- Analytics

- News and Tools

- Market News

- Oil fell

Oil fell

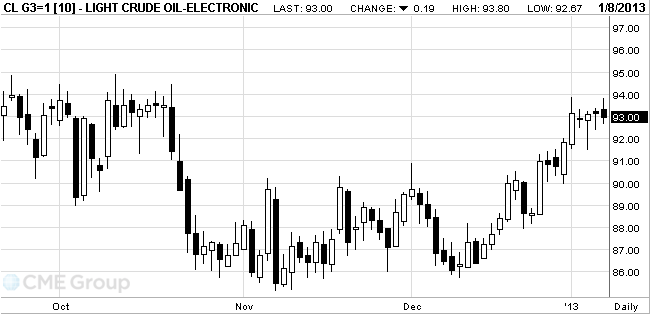

Oil fell for the first time in three days in New York on expectations that U.S. stockpiles rose from a three-month low last week.

Prices dropped as much as 0.6 percent as inventories probably rose 2 million barrels in the week ended Jan. 4, according to a Bloomberg survey before an Energy Department report tomorrow. Prices extended losses as U.S. stocks retreated as investors awaited fourth-quarter earnings reports.

Oil stockpiles probably increased by 0.6 percent to 362 million in the seven days ended Jan. 4, according to the median of nine analyst estimates in the Bloomberg survey. Seven respondents forecast a gain and two a decrease.

Inventories tumbled 11.1 million barrels the previous week as imports dropped to a 13-year low. Stockpiles have decreased during December and risen in January for the past six years because of inventory shifts for tax and accounting purposes. Companies in Gulf Coast states minimize supplies at the end of the year to reduce local taxes.

Oil advanced to $93.80 earlier as products jumped after Motiva Enterprises LLC shut a crude unit at its 325,000-barrel- a-day Port Arthur, Texas, refinery on Jan. 6. Gasoline for February delivery gained as much as 1.1 percent, and heating oil futures jumped as much as 1.4 percent.

Crude oil for February delivery slid to $92.67 a barrel on the New York Mercantile Exchange, down 8.5 percent from a year earlier. Trading volume was 12 percent below the 100-day average.

Brent oil for February advanced 30 cents, or 0.3 percent, to $111.70 a barrel on the London-based ICE Futures Europe exchange. Volume was 12 percent above the 100-day average.

Brent’s premium over West Texas Intermediate oil in New York widened for the first time in four days, to $18.78 from yesterday’s $18.21. The premium has narrowed from $25.53 on Nov. 15 as Enterprise Products Partners LP (EPD) and Enbridge Inc. (ENB) prepare to resume service on the 500-mile (805-kilometer) Seaway link at full rates after more than doubling the line’s capacity to 400,000 barrels a day from 150,000.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.