- Analytics

- News and Tools

- Market News

- European session: the pound rose

European session: the pound rose

06:00 Switzerland Trade Balance June 2.12 Revised From 2.22 2.41 2.73

08:00 Eurozone Current account, adjusted, bln May 23.8 Revised From 19.5 21.3 19.6

08:30 United Kingdom Retail Sales (MoM) June +2.1% +0.4% +0.2%

08:30 United Kingdom Retail Sales (YoY) June +2.1% Revised From +1.9% +1.8% +2.2%

The pound rose after the release of data on retail sales in the UK, which rose sharply in the 2nd quarter. This is another indication that the economic recovery that began in the 1st quarter, gained momentum in April-June. According to the data of the National Bureau of Statistics (ONS), retail sales in the 2nd quarter, up 0.9%. This strong performance is similar to the dynamics of the third quarter of 2012, when sales benefited from the growth in consumer spending in the London Olympics. This growth is likely to add 0.1 percentage points to growth in gross domestic product in the 2nd quarter, said a spokesman for ONS. In the 1st quarter of the year, GDP grew by 0.3% after a similar reduction in the 4th quarter of 2012. Data on retail sales correspond to the polls, according to which the recovery is gaining momentum in the 2nd quarter. According to the report ONS, published on Thursday, retail sales rose in June by 0.2% compared with the previous month, slightly above economists' forecasts. Compared with the same period last year, sales were up 2.2%.

The yen weakened against most major currencies on expectations that the meeting of finance ministers and central bankers of Twenty (G-20), ultra loose monetary policy in Japan will not be condemned by the representatives of the G-20. So Russian Deputy Finance Minister Sergei Storchak said the policy will probably not encourage the Japanese authorities to reduce incentives designed to accelerate the rate of inflation to 2%. As stated in an interview with the Deputy Minister of Economy Nishimura: "The members of the G-20 well aware of the situation in Japan." Recall that since April, the Bank of Japan monthly buys bonds worth more than $ 70 billion, after Japanese Prime Minister Shinzo Abe has instructed the central bank to take steps to overcome deflation.

Euro traded near a six-week high against the yen after the Greek parliament passed a package of laws on the reduction of the public sector is a prerequisite for the release of the next tranche of aid to the country from international lenders. The new rules require the dismissal of more than four thousand civil servants up to the end of the year. In addition, in the near future another 25 thousand people. Approval of a new package of laws was a prerequisite for Greece a loan of 6.8 billion euros from the EU and the International Monetary Fund.

It is worth noting that today, a one-day visit to Athens visited the German Finance Minister Wolfgang Schaeuble. During a joint press conference in Athens with Greek Finance Minister Schaeuble praised Greece's efforts to implement the austerity program, but stressed that more needs to be done. As expected, the German finance minister also announced the country's readiness to provide financial assistance in the amount of 100 million euros Greek companies through development bank KfW. Greek Finance Minister for his part called for greater "political and economic union" within the EU, which will help to overcome the crisis and to stimulate growth.

Demand for the dollar was limited after a speech by Federal Reserve Chairman Ben Bernanke before the lower house of the U.S. Senate. "If the outlook for the labor market will be less favorable if it turns out that inflation is not moving to the target level of 2%, or if the financial conditions that have tightened in recent years, will be challenging enough to allow us to achieve the goals set by the mandate of the Central Bank, the redemption of bonds the current level can be maintained longer, "- said Bernanke. If the situation in the economy will improve faster than expected, and inflation is "strongly" accelerate "the volume of redemption of bonds may be cut more quickly," he said.

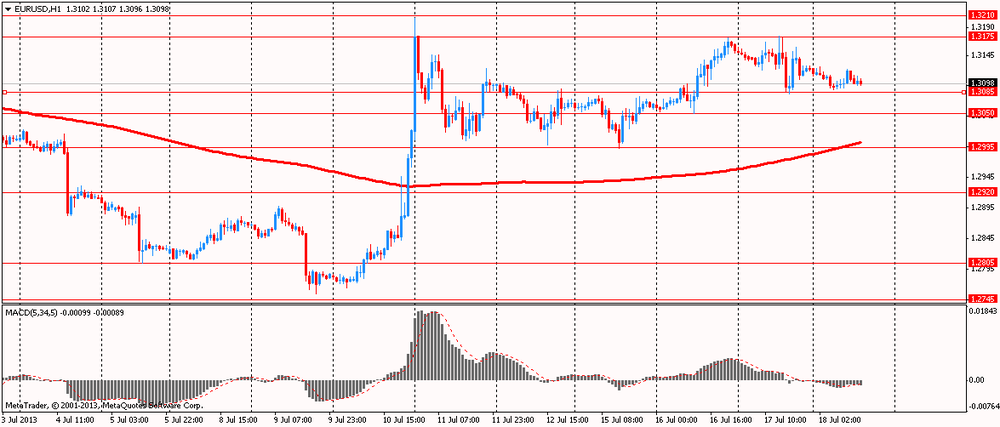

EUR / USD: during the European session, the pair is trading in the range of $ 1.3089 - $ 1.3122

GBP / USD: during the European session, the pair rose to $ 1.5241

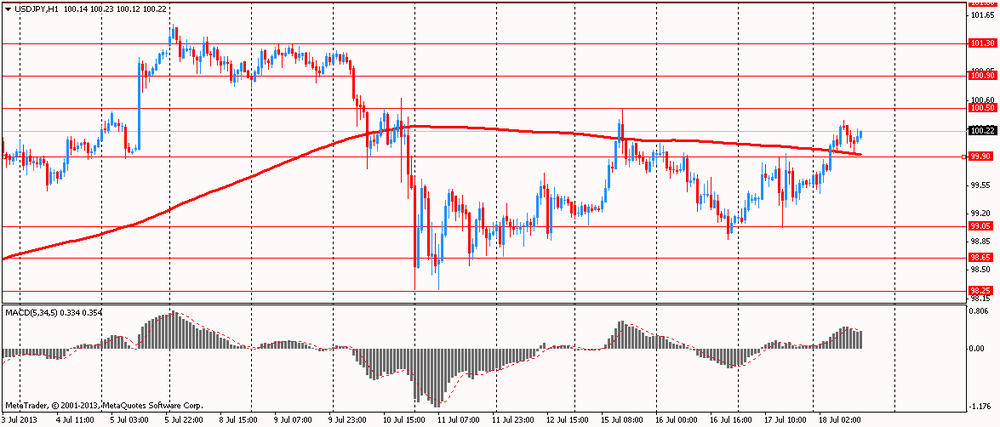

USD / JPY: during the European session, the pair rose to Y100.35

At 12:30 GMT Canada will release the change in the volume of wholesale trade for May. At 14:00 GMT the U.S. will release the manufacturing index, the Philadelphia Fed in July. At 14:00 GMT the chairman of Board of Governors of the Federal Reserve Ben Bernanke testifies.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.