- Analytics

- News and Tools

- Market News

- European session: Dollar recovers losses

European session: Dollar recovers losses

08:00 Eurozone ECB's Jens Weidmann Speaks

Dollar index recovers losses incurred last Friday, trading near session highs around 81.40/45.

For the dollar this week promises to be interesting, and today we know the results of the report on orders for durable goods in the United States. Markets expect a reduction of orders by 3.0% in July, while the index excluding the transport sector is projected at 0.6%. Investor sentiment continues to control the talk about the prospects for reducing the Fed asset purchases, which are amplified as we approach the September meeting of the FOMC. "Our economists still expect the Fed to announce the beginning of tightening at the next meeting, but as yet no figures and dates will not be made public. However, the decision itself will signal the movement of the Central Bank to normalize. We believe that QE could be completed in the middle of next year ", - noted Mr. Barry and J. Yu, strategists at UBS.

Euro traded near-month high against the yen in anticipation of tomorrow's data IFO business climate index in Germany. It is expected that the figure will continue to further recovery of the fourth month in a row. According to the median forecast of economists, the level of business confidence in Europe's largest economy is likely to grow this month to 107 from 106.2 in July. In this case, the German unemployment rate for August is likely to be 6.8%. This is the lowest level since May 2012.

Today in Japan, Chief Cabinet Secretary Suga said that before the start of an extraordinary session of parliament, which will be held this fall, Prime Minister Shinzo Abe will take the decision to raise the sales tax in the country.

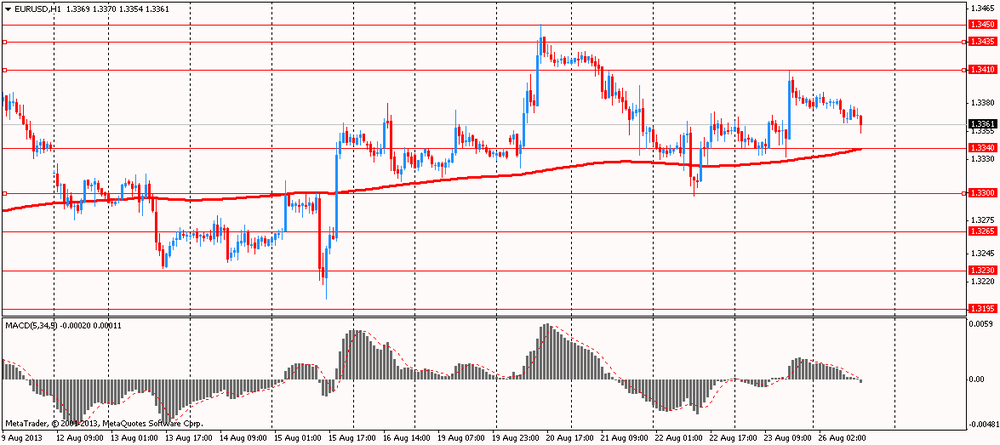

EUR / USD: during the European session, the pair fell to $ 1.3354

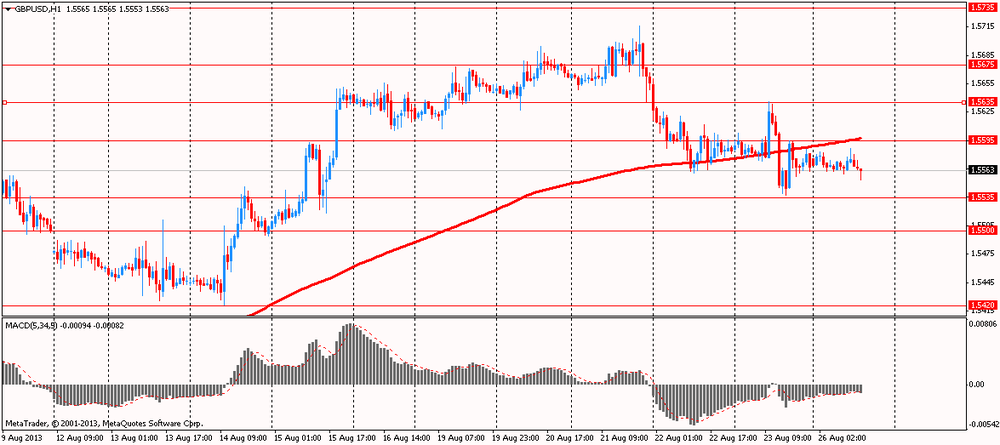

GBP / USD: during the European session, the pair fell to $ 1.5553

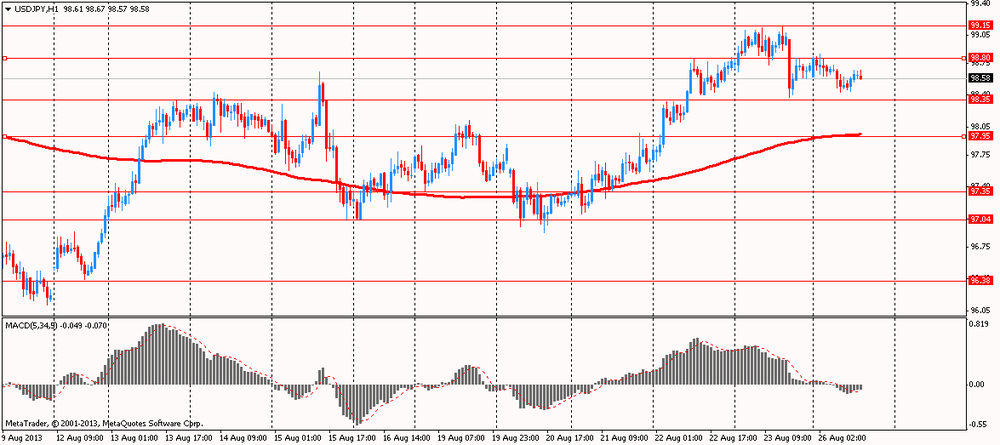

USD / JPY: during the European session, the pair consolidated in the Y98.43-Y98.67

At 12:30 GMT will be published data on the Consumer Price Index in Canada in July. At 13:00 GMT Belgium publish an index of business sentiment for August. At 14:00 GMT is expected to publish an indicator of consumer confidence for August for the euro area. Also this time, the U.S. will present data on the volume of sales in the primary market in July.

At 12:30 GMT the United States will change in orders for durable goods, including excluding transportation equipment in July.

In Britain, the summer bank holiday

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.