- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

06:45 Switzerland SECO Consumer Climate Quarter III -9 -2 -5

08:00 Switzerland Foreign Currency Reserves October 432.4 434.7

11:00 Germany Industrial Production s.a. (MoM) September +1.6% Revised From +1.4% +0.2% -0.9%

11:00 Germany Industrial Production (YoY) September +0.9% Revised From +0.3% +0.8% +1.0%

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.50% 0.50% 0.25%

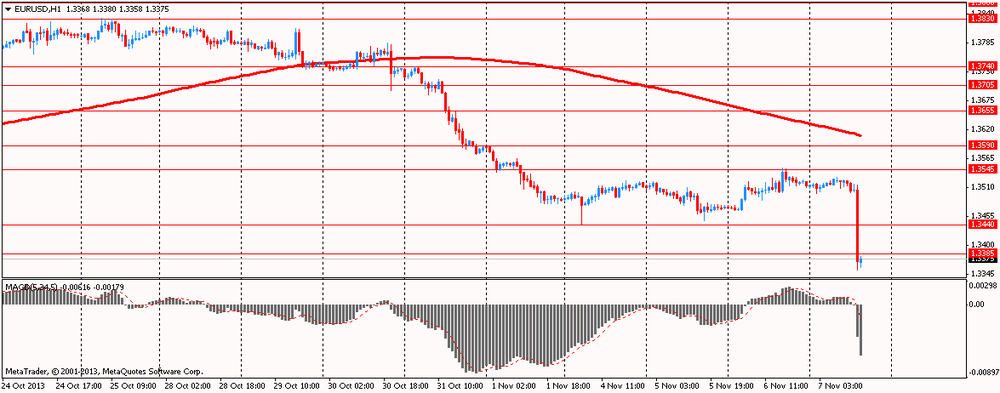

The euro fell sharply against major currencies after the ECB decided to lower its key policy rates to a new record low , and the lending rate , as some analysts predicted after last week's euro zone inflation data came out much worse than expected. The Governing Council of the ECB lowered its main refinancing rate by 25 basis points up to 0.25 %. The bank also lowered the rate of lending by 25 basis points to 0.75 %, while the deposit rate remained unchanged at 0.00%. ECB refrained from lowering rates in May . Now all attention turned to the speech of the Central Bank , Mario Draghi , who will comment on the government's decision at a press conference scheduled for 13:30 GMT.

Previously, the pressure on the single currency had data on German industrial production . The volume of German industrial production fell more than expected to 0.9 percent in September , although the two-month average suggests that the situation in the industry in Europe's largest economy is on the path to growth. Industrial production declined in spite of the consensus forecast of economists, who had expected growth of 0.2 percent. The value in August was revised upwards by 0.2 percentage points , and recorded a growth of 1.6 percent. The two-month average showed a slight increase in production of 0.6 percent , according to the Ministry of Economy. " Production in the manufacturing sector as a whole is on the way up , despite a slight decrease in the current level," the ministry said .

The pound fell against the dollar after the ECB decision , but previously ignored the decision of the Bank of England to keep monetary policy unchanged. At the last meeting of the Bank of England did not bring any surprises markets , leaving the key lending rate at a record low 0.5 %, where it has been since March 2009 , while the purchase of assets remained at £ 375 billion the central bank announced its intention to keep rates at a low level as long as the rate b / d in Britain will not fall below 7% , which is not expected before 2016. The latest economic forecasts willows within the inflation report will be published on 13 November. Minutes of this meeting will be made public on Wednesday, November 20.

EUR / USD: during the European session, the pair fell to $ 1.3353

GBP / USD: during the European session, the pair fell to $ 1.6015

USD / JPY: during the European session, the pair rose to Y98.81

At 13:30 GMT will be the monthly press conference of the ECB . At 13:30 GMT the United States will publish the change in GDP for the quarter , the GDP price index , an index of personal consumption expenditures , the main index of personal consumption expenditures in Q3 . At 19:00 GMT deliver a speech , ECB President Mario Draghi .

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.