- Analytics

- News and Tools

- Market News

- European session: the euro rose

European session: the euro rose

06:00 Germany Gfk Consumer Confidence Survey June 6.2 6.2 6.5

06:00 Germany GDP (QoQ) (Finally) Quarter I +0.1% +0.1% +0.1%

06:00 Germany GDP (YoY) (Finally) Quarter I -0.2% -0.2% -0.2%

07:15 United Kingdom MPC Member Fisher Speaks

08:00 Germany IFO - Business Climate May 104.4 104.6 105.7

08:00 Germany IFO - Current Assessment May 107.2 107.2 110.0

08:00 Germany IFO - Expectations May 101.6 101.6 101.6

08:30 United Kingdom BBA Mortgage Approvals April 31.2 32.7 32.2

10:00 Eurozone ECB's Jens Weidmann Speaks

The euro strengthened for a second day against the dollar after an industry report showed German business confidence unexpectedly increased in May, adding to optimism the region's biggest economy is improving.

The 17-nation currency extended its biggest weekly advance in seven weeks as a separate report forecast German consumer sentiment will improve in June.

The Ifo institute's German business climate index improved to 105.7 from 104.4 in April. Economists surveyed by Bloomberg News (GRIFPBUS) predicted it would remain unchanged. GfK AG said its consumer-sentiment index will increase to 6.5 next month from 6.2 in May. That would be the highest since September 2007.

While risks stemming from Europe's debt crisis persist, the German economy will gather pace in the current quarter, the Bundesbank said this week. Factory orders surged for a second month in March and exports increased.

The yen extended its biggest weekly gain versus the dollar since June after Bank of Japan Governor Haruhiko Kuroda said the central bank had announced sufficient monetary easing. The yen rose for a second day versus the dollar as Kuroda said the BOJ will implement flexible money-market operations and he wants to avoid increasing volatility in bond markets.

The pound rose against the dollar after the data of the British Bankers' Association (BBA), published on Friday, showed that UK companies and households in April continued to pay off debts, as confidence remains subdued, despite a number of government initiatives to stimulate lending. According to the BBA, the net payment of loans by non-financial companies in April was 2.0 billion pounds ($ 3 billion) from 0.8 billion pounds in March.

EUR / USD: during the European session, the pair rose to $ 1.2993 and retreated

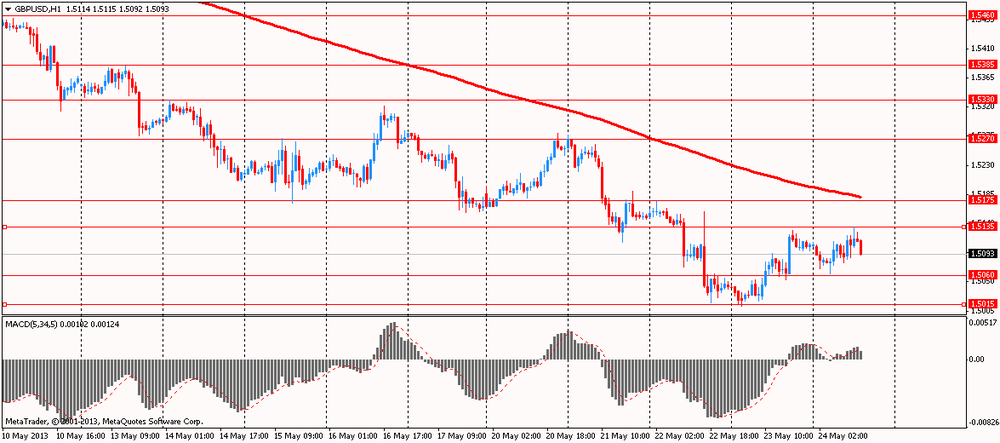

GBP / USD: during the European session, the pair rose to $ 1.5135

USD / JPY: during the European session, the pair fell to Y101.17

At 12:30 GMT the United States will publish the change in orders for durable goods, including excluding transportation equipment in April.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.