- Analytics

- News and Tools

- Market News

- European session: The euro strengthened

European session: The euro strengthened

06:00 Germany PPI (September) 0.3%

06:00 Germany PPI (September) Y/Y 5.5%

08:30 UK Retail sales (September) 0.6%

08:30 UK Retail sales (September) Y/Y 0.6%

The euro strengthened as draft guidelines showed planned changes to the euro- region’s bailout fund may open the door to increased credit lines for countries such as Italy and Spain.

The shared currency reversed earlier losses after European Commission President Jose Barroso said a “positive outcome” was possible at an Oct. 23 meeting of European leaders in Brussels. The European Financial Stability Facility may be able to offer loans up to 10 percent of a member states’ gross domestic product.

The Dollar Index fell as U.S. stock futures rose, damping demand for safer assets.

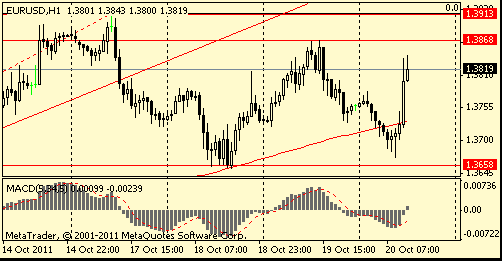

EUR/USD: the pair grown above $1,3800.

GBP/USD: the pair grown in $1.5800 area.

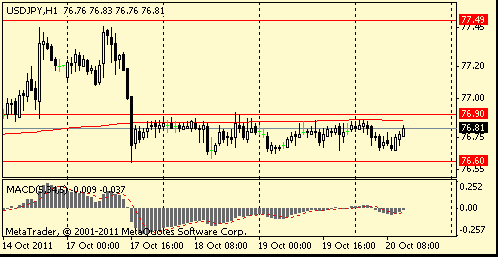

USD/JPY: the pair holds in Y76,65-Y76,85.

US data starts at 1230GMT when initial jobless claims are expected to rise 1,000 to 405,000 in the October 15 employment survey week after declining only 1,000 in the previous week. Claims were at a level of 428,000 in the September 17 employment survey week. This is followed at 1400GMT the Philadelphia Fed Survey, Existing Home Sales and

also the Sep Leading Indicator. The Philadelphia Fed index is forecast to rise to a reading of -10.0 in October, still indicating contraction. The pace of existing home sales is forecast to slow to a 4.95 million annual rate in September after jumping 7.7% in August to the strongest sales rate in over two years. The index of leading indicators is expected to rise 0.3% in September, with positive contributions from a steeper yield curve and an jump in the money supply. These should be offset by negative contributions from falling stock prices and building permits.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.