- Analytics

- News and Tools

- Market News

- Asian session: The euro held a gain from yesterday

Asian session: The euro held a gain from yesterday

00:30 Australia Unemployment rate October 5.6% 5.7% 5.7%

00:30 Australia Changing the number of employed October 9.1 10.3 1.1

05:00 Japan Leading Economic Index September 106.8 109.4 109.5

05:00 Japan Coincident Index September 107.6 108.3 108.2

The euro held a gain from yesterday versus most major peers before European Central Bank policy makers meet today amid speculation the region’s economy isn’t fragile enough to warrant an interest-rate cut. The ECB will leave its main refinancing rate at a record-low 0.5 percent today, according to 67 of 70 economists surveyed by Bloomberg News. Bank of America Corp., Royal Bank of Scotland Group Plc and UBS AG predict the central bank will reduce borrowing costs by 25 basis points.

A gauge of U.S dollar strength remained lower before data that may show an expansion in U.S. gross domestic product slowed last quarter. U.S. GDP grew at a 2 percent annualized rate in the third quarter, down from 2.5 percent in the previous three months, according to a Bloomberg survey before the data are released today. Nonfarm payrolls rose by 120,000 last month after a 148,000 gain in September, Labor Department figures may show tomorrow, a separate poll indicates.

Australia’s dollar slid after a government report showed employers added 1,100 jobs in October. Economists forecast a gain of 10,000 workers, according to the median response in a Bloomberg poll.

