- Analytics

- News and Tools

- Market News

- European session: The euro strengthened

European session: The euro strengthened

09:00 Italy CPI (September) final 0.0%

09:00 Italy CPI (September) final Y/Y 3.0%

09:00 Italy HICP (September) final Y/Y 3.6%

09:00 EU(17) Harmonized CPI (September) final 0.8%

09:00 EU(17) Harmonized CPI (September) final Y/Y 3.0%

09:00 EU(17) Harmonized CPI ex EFAT (September) Y/Y 1.6%

09:00 EU(17) Trade balance (August) adjusted, bln -1.0

The euro strengthened as Group of 20 finance ministers began a two-day meeting to discuss plans to tackle Europe’s debt crisis.

The 17-nation currency approached a five-week high versus the yen as G-20 and International Monetary officials said the ministers meeting in Paris are working on a European rescue plan including boosting the IMF’s lending resources.

Gains in the euro were tempered after Standard & Poor’s cut Spain’s credit rating late yesterday. S&P downgraded Spain to AA- from AA with a negative outlook. The nation’s rating has been lowered by S&P three times since 2009, when the country lost its AAA status.

The Australian dollar headed for a weekly gain after data showed the inflation rate in China, the South Pacific nation’s biggest trading partner, increased 6.1 percent in September from a year earlier. Producer prices rose 6.5 percent.

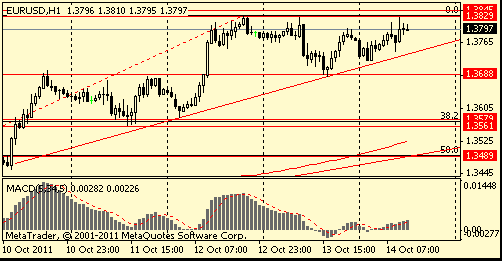

EUR/USD: the pair tested area of strong resistance $1.3830/50 then receded in $1,3800 area.

August increase. Nonauto retail sales are forecast to increase 0.4%. At 1355GMT, the Michigan Sentiment Index is expected to increase slightly to a reading of 60.0 in early-October after a sharper increase in September. The Investor Business Daily Economic Optimism index saw a one percent increase in October, however it remains in negative

territory. Shortly after, at 1400GMT, business inventories are expected to rise 0.5% in August, as factory inventories were already reported down 0.2% and wholesale inventories up 0.4% in the month. Later data sees the 1800GMT release of the September Treasury Statement.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.