- Analytics

- News and Tools

- Market News

- Asian session: The euro declined to the lowest level in two weeks

Asian session: The euro declined to the lowest level in two weeks

00:30 Australia Producer price index, q / q Quarter III +0.1% +0.3% +1.3%

00:30 Australia Producer price index, y/y Quarter III +1.2% +1.9%

01:00 China Manufacturing PMI October 51.1 51.2 51.4

01:45 China HSBC Manufacturing PMI (Finally) October 50.9 50.7 50.9

05:30 Australia RBA Commodity prices, y/y Quarter III -3.1% -1.0%

The euro declined to the lowest level in two weeks against the dollar and the yen as signs of economic weakness in the currency bloc fueled speculation the European Central Bank will cut interest rates.

The 17-nation currency extended its biggest drop in more than a year versus the greenback before data forecast to show manufacturing contracted in France. An index based on a survey of French purchasing managers in manufacturing fell to 49.4 in October, the lowest since June, according to a separate poll for the Nov. 4 data. That would confirm the initial reading released on Oct. 24. Reports yesterday showed the euro region’s inflation slowed and unemployment climbed to a record. The euro area’s annual consumer-price index declined to 0.7 percent last month, the least since November 2009, from 1.1 percent in September, the European Union’s statistics office said yesterday. Euro-area unemployment stood at a record 12.2 percent in September, separate data showed.

The Australian dollar pared declines after data showed Chinese manufacturing expanded at the fastest pace in 18 months, boosting trade prospects. China’s Purchasing Managers’ Index rose to 51.4 in October, the highest since April 2012 and up from 51.1 in September, National Bureau of Statistics and China Federation of Logistics and Purchasing said in Beijing today. China is Australia’s biggest export market.

