- Analytics

- News and Tools

- Market News

- European session:The euro dropped

European session:The euro dropped

The 17-nation currency slid against most of its 16 major peers before European Union and International Monetary Fund officials speak today with Greek Finance Minister Evangelos Venizelos to judge whether his government is eligible for its next aid payment.

The U.S. currency rose as Asian stocks fell, spurring demand for the safest assets.

The Australian dollar dropped against the greenback before the Reserve Bank is due to release tomorrow the minutes of this month’s policy meeting.

The dollar rallied before the Federal Open Market Committee gathers tomorrow for a two-day meeting.

The committee may decide to replace some of the short-term Treasury securities in the Federal Reserve’s $1.65 trillion portfolio with long-term debt in a bid to lower rates on everything from mortgages to car loans, according to economists at Wells Fargo & Co., Barclays Capital Inc. and Goldman Sachs Group Inc. Some analysts dub the maneuver “Operation Twist” because it would bend long-term yields lower.

Australia’s dollar snapped two days of gains versus the greenback on concern the RBA will signal interest-rate cuts in its September meeting minutes to be released tomorrow, curbing demand for the South Pacific nation’s currency.

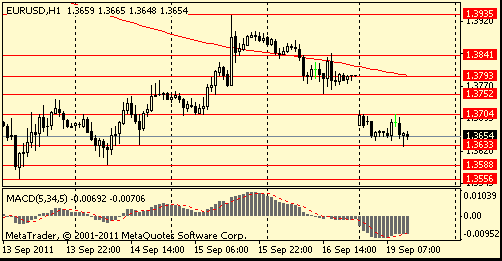

EUR/USD: holds $1.3630-$ 1.3700.

GBP/USD: the pair restored from morning low in area $1.5750. But returned back to $1.5700 area later.

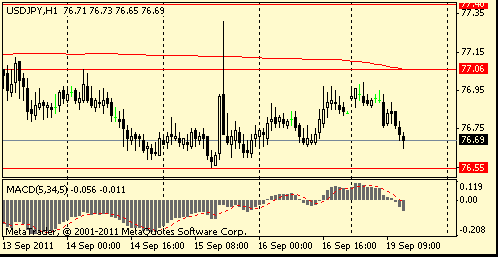

USD/JPY: the pair decreased in Y76.60 area.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.