- Analytics

- News and Tools

- Market News

- European session: the euro fell after EMU labor data

European session: the euro fell after EMU labor data

Data:

07:00 Germany Retail sales (September) real adjusted 0.4%

07:00 Germany Retail sales (September) real unadjusted Y/Y 0.3%

07:45 France PPI (September) 0.2%

07:45 France PPI (September) Y/Y 6.1%

09:30 UK M4 money supply (September) final -0.4%

09:30 UK M4 money supply (September) final Y/Y -1.7%

09:30 UK Consumer credit (September), bln 0.6

10:00 EU(17) Harmonized CPI (October) Y/Y preliminary 3.0%

10:00 EU(17) Unemployment (September) 10.2%

10:00 Italy CPI (October) preliminary 0.6%

10:00 Italy CPI (October) preliminary Y/Y 3.4%

10:00 Italy HICP (October) preliminary Y/Y 3.8%

11:00 Italy PPI (October) 0.2%

11:00 Italy PPI (October) Y/Y 4.7%

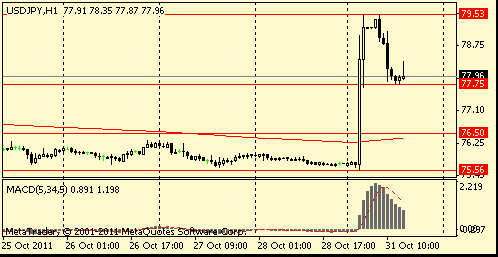

The yen slumped against the dollar as Japan stepped into foreign-exchange markets to weaken the currency for the third time this year after its gains to a postwar record threatened exporters.

The euro fell the most in four weeks versus the dollar amid speculation Europe’s leaders will struggle to garner financial support for their revamped crisis-fighting plan.

The dollar rose against all its major peers on refuge demand.

The euro pared last week’s advance versus the dollar as China’s official Xinhua News Agency said the nation can’t play the role of “savior” to Europe.

European Bailout

Euro-region’s leaders agreed on Oct. 27 to increase their bailout fund to 1 trillion euros, recapitalize banks and convinced banks to write down their holdings of Greek debt by 50 percent. While the help of China and cooperation of the International Monetary Fund were immediately sought, pledges of hard cash are proving hard to come by as Group of 20 members press for more details of the plan.

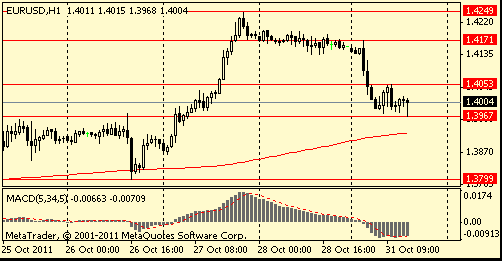

EUR/USD: the pair lead the European session in area $1.3970-$ 1,4050.

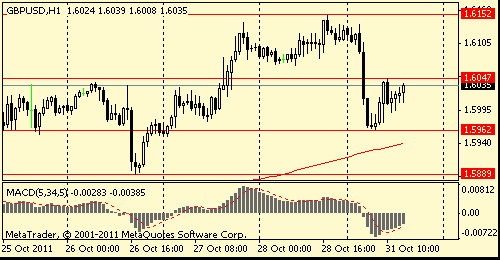

GBP/USD: the pair showed low in $1.5960 area then returned back above $1.6000.

USD/JPY: the pair decreased in Y78,00 area.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.