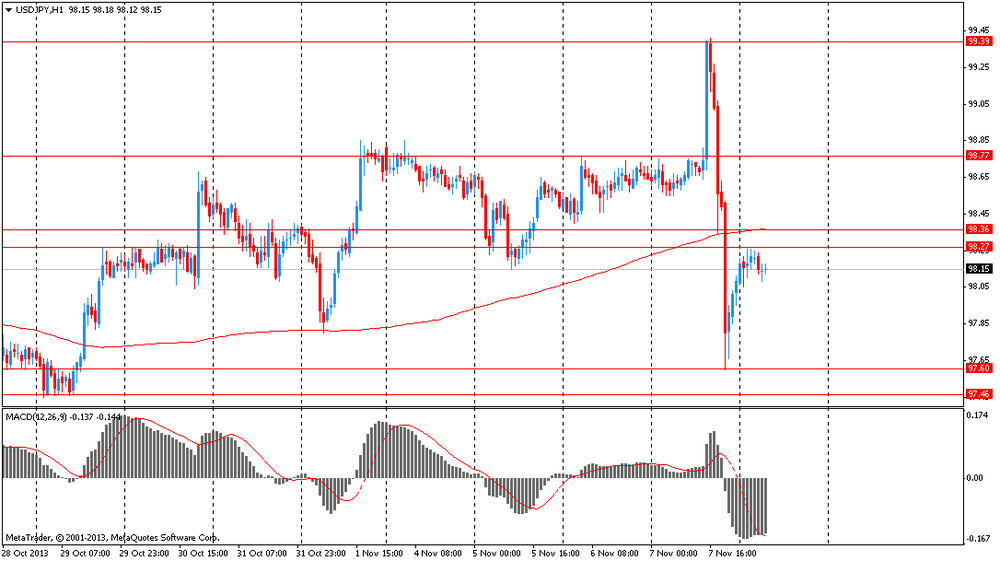

USD / JPY: during the Asian session the pair traded in the range of Y98.05-25

There is a full calendar on both sides of the Atlantic Friday, with the US jobs data the stand out feature, although markets are still taking on board the semi-surprise from the ECB Thursday. The European calendar gets underway at 0645GMT, with the release of the Swiss October unemployment data. Analysts are looking for a rate of 3.1%, up from September's 3%. At 0700GMT, German September trade data will be published. This is followed at 0745GMT by the release of the French September trade data, September budget figures and the September industrial output numbers. Industrial output is seen higher by 0.1% on the month, but 0.9% lower on year. There is more Swiss data due for release at 0815GMT, when the September retail sales and October CPI numbers are released. Retail sales are seen coming in at 2.7%, up from 2.4% in August. At 1000GMT, German Finance Minister Wolfgang Schaeuble speaks at an award ceremony for Luxembourg Prime Minister Jean- Claude Juncker, in Berlin. Following on from Thursday's rate cut, there are a few ECB speakers on the wires. At 1400GMT, ECB' Mersch will speak at a conference on the eurozone Crisis in Athens. At 1430GMT, ECB' Asmussen is scheduled to speak at a conference in Berlin. UK data set for release at 0930GMT includes the October construction numbers and the September trade release.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.