- Analytics

- News and Tools

- Market News

- European session: the euro and pound rose

European session: the euro and pound rose

08:00 Eurozone ECB’s Vitor Constancio Speaks

08:48 France Manufacturing PMI (Finally) October 49.4 49.4 49.1

08:53 Germany Manufacturing PMI (Finally) October 51.5 51.5 51.7

08:58 Eurozone Manufacturing PMI (Finally) October 51.3 51.3 51.3

09:30 Eurozone Sentix Investor Confidence November 6.1 6.6 9.3

09:30 United Kingdom PMI Construction October 58.9 58.9 59.4

The euro rose against the dollar , supported by data on business activity in the manufacturing sector and the confidence of investors.

Eurozone manufacturing sector suffered a modest pace of recovery in the third quarter in the last quarter of the year , as originally expected, showed the final data from Markit Economics, published on Monday . The manufacturing purchasing managers' index rose to 51.3 in October from 51.1 in September. The October result coincided with the preliminary estimates and forecasts of experts.

Despite the modest rate of growth in general , increasing the active signals received from all but two countries in the study . Manufacturing output and new orders rose a fourth straight month in October. At the same time , employment declined twenty-first consecutive month of job cuts mainly reflects subdued demand growth and care costs.

At the same time , the level of investor confidence in the euro area has grown significantly in November , beating economists' expectations , and reached a two-and- a-half year high on Monday showed a monthly survey of the analytical center Sentix. The index of investor confidence rose in November, the fourth consecutive month to 9.3 from 6.1 in October. Economists had expected a slight increase to 6.6 .

The latter value is the highest since May 2011 and the strongest among the rest of the world , said the research team . Investors about the current economic situation is better than last month, according to the study . Assessment of the current situation index rose to -3.3 from -8.5 , while the expectations index rose to 22.8 from 21.8 .

The level of confidence of German investors reached a record 30.2 in November , said the Sentix. November's value is the highest since the beginning of entering the data in 2009. In October confidence index was 28.3 . Improving investor expectations contributed to the growth of the index.

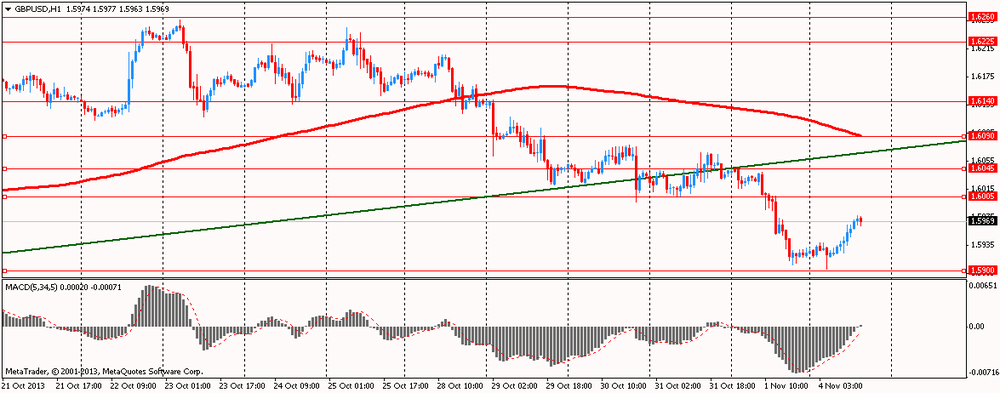

The pound rose against the dollar , which was associated with the release of strong data on activity in the construction sector in Britain.

Activity in the construction sector in the UK in October continued to increase, with the maximum rate of growth reached more than six years. Published data have filled up a list of evidence the UK economic recovery in the 4th quarter of this year , which continues to rise , which began in January.

According to data released by the company Markit , the index of purchasing managers in the construction sector (PMI) in October rose to 59.4 against 58.9 in September. The index remains above the threshold level of 50.0 sixth consecutive month. In Markit reported that participated in the survey respondents said housing as the main factor of growth in October.

EUR / USD: during the European session, the pair rose to $ 1.3513

GBP / USD: during the European session, the pair rose to $ 1.5972

USD / JPY: during the European session, the pair fell to Y98.57

At 15:00 GMT the United States will change in the volume of production orders for August and September. At 16:20 GMT a speech Jerome Powell, a member of the FOMC . At 18:10 GMT a speech the Deputy Governor of the Bank of Canada Lawrence Schembri . At 21:00 GMT a speech FOMC member Eric Rosengren . At 21:45 GMT New Zealand will publish the change in the number of employed, the unemployment rate , changes in the level of wages in the private sector , excluding overtime for the 3rd quarter . At 22:30 GMT Australia will release the index of activity in the service of the AiG in October. At 23:50 GMT Japan will change in the monetary base in October.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.