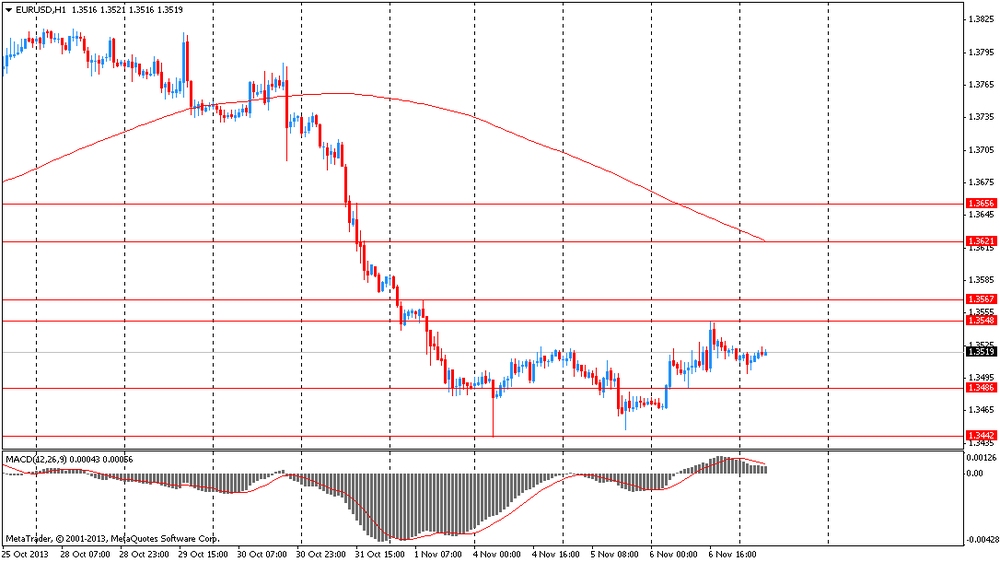

EUR / USD: during the Asian session the pair traded in the range of $ 1.3500-20

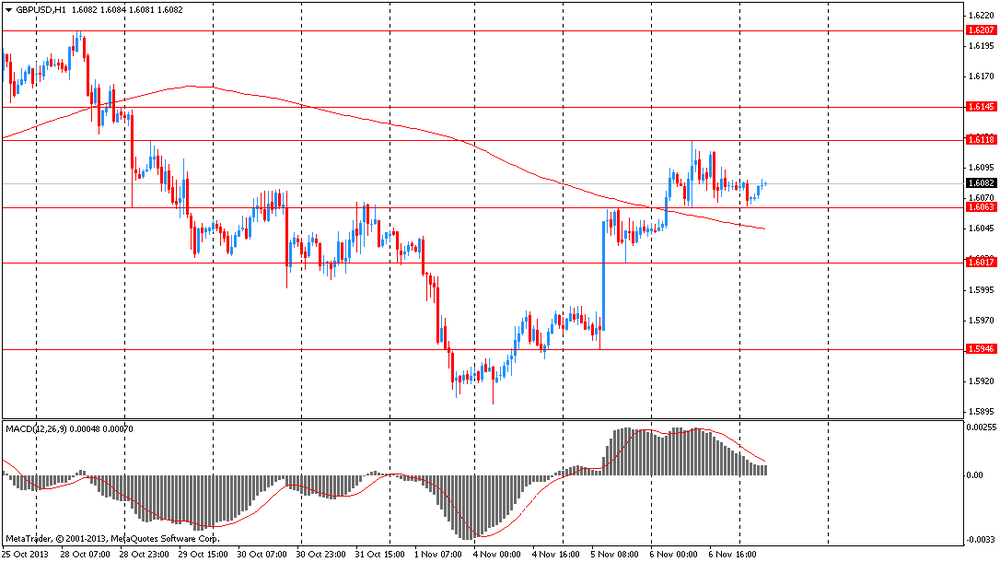

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6065-85

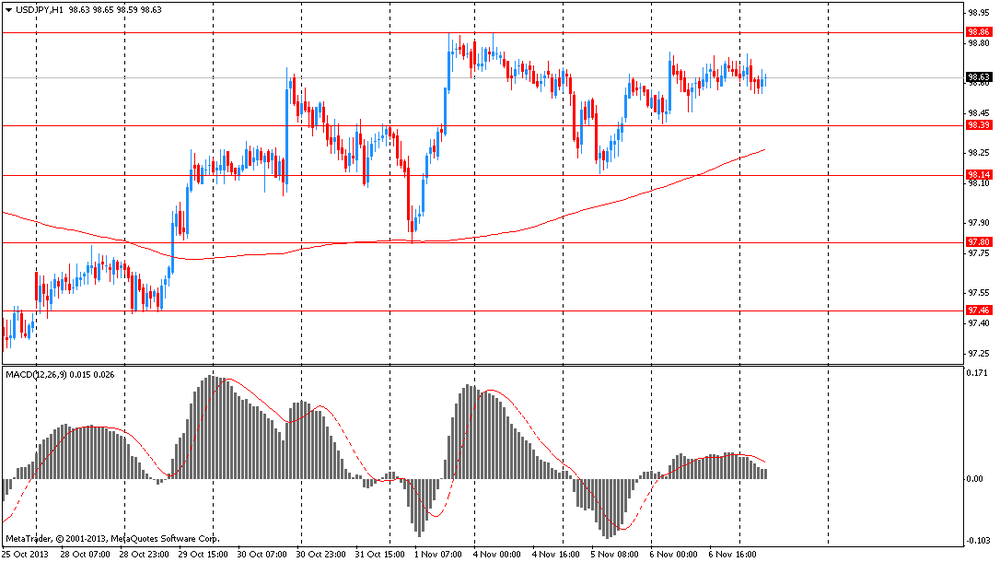

USD / JPY: during the Asian session the pair traded in the range of Y98.55-75

The main focus for the day is undoubtedly the key policy decisions from both the ECB and the BOE, both due lunchtime. Across the Atlantic, the third quarter US GDP data will be the highlight. There is only a limited European data calendar expected ahead of the central bank decisions. At 0800GMT, Spain's September industrial output data is set for release. At 1100GMT, Germany's September industrial output data will be published. The ECB announces the latest policy decision at 1245GMT, with President Draghi's press conference expected at 1330GMT.

The first central bank decision of the day is expected at 1200GMT, when the Bank of England announces their outcome. With the economic recovery starting to gain traction, no change is seen either in Bank Rate or QE levels, with forward guidance firmly anchored.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.