- Analytics

- News and Tools

- Market News

- European session: the yen fell to the weakest in three years against the euro

European session: the yen fell to the weakest in three years against the euro

08:00 Eurozone Current account, adjusted, bln March 16.3 14.2 25.9

08:30 United Kingdom Bank of England Minutes May

08:30 United Kingdom Retail Sales (MoM) April -0.7% 0.0% -1.3%

08:30 United Kingdom Retail Sales (YoY) April -0.5% +2.0% +0.5%

08:30 United Kingdom PSNB, bln April 16.7 7.6 8.0

10:00 Eurozone EU Economic Summit May

10:00 United Kingdom CBI industrial order books balance May -25 -17 -20

10:00 Switzerland SNB Chairman Jordan Speaks

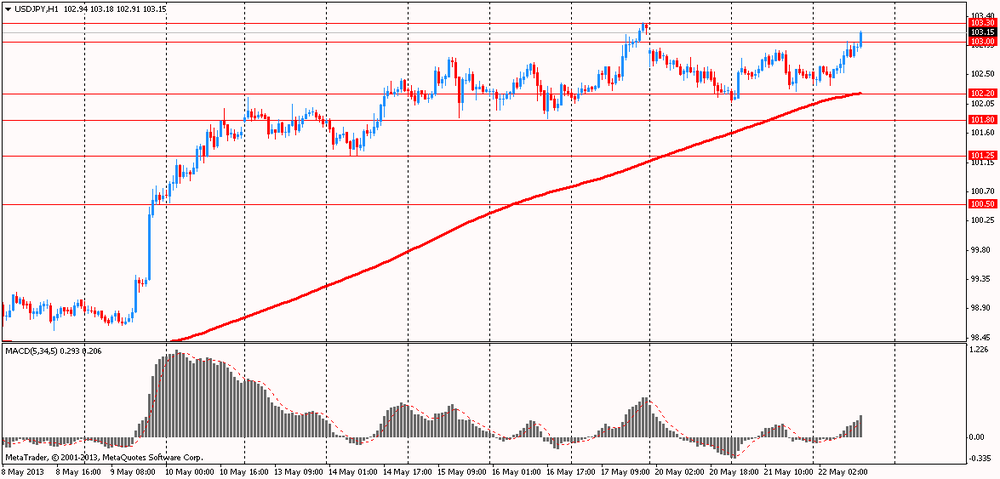

The yen fell to the weakest in three years against the euro after Bank of Japan policy makers affirmed a plan to double the monetary base over two years and their statement showed no concern with rising bond yields. Japan's currency declined versus 13 of its 16 major peers after a government report showed the trade deficit swelled more in April than analysts forecast. BOJ Governor Haruhiko Kuroda told reporters in Tokyo that the central bank will conduct its debt purchases in a flexible manner, and that the recent volatility in government securities isn't yet affecting the economy. The central bank will expand the supply of money in the economy by 60 to 70 trillion yen a year, as pledged in April, the BOJ said. Japanese exports rose 3.8 percent from a year earlier, the Finance Ministry said, less than the median 5.4 percent estimate of economists surveyed by Bloomberg News. The trade deficit expanded to 879.9 billion yen, the widest in three months.

The dollar dropped for a third day against the euro before Federal Reserve Chairman Ben S. Bernanke addresses Congress on the outlook for the U.S. economy. The dollar fell against the euro before Bernanke testifies to the Joint Economic Committee in Washington. The Fed is buying $85 billion a month in Treasury and mortgage debt to push down borrowing costs and spur growth.

The franc fell to the weakest since May 2011 versus the euro after Swiss National Bank President Thomas Jordan said an adjustment of the currency's cap was possible. The franc weakened to a one-year low against the euro after Swiss National Bank President Jordan said a shift of the cap on the currency and negative interest rates are among measures it may take to prevent a tightening of monetary conditions.

