- Analytics

- News and Tools

- Market News

- European session: The euro rose

European session: The euro rose

06:00 Germany PPI (August) -0.3%

06:00 Germany PPI (August) Y/Y 5.5%

09:00 Germany ZEW economic expectations index (September) -43.3

The euro snapped two days of declines against the dollar as gains in European stocks boosted sentiment toward the currency on signs that talks aimed at staving off a Greek debt default were making progress.

The 17-nation currency erased a drop against the yen as Greece resumed talks with creditors as well as European Union and International Monetary Fund officials.

Standard & Poor’s cut its credit rating for Italy, which has Europe’s second-largest debt load, to A from A+ yesterday. The firm said Italy’s net general government debt is the highest among A rated sovereigns, and now expects it to peak later and at a higher level than it previously anticipated.

Italy follows Spain, Ireland, Portugal, Cyprus and Greece as euro-region countries having their credit ratings cut this year. The European Central Bank last month started buying Italian and Spanish government bonds after the region’s debt crisis pushed their yields to euro-era records.

Fed policy makers may decide to replace some of the short- term Treasuries in the Fed’s $1.65 trillion portfolio with longer-maturity debt in a bid to lower borrowing costs, according to economists at Wells Fargo & Co., Barclays Plc and Goldman Sachs Group Inc.

The euro pared declines against the dollar after data showed Germany’s investor confidence fell less than economists expected this month.

The ZEW Center for European Economic Research in Mannheim said its index of investor and analyst expectations, which aims to predict developments six months in advance, declined to minus 43.3 in September from minus 37.6 last month, the lowest since December 2008. Economists expected a drop to minus 45, according to the median estimate in a survey.

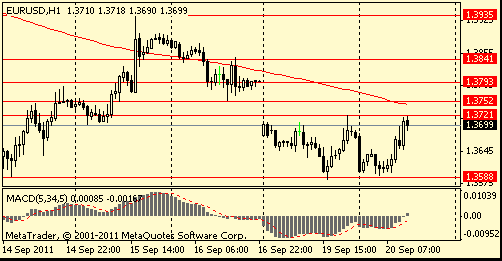

EUR/USD: the pair become stronger above $1.3700.

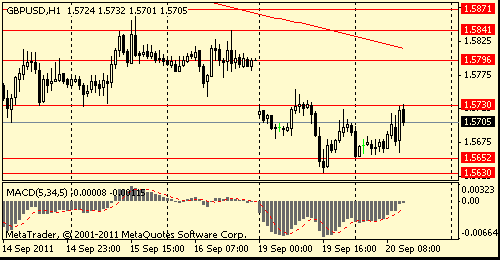

GBP/USD: the pair become stronger above $1.5700.

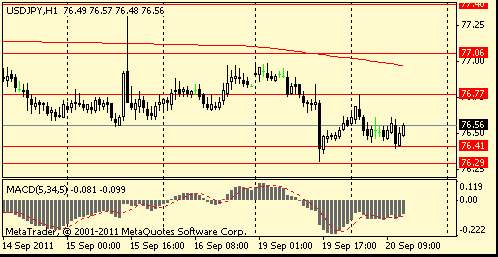

USD/JPY: the pair holds Y76.40-Y76.60.

US data released at 1230GMT includes August housing starts and building permits. The pace of housing starts is expected to slow further to a 580,000 annual rate after falling in the previous month. Weak new home sales and the high inventory level of unsold existing homes continue to restrain new home building.

At 1300GMT, the IMF releases its World Economic Outlook, with revised economic forecasts, with many expecting a downgrade of GDP

forecasts.

The FOMC begins its two-day monetary policy meeting, a meeting expended from 1-day to 2, for the members to explore further

exceptional measures available to the Fed.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.