- Analytics

- News and Tools

- Market News

- EU session review: Swiss franc rises on safe-haven demand

EU session review: Swiss franc rises on safe-haven demand

Data released:

08:00 Italy Consumer confidence (July) 103.7 104.0 105.8

Investors buy the safe-haven currencies like the Swiss franc and yen today as global sovereign debt concerns were heightened by a further downgrade of Greece and the continuing political disputes in the US over the country’s debt ceiling.

Moody’s, the rating agency, on Monday downgraded Greek sovereign debt by three notches, saying that following last week’s €159bn bail-out by the European Union and International Monetary Fund, the country’s second major rescue pay-out, the risk of default was now almost a certainty.

“The announced programme implies that the probability of a distressed exchange, and hence a default, on Greek government bonds is virtually 100 per cent,” Moody’s said. But the rating agency was broadly positive about the bail-out, adding that Greece could now stabilise and eventually reduce its overall debt burden.

The situation in the US also dominated investors’ concerns, as meetings between President Obama and senior Republicans to discuss lifting the country’s debt ceiling to avoid default ended in stalemate.

Although the dollar was broadly weaker it still managed gains against the pound as UK data disappointed. Research institute Markit revealed that UK household finances were at the weakest level since its survey started in 2009.

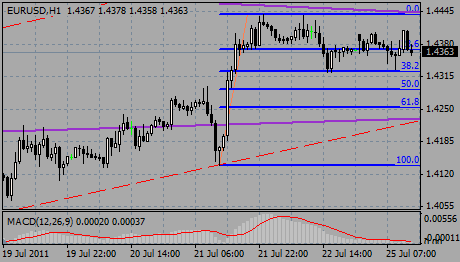

EUR/USD failed to break above $1.4400 and retreated to the lows around $1.4357. Rate still remains under pressure.

GBP/USD holds within the $1.6260/$1.6310 range.

USD/JPY continues to recover after it teated bids ahead of Y78.00. Rate currently holds around Y78.34.

There is no major US data for today.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.