- Analytics

- News and Tools

- Market News

- European session: the euro declined

European session: the euro declined

06:00 Switzerland Trade Balance March 2.10 1.73 1.9

07:00 France Manufacturing PMI (Preliminary) April 44.0 44.2 44.4

07:00 France Services PMI (Preliminary) April 41.3 42.3 44.1

07:30 Germany Manufacturing PMI (Preliminary) April 49.0 49.0 47.9

07:30 Germany Services PMI (Preliminary) April 50.9 51.1 49.2

08:00 Eurozone Manufacturing PMI (Preliminary) April 46.8 46.8 46.5

08:00 Eurozone Services PMI (Preliminary) April 46.4 46.7 46.6

08:30 United Kingdom PSNB, bln March 4.4 13.9 16.7

10:00 United Kingdom CBI industrial order books balance April -15 -14 -25

11:00 United Kingdom MPC Member McCafferty Speaks

The British pound during the session updated intraday lows against the dollar on record PSNB, but then stabilized and recovered somewhat. According to the Confederation of British Industry, the April CBI industrial orders index fell to -25 from the March level of the value -15. Analysts had expected a slight improvement to -14. In March, public sector net borrowing of Britain (PSNB) increased to 16,747 billion pounds, although analysts expect growth to 14.000 billion pounds. February's result was also revised to increase - from 4.356 billion pounds to 7.196 billion pounds.

The euro fell against the dollar on weak results PMI Germany. Activity in the private sector of the eurozone declined again in April. Such developments are likely to trigger the growth of appeals to the rejection of austerity measures in favor of the policy instruments that promote growth.

According to a survey of purchasing managers, active in German business confidence fell for the first time since November. Together with a similar report testifying to the slowdown in manufacturing activity in China, it has raised concern about the likely decline in global growth.

In April, a preliminary PMI index of manufacturing activity in the country has decreased to around 47.9 to 49 pips. in March. The result was weaker than the market forecast of 49. A similar index in the services sector also dropped from 50.9 pts. in March to 49.2, contrary to expectations of growth to 51. France reported that preliminary index of manufacturing activity PMI Markit rose to 44.4 in April, surpassing the forecast of 44.3 and 44.0 March result, while the same index in the service sector rose from 41.3 to 44.1, compared with an expected 42.0.

The disappointing news came today from China, where preliminary index of manufacturing activity in China HSBC PMI in March amounted to 50.5 (vs. 51.5). According to experts, these results have reinforced voiced over the weekend words of the head of the Central Bank of China that the country is going now to the "slower pace of sustainable growth." Market and leading institutions such as the IMF still predicts China's GDP growth this year at 8 +%.

EUR / USD: during the European session, the pair fell to $ 1.2971

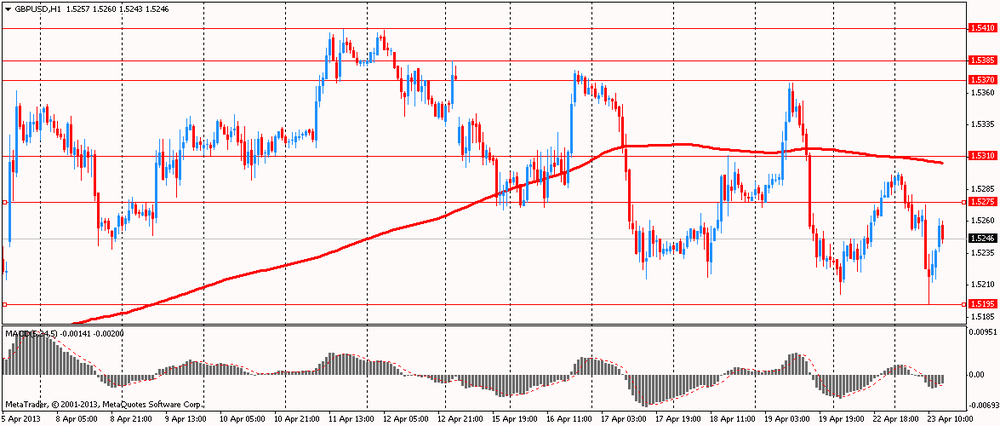

GBP / USD: during the European session, the pair fell to $ 1.5195

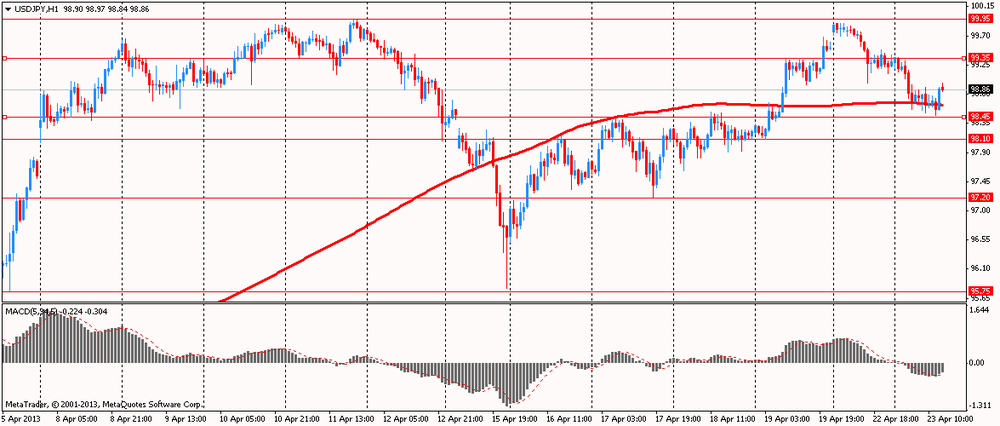

USD / JPY: during the European session, the pair fell to Y98.47

At 12:30 GMT Canada will release the change in the volume of retail sales, the change in retail sales excluding auto sales for February. In the U.S., will be released at 13:00 GMT the index of business activity in the manufacturing sector in April, the 14:00 GMT - sales in the primary market in March, at 20:30 GMT - the change in volume of crude oil, according to API. At 21:00 GMT we will know the decision of the Reserve Bank of New Zealand's main interest rate and the accompanying statement will be made of the Reserve Bank of New Zealand.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.