- Analytics

- News and Tools

- Market News

- EU session review: Euro falls as Juncker says Greek default is possible

EU session review: Euro falls as Juncker says Greek default is possible

Data released

06:58 France PMI (July) flash 50.1 53.0 52.5

06:58 France PMI services (July) flash 54.2 56.7 56.1

07:28 Germany PMI (July) flash 52.1 54.0 54.6

07:28 Germany PMI services (July) flash 52.9 56.1 56.7

07:58 EU(17) PMI (July) flash 50.4 51.5 52.0

07:58 EU(17) PMI services (July) flash 51.4 53.2 53.7

08:00 EU(17) Current account (May) unadjusted, bln -18.3 - -6.5

08:00 EU(17) Current account (May) adjusted, bln -5.2 - -5.4 (-5.1)

08:30 UK Retail sales (June) 0.7% 0.5% -1.4%

08:30 UK Retail sales (June) Y/Y 0.4% 0.3% 0.2%

08:30 UK PSNCR (June), bln 21.0 - 11.1

08:30 UK PSNB (June), bln 14.0 12.8 17.4

The euro fell against the dollar for the first time in three days after European officials signaled Greece may default on government bonds.

The 17-nation currency was weaker amid concern a summit won’t stop contagion from Greece spreading through Europe’s bond markets.

Luxembourg Prime Minister Jean-Claude Juncker said today he couldn’t rule out a so-called selective default on Greek debt.

“The word ‘default’ is still in these headlines; that, of course, is a bit disappointing,” said Jane Foley, a senior currency strategist at Rabobank International.

German Chancellor Angela Merkel and French President Nicolas Sarkozy reached an agreement on Greece after seven hours of talks in Berlin and details will be released at the summit in Brussels.

“I am not in charge of explaining if yes or no there will be a selective default,” Luxembourg’s Juncker told reporters today before the summit. “You can never exclude such a possibility, but everything should be done in order to avoid such a possibility.”

The Swiss franc fell against the dollar after Zurich-based newspaper Blick quoted Switzerland’s Economy Minister Johann Schneider-Ammann as saying the currency’s strength versus the euro is “alarming.”

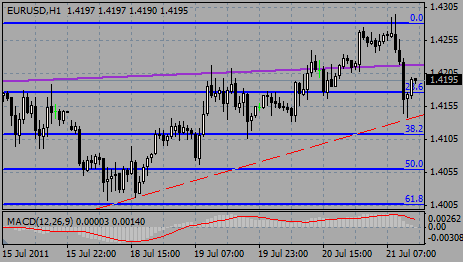

EUR/USD was close to $1.4300, but failed to break above. Rate corrected to session lows around $1.4138 before recovered to $1.4190.

GBP/USD fell from the highs on $1.6200 to $1.6120 before it was back to $1.6170.

USD/JPY tested Y79.00 and retreated to Y78.80.

US Jobless claims comes at 12:30 GMT.

Later, at 14:00 GMT, Philadelphia Fed index for July is due to comes.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.