- Analytics

- News and Tools

- Market News

- Forex: Monday's review

Forex: Monday's review

The 17-nation currency rose for a second day against the dollar after regional leaders agreed during the weekend to widen the scope of a rescue fund aimed at resolving the debt crisis and cut the cost of loans to Greece.

The ECB’s governing council is scheduled to meet March 17.

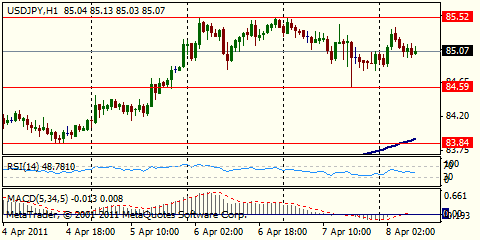

The yen erased a gain against the dollar as Japan’s central bank said it will add 15 trillion yen ($183 billion) to the financial system and increase its asset-purchase program following last week’s earthquake.

BOJ Governor Masaaki Shirakawa and his board also doubled the facility that buys assets from government bonds to exchange- traded funds to 10 trillion yen. Besides the 15 trillion yen of emergency funds deployed, the central bank offered to buy 3 trillion yen of government bonds from lenders in repurchase agreements starting March 16.

Borrowing costs were cut near zero in 2008 as officials sought to revive growth and end deflation. Finance Minister Yoshihiko Noda said earlier today that he’s closely watching the foreign exchange, stock and Japanese bond markets.

Australia’s dollar slid. Traders have cut bets the Reserve Bank of Australia will raise interest rates over the next year.

The main EMU data release will be the German ZEW survey, at 1000GMT, where the expectations index is expected to edge up to a reading of 16.0 and the current conditions index is expected to edge up to 85.4.

US data starts at 1145GMT with the weekly ICSC-Goldman Store Sales data. This is followed at 1230GMT by the Import & Export Price Index as well as the Empire State Index, which is expected to increase to a reading of 16.0 in March after also rising in February. The Empire index has been lagging other manufacturing surveys which have been trending up. The weekly Redbook Average then follows, at 1255GMT, shortly followed at 1300GMT by the latest Treasury International Capital System (TICS) data. US data continues at 1400GMT with the NAHB Housing Market Index, while at the same time, US Treasury Secretary Tim Geithner testifies on the future of housing finance before the Senate Banking Committee in Washington.

The decision and statement from the latest FOMC meeting is due at 1815GMT although market expectations are for nothing major to come out of the meeting. MNI's Steve Beckner writes Monday there has been a subtle shift in Fed officials' thinking and commentary on the economy and inflation -- not just a more upbeat tone on the outlook for growth and jobs, but also slightly more acknowledgement of public inflation concerns.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.