- Analytics

- News and Tools

- Market News

- FOREX: Wednesday's review

FOREX: Wednesday's review

Data released:

07:45 Italy PMI services (July) 48.6 47.0 47.4

07:50 France PMI services (July) 54.2 54.2 56.1

07:55 Germany PMI services (July) seasonally adjusted 52.9 52.9 56.7

08:00 EU(17) PMI services (July) 51.6 51.4 53.7

08:30 UK CIPS services index (July) 55.4 53.2 53.9

09:00 EU(17) Retail sales (June) adjusted 0.9% 0.4% -1.3 (-1.1)%

09:00 EU(17) Retail sales (June) adjusted Y/Y -0.4% -1.1% -2.3 (-1.9)%

12:15 USA ADP employment (July) +114K +97K +157K

14:00 USA ISM Non-mfg PMI (July) 52.7 52.8 53.3

14:00 USA ISM Non-mfg business index (July) - 53.4

14:00 USA Factory orders (June) -0.8% -1.0% 0.6 (0.8)%

US dollar remained under pressure amid worries that US economic recovery linger. Another factor to fall is ISM Non-Manufacturing data, which missed estimates.

Better-than-expected statistics from ADP didn't support the currency as last month ADP data were also significantly higher forecasts, but followed two days later government report showed substantial lower payrolls than expected.

The franc fell after the Swiss National Bank decided to cut its interest rate target to curb franc's sharp appreciation.

The Swiss franc renewed its downward trend against the dollar after the nation’s central bank said the currency is “massively overvalued.” The central bank said it "have to take measures against strong frank".

The loonie fell after Canada’s 30-year government bonds rose to the records dating at 1970. Earlier the currency war under pressure amid weak macroeconomic data in the US, Canada’s largest trading partner.

Yen continued gaining despite today Japan FinMin Noda said that “Yen is overvalued and will do "utmost" to stem yen strength”.

Australia’s currency rebounds against the U.S. dollar after its 5-day fall as today data showed an unexpected decline in retail sales in June. The Aussie also fell as the Bureau of Statistics in Sydney reported a lower-than-forecast trade surplus.

The New Zealand’s dollar also corrected versus the dollar. Today the currency slid to the lowest two weeks against the greenback after Fonterra Cooperative Group Ltd., the world’s largest dairy exporter, said whole-milk powder prices remained near an eight-month low.

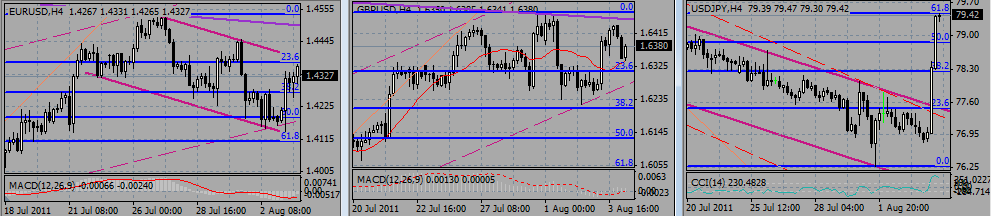

EUR/USD rose to $1.4344 after it tested daily lows around $1.4140. Later rate was narrowed within the $1.4260/$1.4350 range.

GBP/USD gained from $1.6250 to $1.6410. After some consolidation rate resumed its recovery and printed highs on $1.6430.

USD/JPY weakened from Y77.40 to Y76.80.

Germany's Factory Orders are scheduled at 10:00 GMT.

The BoE and ECB rate decisions will be the main focus for today with announcement comes at 11:00 GMT and 11:45 GMT respectively.

Later the main attention will be on ECB's head Trichet's traditional press-conference at 12:30 GMT.

US Jobless claims report also due to come at 12:30 GMT.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.