- Analytics

- News and Tools

- Market News

- Asian session: the euro dropped

Asian session: the euro dropped

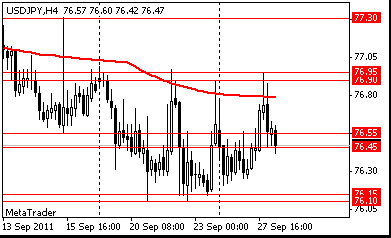

The yen rose against most of its major counterparts as EU’s worsening debt crisis and speculation that a report today will show U.S. durable goods orders fell last month, bolstered demand for the safest assets.

The euro headed for its biggest monthly decline against the yen in more than a year after the Financial Times reported yesterday that some euro-area countries want private creditors to take bigger writedowns on their Greek bond holdings. The euro held a three-day advance against the dollar.

Greek Prime Minister George Papandreou won parliamentary backing late yesterday for a property tax to meet deficit- reduction targets required to avoid default. Germany still privately anticipates that the Mediterranean nation will default on its debt as early as this year, Bild reported Chancellor Angela Merkel. France’s statistics office confirmed today that gross domestic product was unchanged in the second quarter from the preceding period. That’s in line with the initial estimate reported last month.

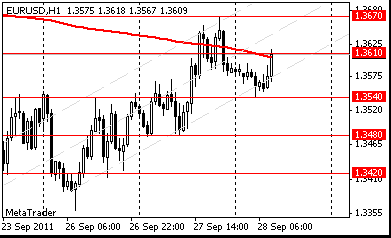

EUR/USD: on asian session the pair gain dropped.

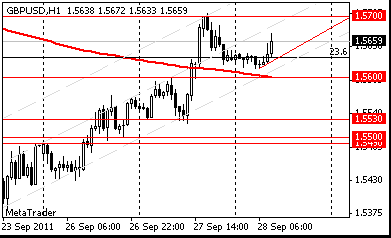

GBP/USD: on asian session the pair hold at narrow range.

USD/JPY: on asian session the pair gain.

Focus today Troika to return to Athens to continue inspection/review. Finnish parliament vote on the amendment to the EFSF framework

agreement at 1100GMT. Later U.S. Durable Goods Orders August and U.S. EIA Crude Oil Stocks change.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.