- Analytics

- News and Tools

- Market News

- European session: the euro fell

European session: the euro fell

05:30 France GDP, q/q (Preliminary) Quarter II +0.1% +0.6% +0.5%

05:30 France GDP, Y/Y (Preliminary) Quarter II -0.4% -0.1% +0.3%

06:00 Germany GDP (QoQ) (Preliminary) Quarter II +0.1% +0.6% +0.7%

06:00 Germany GDP (YoY) (Preliminary) Quarter II -1.4% +0.7% +0.9%

06:45 France CPI, m/m July +0.2% -0.1% -0.3%

06:45 France CPI, y/y July +0.9% +1.1% +1.2%

06:45 France Non-Farm Payrolls (Preliminary) Quarter II -0.1% 0.0% -0.2%

07:15 Switzerland Producer & Import Prices, m/m July +0.1% +0.4% 0.0%

07:15 Switzerland Producer & Import Prices, y/y July +0.2% +0.5% +0.5%

08:30 United Kingdom ILO Unemployment Rate June 7.8% 7.8% 7.8%

08:30 United Kingdom Average Earnings, 3m/y June +1.7% +2.1% +2.1%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June +1.0% +1.1% +1.1%

08:30 United Kingdom Bank of England Minutes

08:30 United Kingdom Claimant count July -21.2 -14.3 -29.2

08:30 United Kingdom Claimant Count Rate July 4.4% 4.4% 4.3%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter II -0.3% +0.2% +0.3%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter II -1.7% -0.8% -0.7%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 4.8 7.2

The euro fell against the U.S. dollar despite strong GDP data for the euro zone, Germany and France.

Eurozone GDP in the 2nd quarter grew by 0.3% compared with the previous quarter, according to the Eurostat.

Compared to the same period last year, GDP Monetary Union fell by 0.7%. The results were better than expected by experts who predicted the growth of the first indicator by 0.2%, and the fall of the second - by 0,8%.

Certificates pursuant to the revised data in the 1st quarter of the euro zone economy falling relative to the fourth quarter was 0.3%, not 0.2% as previously expected.

The most significant increase in GDP was recorded in Germany and France, which are the largest in the eurozone. The German economy grew by 0.7%, while experts predicted growth of 0.6%. The French economy for the period increased by 0.5%, analysts were expecting a 0.2% rise.

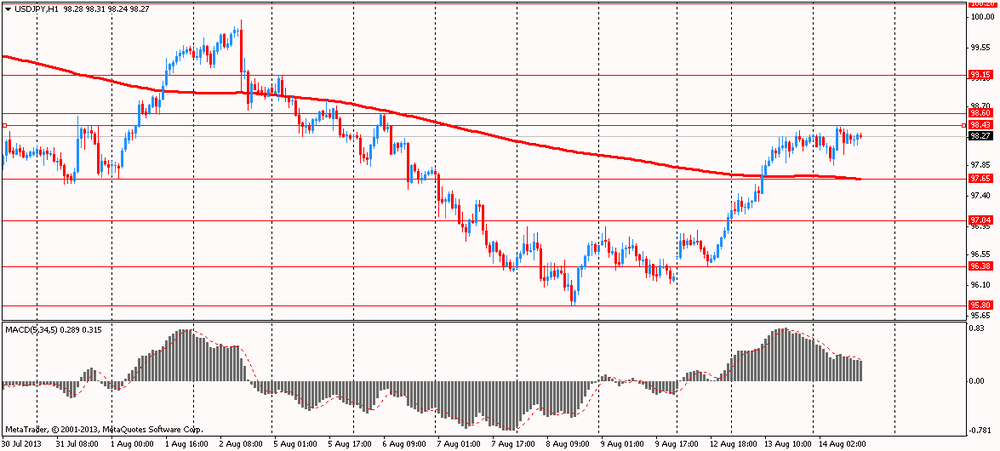

The U.S. dollar traded near one-week high against the yen ahead of tomorrow's publication of the index of activity in the manufacturing sector of the Federal Reserve Bank of New York.

According to the median forecast of economists, the index is likely to be highest in the last six months and will be 10.2. Recall that the index is built based on the results of a survey of top managers and provided by the Federal Reserve Bank of New York. The indicator reflects the situation in the segment of industrial orders and business confidence in the business environment. Values above zero reflect the increase of activity below - its decline.

Also today, investors expect the president's speech, Federal Reserve Bank of St. Louis James Bullard, who previously played for the continuation of the program QE. Performance will be held tonight in Paducah, Kentucky.

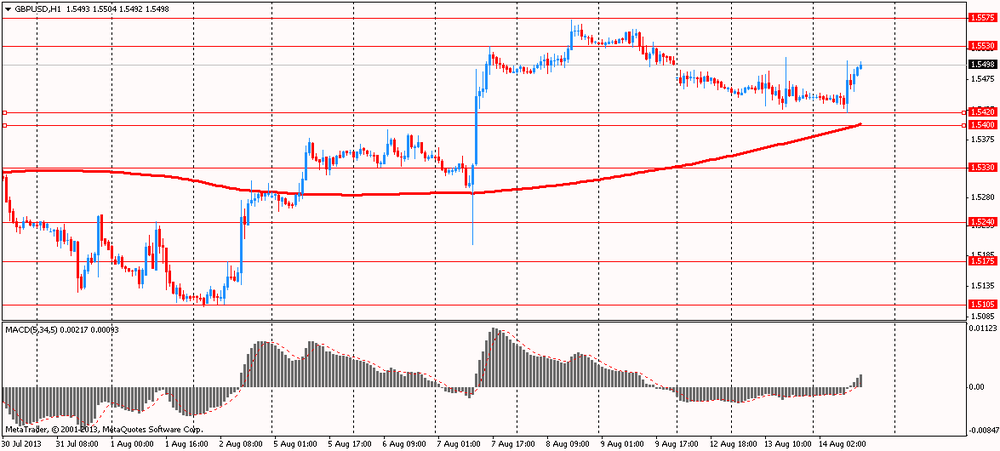

The British pound rose against the dollar after data on the labor market and the publication of minutes of the Bank of England.

In July, the unemployment rate in Britain fell by 29.2 million, exceeding the median forecast of -14.3 million and were better than the result of the June -29.4 million (restated). Unemployment rate by ILO standards in the three months to June remained at around 7.8%.

As shown by the Bank of England meeting minutes from July 31-August 1, members of the MPC voted unanimously to maintain the interest rate at around 0.5%.

Meanwhile, transparent communication policy, proposed by Mark Carney, and assuming that the Central Bank will not raise rates from the current level as long as inflation in the next 18-24 months will not fall under the 2.5% mark, won the support of 8 members. Martin Weale voted against the adoption of the new policy, explaining it by the fact that the "preferred to him in the time range of the inflation forecast is shorter than what was proposed."

All members of the MPC unanimously in favor of keeping the size of the previous program of asset purchases (£ 375 billion). However, some members of the MPC noted that you may need additional stimulus, but this will depend on the first effects of the policy of transparency.

In addition, the report showed that all members of the MPC considered market expectations for a rate hike, "Central Bank forecasts inappropriate" for the British economy.

EUR / USD: during the European session, the pair fell to $ 1.3238

GBP / USD: during the European session, the pair rose to $ 1.5505

USD / JPY: during the European session, the pair rose to Y98.43

At 12:30 GMT the U.S. will release the producer price index and producer price index excluding prices for food and energy prices in July. At 22:30 GMT New Zealand will report on the index of business activity in the manufacturing sector of Business NZ in July.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.