- Analytics

- News and Tools

- Market News

- European session: commodity currencies rose after the decision of the People's Bank of China

European session: commodity currencies rose after the decision of the People's Bank of China

06:00 Germany Producer Price Index (MoM) June -0.3% -0.2% 0.0%

06:00 Germany Producer Price Index (YoY) June +0.2% +0.6% +0.6%

08:30 United Kingdom PSNB, bln June 12.7 Revised From 10.5 9.4 10.2

Commodity currencies rose against the decision of the People's Bank of China deregulate interest rates and allow banks themselves set the rates on loans. As part of measures to normalize the flow of capital and the maintenance of slowing economic growth, China has adopted a decision on the liberalization of interest rates, and as an important first step declared his intention to remove the lower bound on the official rates of bank lending. The People's Bank also announced on its website that it will terminate the control of interest rates on discount bills. However, he will continue to monitor the deposit rate.

The British рound was higher against the U.S. dollar. Published a report on the state of public finances in June, according to which, in June, net borrowing of the public sector, the preferred measure of the budget deficit amounted to 8.5 billion pounds against 11.9 billion pounds of debt in June of last year. However, the positive effect on the data for June has had a profit of the Bank of England in the amount of 3.9 billion pounds from operations to buy bonds.

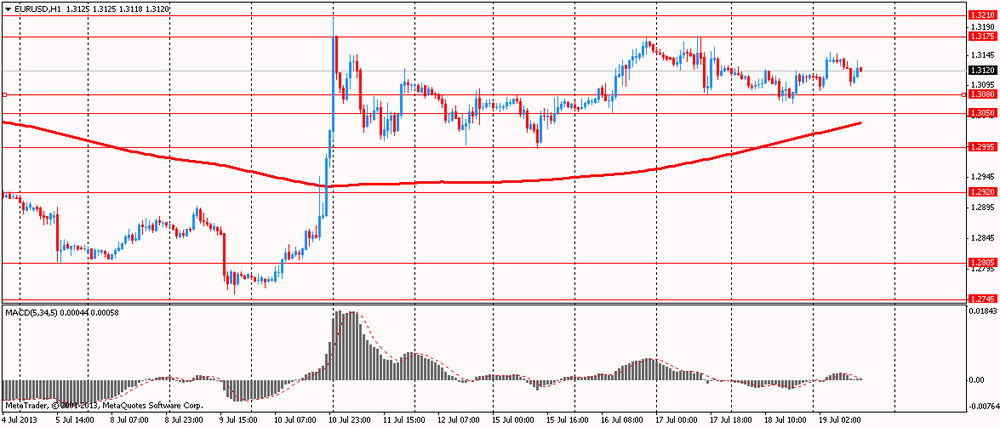

The euro fell against the dollar on data on producer prices in Germany. The Producer Price Index rose by 0.6 percent year on year in June after a 0.2 percent rise in May, the Federal Statistical Office. The growth rate in June was in line with economists' forecasts. Led the overall increase in the prices of consumer non-durable goods, which grew by 2.6 percent per year, while the price of capital goods rose by 0.8 percent. Expenditure on durable goods and energy prices were up 0.9 percent and 0.7 percent, respectively, compared to June 2012. On a monthly basis, producer prices were unchanged in June after a 0.3 percent decline the previous month. The index is forecast was reduced by 0.2 percent on a monthly basis.

Today in Moscow launched a 2-day summit of central bankers and finance ministers of the G-20. As expected, the focus will be to discuss the current situation in the global economy, labor market issues and reform of financial regulation. In addition, an important issue on the agenda may be the policy of central banks. Thus, the debate over the possible aggressive easing implemented by the Bank of Japan and the Federal Reserve's plans to curtail QE. However, according to the published communiqué, such measures are unlikely to be subjected to official criticism. Representatives of the G-20 will continue negotiations on the key issue - the financing of investment, "which are essential for economic growth and an important factor in stimulating job growth."

EUR / USD: during the European session, the pair fell to $ 1.3096

GBP / USD: during the European session, the pair rose to $ 1.5281

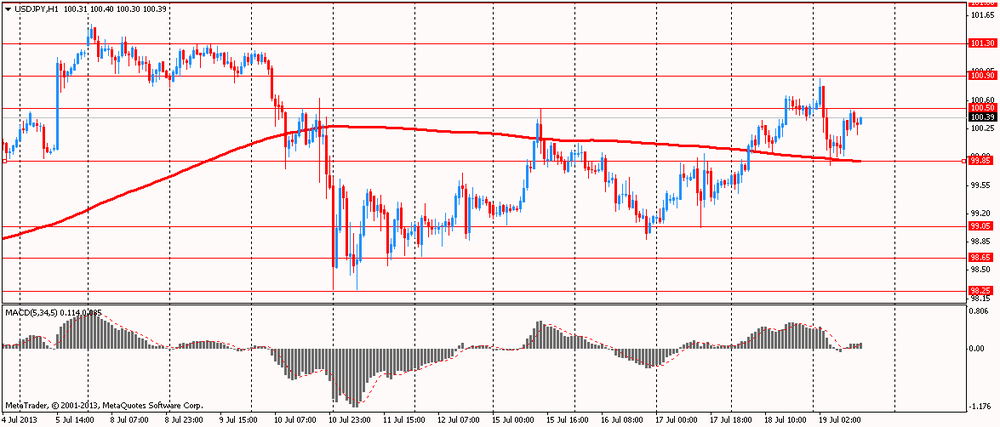

USD / JPY: during the European session, the pair rose to Y100.48

At 12:30 GMT Canada will release the consumer price index, core consumer price index from the Bank of Canada in June. On Friday and Saturday will be a meeting G20.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.