- Analytics

- News and Tools

- Market News

- FOREX: Tuesday's review

FOREX: Tuesday's review

Tuesday the dollar significantly weakened against a basket of rival currencies on concerns about a lack of agreement on raising the U.S. debt ceiling. The dollar fell as US President Barack Obama said the U.S. may experience a “deep economic crisis” if leaders fail to reach a compromise on spending cuts and the nation defaults.

If the debt ceiling isn’t raised from the current $14.3 trillion by August 2, the country would face technical default.

The Swiss franc reached a new record high versus the dollar on demand for safety.

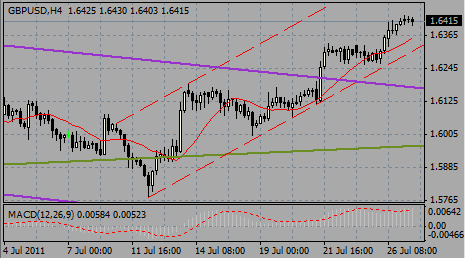

The pound rallied from a two-week low against the euro after the U.K. economy expanded for a second quarter.

The British economy expanded by 0.2% in the second quarter, down from 0.5% in the first three months of the year, the Office for National Statistics said today. GDP would have grown by 0.7% without special factors such as Japan’s earthquake, an extra holiday for the royal wedding, and unusually warm weather in April, the statistics office said.

Gains in the yen were limited on speculation Japanese officials will intervene to weaken the currency.

Japanese Finance Minister Yoshihiko Noda said currency moves have been one-sided and he will continue to watch the yen closely. Bank of Japan Governor Masaaki Shirakawa said yesterday that the yen’s strength could hurt the economy and the central bank is ready to take appropriate action as needed.

EUR/USD initially fell from the highs around $1.4523 to lows on $1.4450. After some consolidation rate recovered to $1.4520/25.

GBP/USD rose after the UK GDP report. Rate managed to break above the resistance at $1.6400/05 and tested earlier highs on $1.6426.

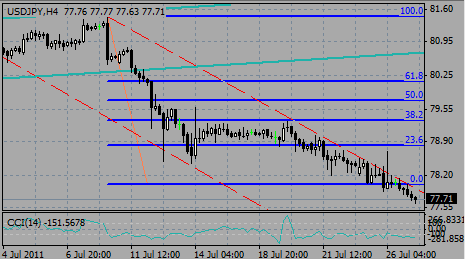

USD/JPY printed lows on Y77.81 before recovered to Y78.01.

June.

UK data includes the 1000GMT release of the latest CBI Industrial trends data. The June CBI industrial trends survey appeared robust, with

At 1800GMT, the Fed's Beige Book will provide anecdotal evidence of conditions in the US economy for June through mid-July.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.