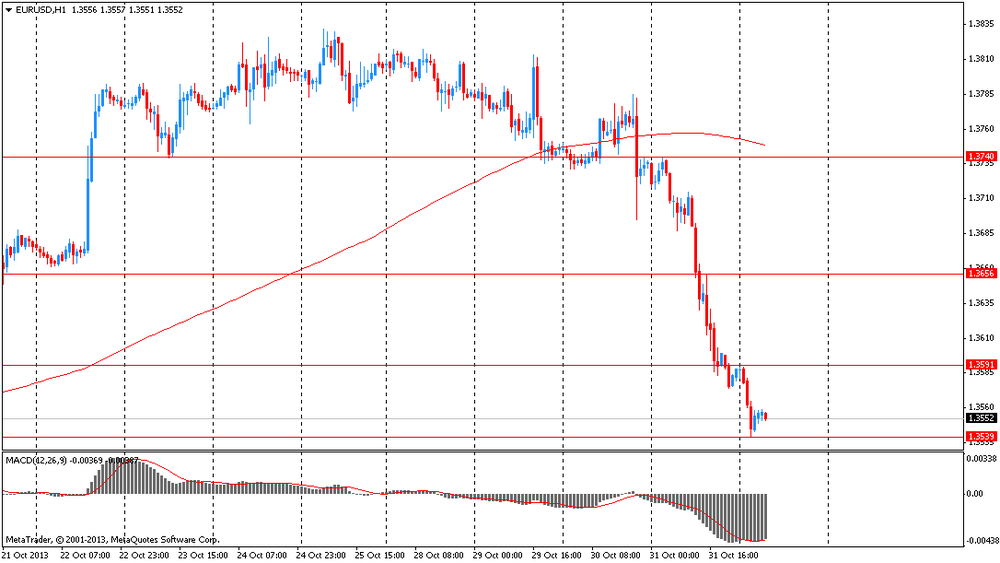

EUR / USD: during the Asian session the pair fell to $ 1.3540

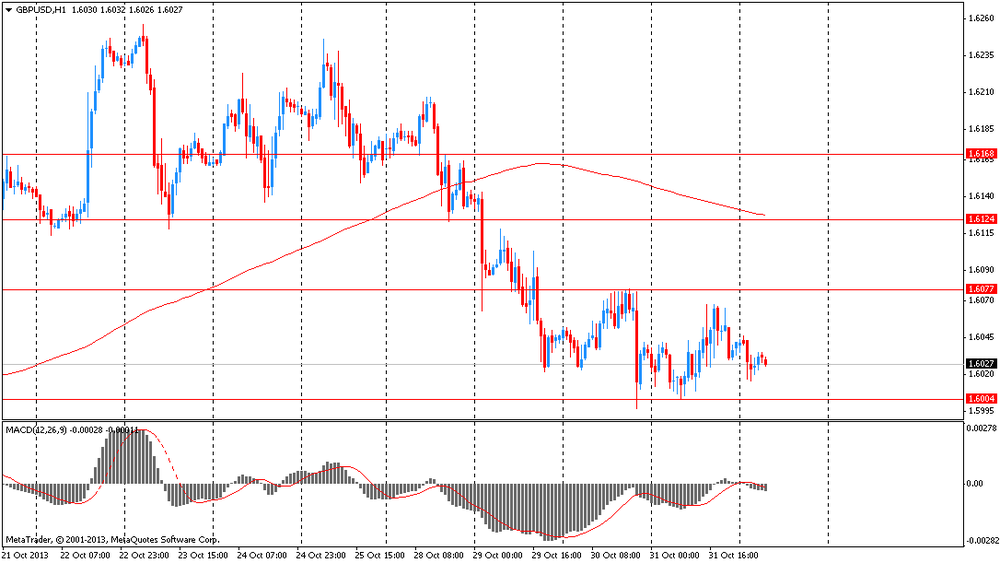

GBP / USD: during the Asian session, the pair fell to $ 1.6015

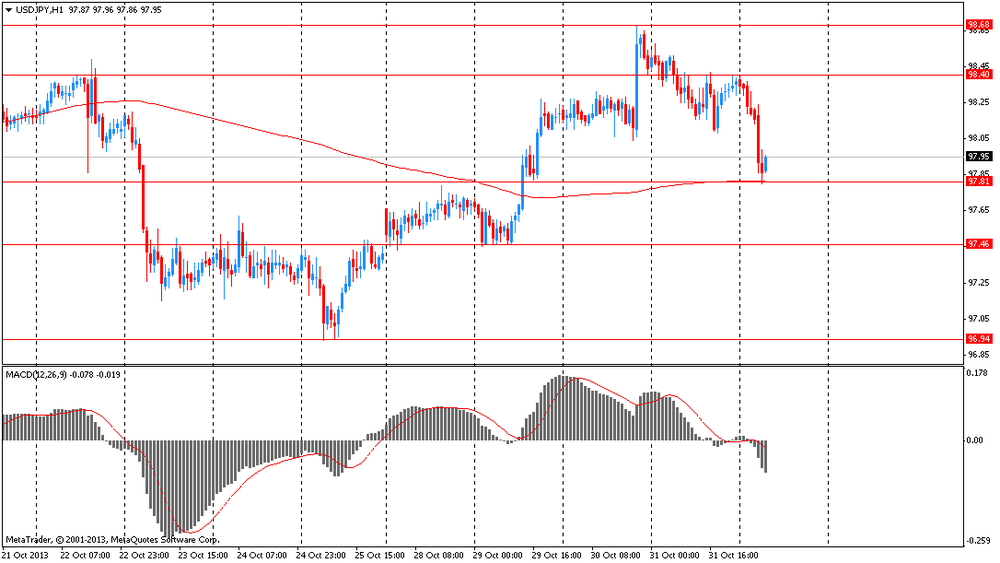

USD / JPY: during the Asian session the pair fell to Y97.80

UK manufacturing PMI data due at 0928GMT and will provide the main domestic focus (f'cast 56.4 vs last 56.7). For the afternoon, US PMI and ISM data will provide interest. Fed Bullard speaks at 1310GMT.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.