- Analytics

- News and Tools

- Market News

- European session: The yen and dollar strengthened

European session: The yen and dollar strengthened

06:00 Germany CPI (September) final 0.1% 0.1%

06:00 Germany CPI (September) final Y/Y 2.6%

06:00 Germany HICP (September) final Y/Y 2.9%

08:30 UK Trade in goods (August), bln -7.8

The yen and dollar strengthened after a Chinese report showed exports slowed last month and the customs bureau warned of “severe” challenges, adding to signs global growth is slowing.

The euro fell as Germany’s top economic institutes cut their 2012 forecast for growth by more than half as the spiraling debt crisis weighs on banks and spending. Growth will slow to 0.8 percent next year from 2.9 percent in 2011, according to a bi-annual independent report commissioned by the German government. In April, the group forecast 2 percent economic growth for 2012.

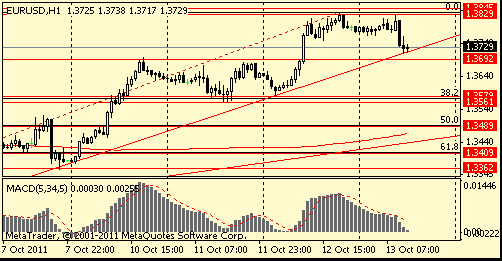

EUR/USD: the pair fell in $1.3720 area.

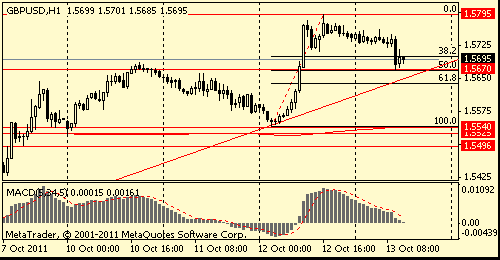

GBP/USD: the pair decreased below $1.5700.

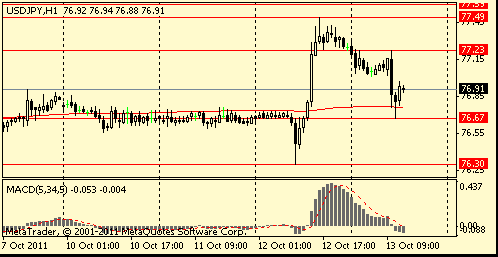

USD/JPY: the pair decreased below Y77,00.

US data starts at 1230GMT with jobless claims and the international trade balance. Initial jobless claims are expected to increase by 9,000 claims to 410,000 in the October 8 week. Seasonal adjustment factors expect unadjusted claims to rise sharply in the current week, the first full week of the new quarter. The international trade gap is expected to rise to $45.5 billion in August after narrowing sharply in July on widespread import declines. In August, Boring reported 18 orders from foreign buyers and 34 deliveries to foreign

buyers, both up from July. The import price index fell 0.4% on a sharp decline in energy imports. Excluding the energy price drop, import prices were up 0.3%. At the same time, export prices rose 0.5%, boosted by agriculture prices.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.