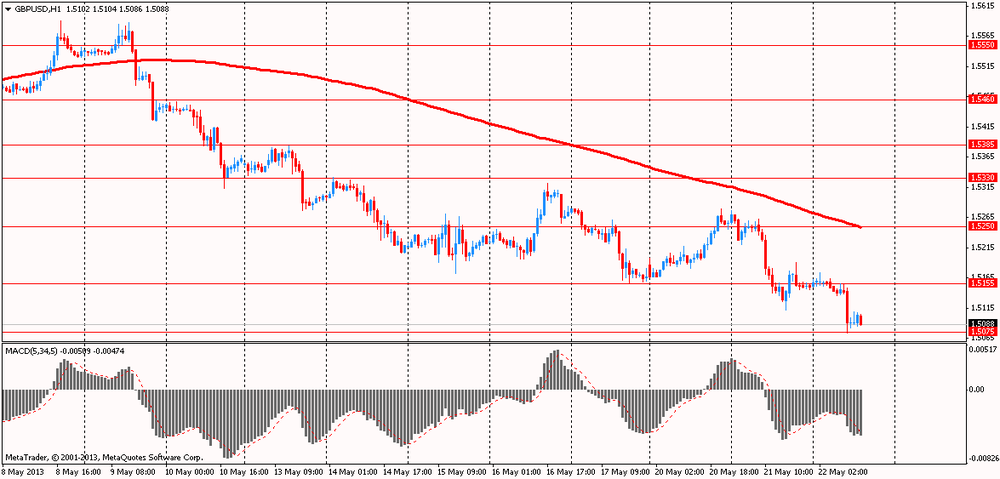

The pound declined to a four-week low against the euro after a government report showed U.K. retail sales unexpectedly dropped last month. The U.K. currency slid to a six-week low versus the dollar after minutes of the Bank of England's May 8-9 policy meeting showed Governor Mervyn King was defeated for a fourth month in his bid to expand stimulus. King, David Miles and Paul Fisher maintained their campaign to increase so-called quantitative easing by 25 billion pounds ($37.7 billion) from the current 375 billion pounds.

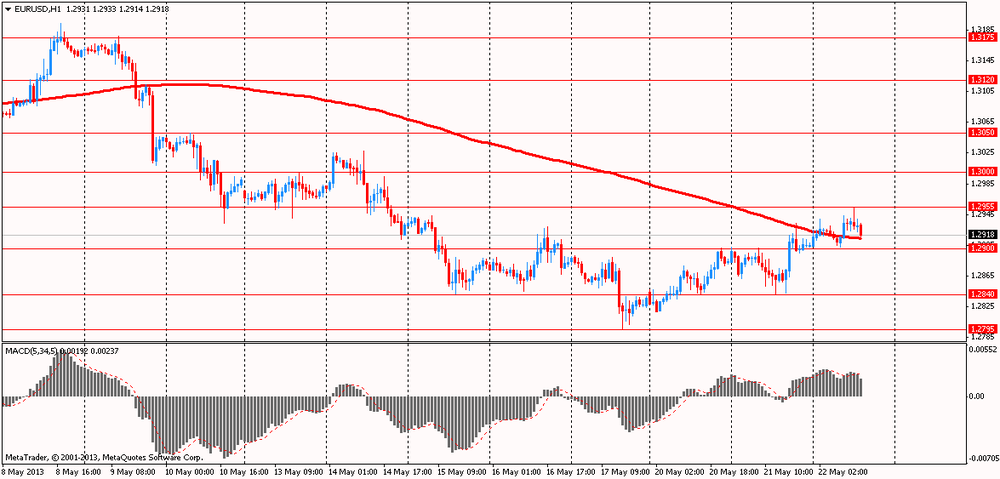

EUR / USD: during the European session, the pair rose to $ 1.2955

GBP / USD: during the European session, the pair fell to $ 1.5073

USD / JPY: during the European session, the pair rose to Y103.15

At 12:30 GMT Canada will publish the change in the volume of retail sales, including excluding vehicle sales for March. In the U.S., will be released at 14:00 GMT volume of sales in the secondary market for April, at 14:30 GMT - the data on stocks of crude oil from the Ministry of Energy. At 18:00 GMT will be publication of the minutes of the Fed meeting.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.